- Prior +2.6%

- CPI +0.3% vs +0.4% m/m expected

- Prior +0.1%

- Core CPI +3.2% vs +3.4% y/y expected

- Prior +3.5%

- Core CPI +0.3% vs +0.5% m/m expected

- Prior 0.0%

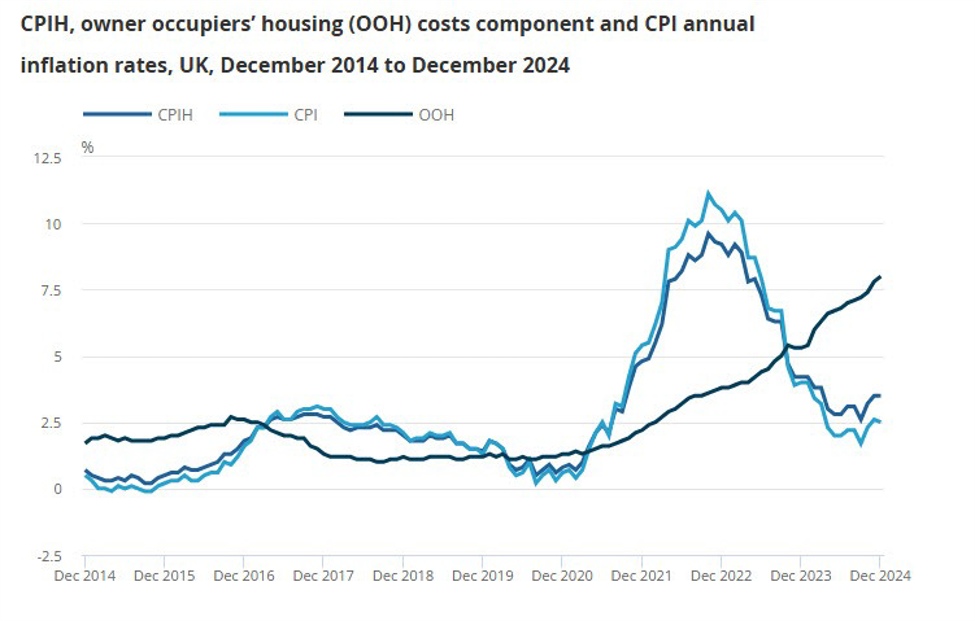

As the BOE looks to cut rates further, this will at least support the case for that. The inflation numbers were softer than expected with core annual inflation down as well and returning to the lowest since the September 2024 reading. This comes as the annual rate for core services inflation is seen dropping from 5.0% previously to 4.4% last month.

The odds of a BOE rate cut next month were around ~62% before this. So, we should see market players lean more towards that after this.

Cable is now lower on the day, down 0.2% to 1.2186 with sellers having good reason to keep price action under the 100-hour moving average of 1.2223 for now. It’s on to the US CPI report later in the day next.