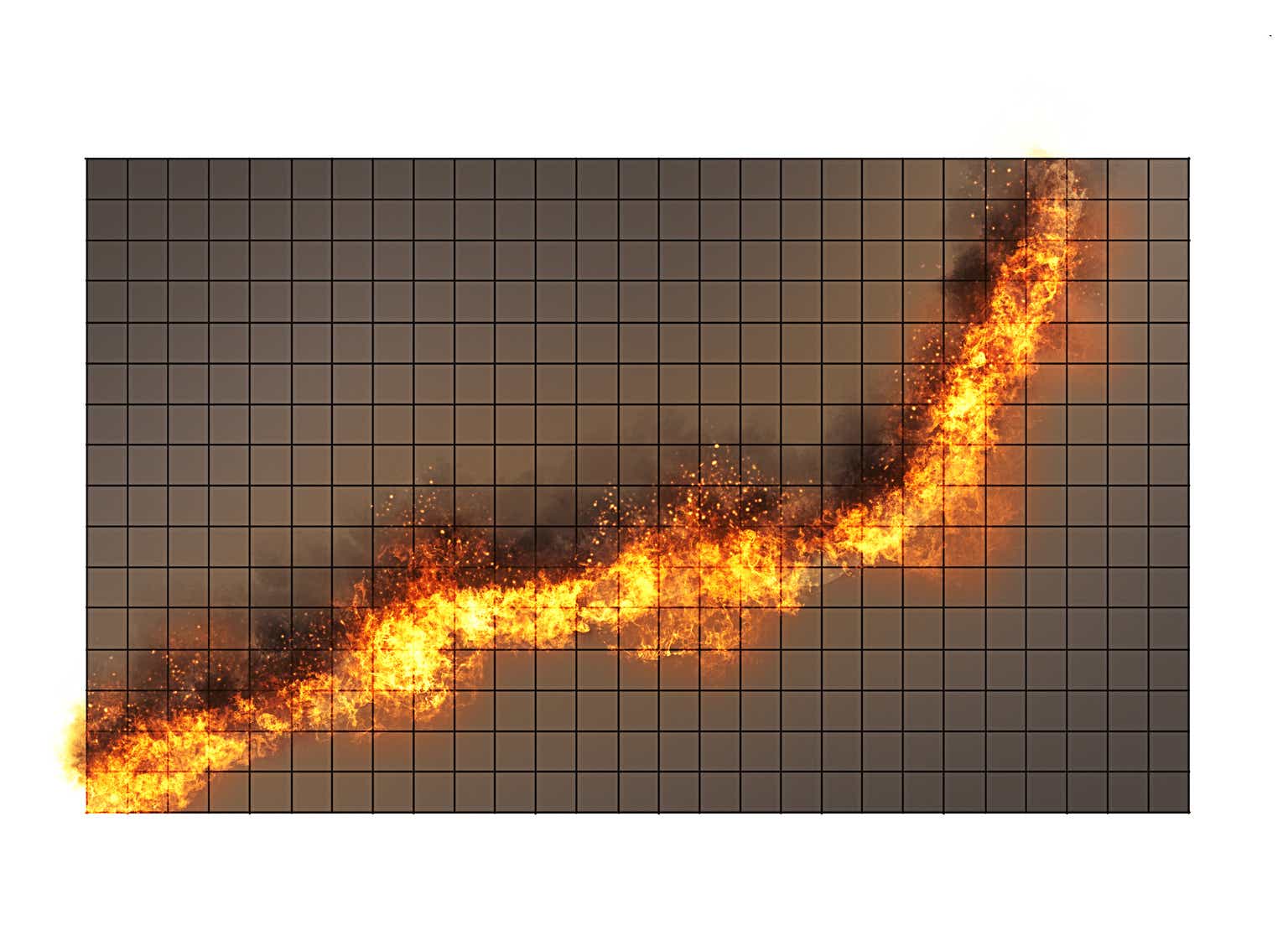

EUR/USD Trade Idea: Fade the Rally Strategy

The EUR/USD futures market is showing persistent bearish pressure as it trades near 1.03305, as this EURUSD analysis shows, with key resistance levels above and bearish momentum evident in the long-term performance. This creates an opportunity to fade any potential rally into key resistance zones for a short trade. Below is a detailed trade setup with entry, stop loss, and profit targets.

Trade Setup: Short the Rally

- Entry Price: 1.03800 (near the Value Area Low of January 7th)

- Stop Loss: 1.04180 (just above the VWAP of January 7th and the next significant resistance level)

- Profit Targets:

- First Target: 1.03150 (Value Area Low of January 3rd)

- Final Target: 1.02835 (Point of Control from January 1st)

Trade Rationale

-

Key Resistance Levels Above:

The zone between 1.03800–1.04180 serves as a significant resistance area due to:- The Value Area Low (VAL) of January 7th at 1.03800, which aligns with historical volume and liquidity clusters.

- The VWAP of January 7th at 1.04180, marking the upper boundary of the resistance zone.

A rally into this zone is likely to attract sellers, making it a favorable entry point for a short position.

-

Bearish Momentum:

The Euro’s inability to close above the 20 EMA on multiple attempts reinforces the bearish bias. Any rally into the resistance zone is expected to be corrective, not a reversal. -

Risk Mitigation Through Partial Profits:

Taking partial profits at 1.03150 allows traders to mitigate risk while targeting the next key support level at 1.02835 for the remainder of the position. This approach balances short-term gains with the potential for a larger move. -

Dynamic Stop Adjustment:

Once the price hits the first profit target (1.03150), move the stop loss to the entry price (1.03800) to eliminate risk and secure profits.

Execution Plan

-

Monitor Price Action Near 1.03800:

Wait for the price to rally toward 1.03800, ensuring it struggles to break through the resistance zone. Signs of hesitation or declining bullish momentum (e.g., lower Delta or high sell volume) will confirm the entry. -

Enter Short at 1.03800:

Initiate a short position at or near this level, ensuring a stop loss at 1.04180 to account for potential volatility. -

Take Partial Profit at 1.03150:

Close 50% of the position at 1.03150 to lock in profits as the price reaches the first major support. -

Target Final Profit at 1.02835:

Hold the remaining position for a larger move to 1.02835, a key liquidity zone and historical POC. -

Adjust Stop Loss:

Once the first target is hit, move the stop loss to the entry price (1.03800) to secure a risk-free trade.

Risk-Reward Analysis

- Risk: ~38 pips (from 1.03800 to 1.04180)

- Reward (Target 1): ~65 pips (from 1.03800 to 1.03150)

- Reward (Target 2): ~115 pips (from 1.03800 to 1.02835)

This results in a favorable risk-to-reward ratio of 1:1.7 for the first target and 1:3 for the final target.

This trade idea is for educational purposes and if you trade, then that is always at your risk only. Fading a move in trading is a contrarian strategy where you sell into rising prices and buy into falling prices, essentially betting that the current trend is about to reverse. You’re anticipating that the market has overreacted and is due for a correction, allowing you to profit from the pullback, even a temporary one (part of the reason we take partial profits along the way!).

However, this strategy is not without risk as the trend could continue, leading to losses.

This idea leverages the bearish momentum in EUR/USD by fading any rally into the 1.03800–1.04180 resistance zone. By employing a systematic approach with clear profit targets and dynamic stop-loss adjustments, traders can manage risk effectively while capitalizing on the Euro’s bearish trend.

Trade at your own risk, and ensure proper position sizing to maintain discipline and consistency in execution.Visit ForexLive.com for additional views.