Bitcoin has shown resilience by pushing above key demand levels, but the psychological and technical barrier of $100K remains unclaimed. This resistance has left investors and analysts in a state of uncertainty, with no clear short-term direction for the market leader. Despite this, a growing consensus among market experts suggests that BTC will likely see a significant rise in the coming weeks.

Top analyst Axel Adler recently shared insightful data highlighting an intriguing trend in BTC’s transaction activity. According to Adler, retail activity for transactions under $10K has dropped to its lowest point since the summer of 2021—a period marked by widespread market panic following China’s mining ban. This decline in retail participation indicates that smaller investors are staying on the sidelines for now.

Adler suggests that this reduced retail presence could shift dramatically once Bitcoin reclaims higher levels, igniting renewed interest and participation from smaller investors. This pattern aligns with historical cycles, where retail tends to reenter the market as prices start gaining momentum. With BTC hovering just below $100K, all eyes are on whether the bulls can break through and kickstart a new phase of the rally. The next few weeks could be pivotal for Bitcoin’s trajectory.

Bitcoin Consolidates And Retail Investors Wait

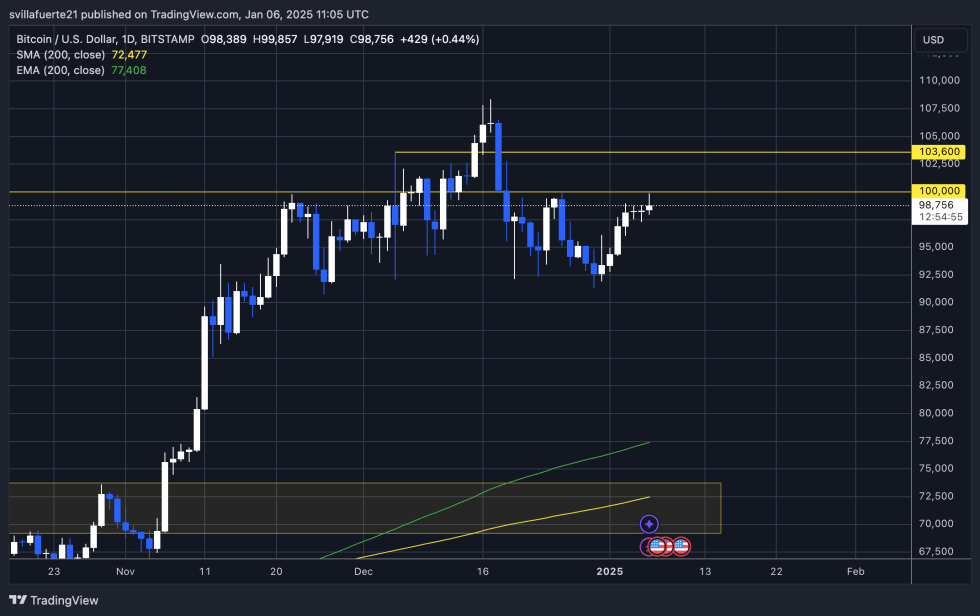

Bitcoin has remained in a consolidation phase since November 22, when it first tested the $100K level. This significant milestone initially brought immense optimism, but the market’s sentiment quickly shifted from extremely bullish to cautious and even bearish. Since then, Bitcoin has struggled to reclaim its momentum, with price action constrained below the psychological barrier of $100K.

One notable trend during this period is the cooling off of retail activity. Top analyst Axel Adler recently shared an analysis on X, revealing that retail transactions involving amounts up to $10K are at their lowest level since the summer of 2021.

This period was marked by widespread market panic following China’s mining ban, a time when retail investors largely exited the market. Adler suggests that this current stagnation could be a precursor to renewed retail interest, which typically surges as BTC begins to rally.

Despite concerns about retail inactivity, many analysts remain optimistic about Bitcoin’s prospects. The general consensus is that the market structure remains intact, and a breakout above $100K could catalyze a fresh wave of buying. However, there is still a risk if BTC fails to reclaim this key level, potentially leading to further declines and heightened uncertainty. The coming weeks will be crucial in determining Bitcoin’s next move.

BTC About To Break Above $100K?

Bitcoin is currently trading at $98,800 after tagging $99,857 just a few hours ago. The price is testing the upper boundary of a critical psychological level, flirting with a breakout above the highly anticipated $100K mark. Market participants are eagerly watching for a decisive move, as breaking above this level is widely expected to trigger a massive surge in price.

The $100K milestone is not just a psychological barrier but also a major supply zone where selling pressure has historically capped rallies. However, Bitcoin’s consistent push towards this level indicates growing bullish momentum. Analysts believe that if BTC manages to close above $100K and hold it as support, the market could enter a new phase of price discovery, with significant upside potential.

The anticipation surrounding this breakout is palpable as traders prepare for the possibility of increased volatility. On-chain metrics suggest that buying pressure has been building steadily, with demand zones around $92K and $95K acting as strong support during recent consolidations. While the immediate focus is on Bitcoin breaking the $100K barrier, failure to do so could lead to a short-term pullback, potentially testing lower support levels before another attempt.

Featured image from Dall-E, chart from TradingView