- Prior month Year on year -1.0%

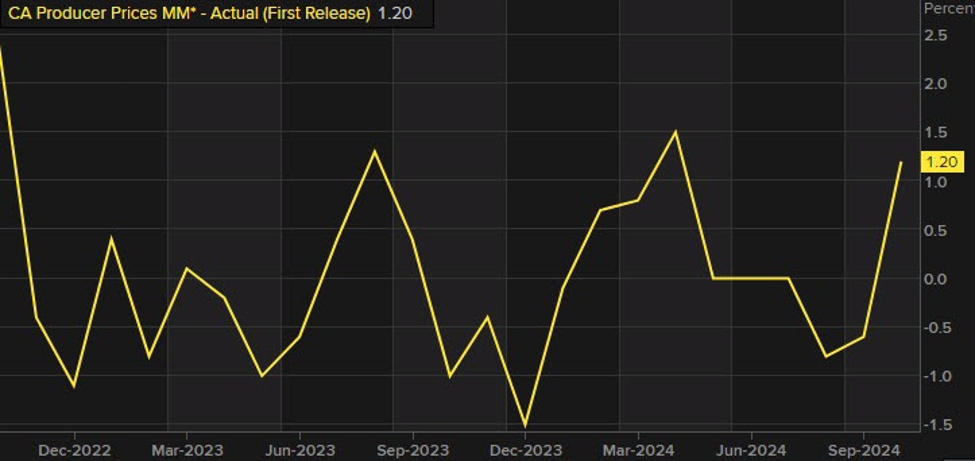

- PPI MoM 1.2% versus -0.8% last month. The gain comes after 2-months of declines. The rise was the largest since April 2024.

- PPI YoY 1.1% versus -1.0% last month

- Raw material price MoM was 3.8% versus -3.2% last month

- Raw material prices YoY -2.8% versus -8.8% last month

Details for IPPI:

- The prices of primary non-ferrous metal products rose 5.5% month over month in October, leading the increase in the IPPI. Higher prices for unwrought gold, silver, and platinum group metals, and their alloys (+7.6%) were mainly behind the gain in this group. Precious metal prices were boosted by several factors in October. Middle Eastern conflict, uncertainty surrounding the outcome of the United States election, and interest rate cuts by central banks, all contributed to the higher prices.

- Prices for energy and petroleum products increased 2.5% in October following two months of consecutive declines.

- Prices for lumber and other wood products (+1.3%) rose for the third month in a row in October, mainly due to higher prices for softwood lumber (+2.3%)

Details for RMPI:

- On a monthly basis, the RMPI rose 3.8% in October after posting two consecutive monthly declines. Excluding crude energy products, the RMPI was up 3.1%.

- Prices for crude energy products (+5.0%) led the RMPI’s monthly increase in October. This was the largest monthly increase for crude energy products since April 2024 (+5.8%).

- The prices of metal ores, concentrates and scrap also contributed significantly to the RMPI’s increase in October, rising 6.8% compared with September.

The RMPI fell 2.8% year over year in October 2024, the third consecutive year-over-year decrease.

- The largest downward contributors to the RMPI’s year-over-year decrease in October were conventional crude oil (-14.6%) and synthetic crude oil (-20.6%), despite prices for both increasing on a monthly basis. In addition, logs and bolts (-15.4%) and grains (-22.0%) also contributed to the yearly decline in the RMPI, to a lesser extent.

This article was written by Greg Michalowski at www.forexlive.com.