Market pricing is still showing over 100bp of Federal Open Market Committee (FOMC) rate cuts through to the end of 2025.

BRock says this is too much, citing:

1. A solid economy

“U.S. Q3 GDP data last week showed consumer spending is still driving overall economic growth. Average monthly job creation over the past three months now stands at 104,000 after last week’s jobs report — still a healthy pace and one likely to pick up given hiring stalled due to hurricane-related disruptions.”

2. Stubborn inflation

3. Profligate politicians on both sides:

- As the U.S. election occurs, neither presidential candidate is focused on budget deficits that are likely to stay large no matter who wins

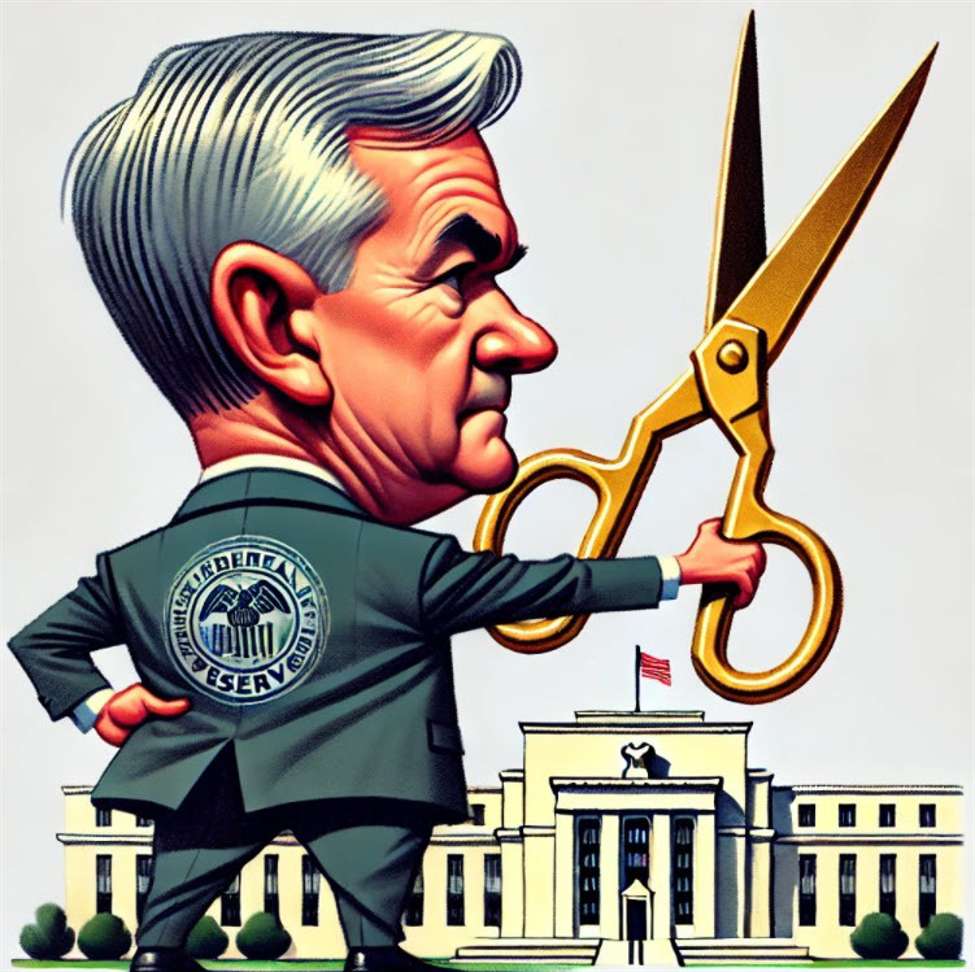

Chair Powell preparing for a BIG cut?