Prediction markets had a breakout moment during the presidential election, when they proved to be more accurate than most opinion polls.

So with various cryptocurrencies soaring since Donald Trump won the election, maybe prediction markets can accurately answer the question, “How high will Bitcoin go?”

On the crypto-based Polymarket, where the so-called French whale netted a massive post-election windfall, bettors have various options for Bitcoin, which is currently trading at about $91,000.

For a contract on what price Bitcoin will hit in November, the odds are 72% that it will reach $95,000. The price with the next highest odds is $105,000 at 23%, then $110,000 at 14%.

A separate contract that asks if Bitcoin will be above $90,000 on Nov. 22 shows 60% odds, while yet another contract asking if Bitcoin will reach $100,000 in November only has a 42% chance.

On the prediction market Kalshi, a contract that asks how high Bitcoin will get before 2026 shows 52% odds for $125,000 or above and 44% odds for $150,000 and above.

If prediction markets aren’t your thing, and you prefer a forecast from a more conventional Wall Street analyst, there’s Fundstrat Global Advisors cofounder Tom Lee.

Among the forecasters surveyed by Bloomberg, his stock market call in 2023 turned out to be the most accurate.

As for Bitcoin, he said in March that it could hit $150,000 by year-end. While that looks less likely now with just a month and a half left in the year, Lee told CNBC last week that “six figures” is still possible before the end of the year with more gains in 2025 in 2026.

“I think now because post-halving, Bitcoin is becoming a lot more relevant, and I think maybe the regulatory overhang is diminishing, there’s a lot of upside from here,” he explained.

Bitcoin has already soared 32% so far in November alone and has more than doubled this year. To get to $100,000, it would have to climb another 10%.

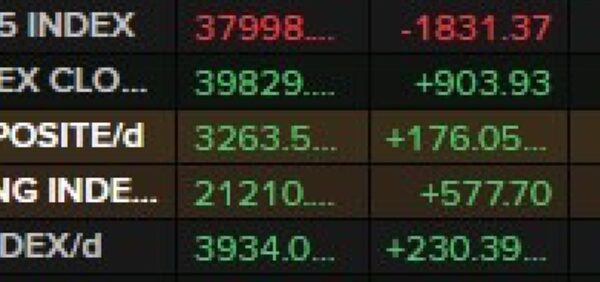

But there are signs that the post-election rally is stalling as the stock market notched a losing week. Still, key components of the “Trump trade” are riding high, like Tesla stock, Treasury yields, and the dollar.

Meanwhile, Quinn Thompson, the founder of the crypto hedge fund Lekker Capital, told Fortune this past week that he’s optimistic Bitcoin will attain the $100,000 milestone soon.

“I feel good that we hit it by year-end,” he said. “Very possible by end of month, but we’ll see.”