The yen is the main mover so far on the day, after Tokyo inflation showed signs of speeding up. That being said, it is worth noting that the higher figures also owes in part to the ending of government energy subsidies. So, there’s that. Nonetheless, traders are taking it at face value with the BOJ potentially looking to use that as an excuse to act in December.

Elsewhere, the dollar is marginally lower as it eases back following a steadier showing yesterday. But that follows from a much poorer showing on the eve of Thanksgiving, with month-end flows arguably a factor in play.

Looking to the session ahead, there will be quite a number of items on the economic calendar in Europe today.

The main focus though will be on the Eurozone CPI data. Headline annual inflation is expected to nudge higher but so is core annual inflation. If anything, it reaffirms a more bumpy path back towards the 2% target for the ECB. And that should likely ease bets of a 50 bps move in December, aligning with a more gradual path of moving by 25 bps instead.

As for the day itself, US markets are open again but expect liquidity conditions to still be lighter than usual as the Thanksgiving holiday period tends to carry through until the weekend.

0700 GMT – Germany October import price index

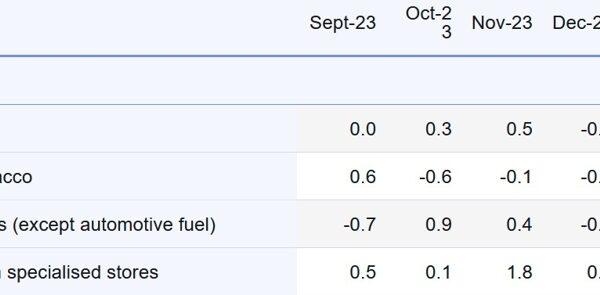

0700 GMT – Germany October retail sales data

0745 GMT – France Q3 final GDP figures

0745 GMT – France November preliminary CPI figures

0800 GMT – Switzerland Q3 GDP figures

0800 GMT – Switzerland November KOF leading indicator index

0855 GMT – Germany November unemployment change, rate

0930 GMT – UK October mortgage approvals, credit data

1000 GMT – Italy November preliminary CPI figures

1000 GMT – Eurozone November preliminary CPI figures

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.