The European session is going to be pretty empty on the data front with no market moving releases. The main events will be all in the American session when we will get a few US economic indicators and Scott Bessent’s confirmation hearing before Senate at 15:30 GMT/10:30 ET.

13:30 GMT/08:30 ET – US Jobless Claims

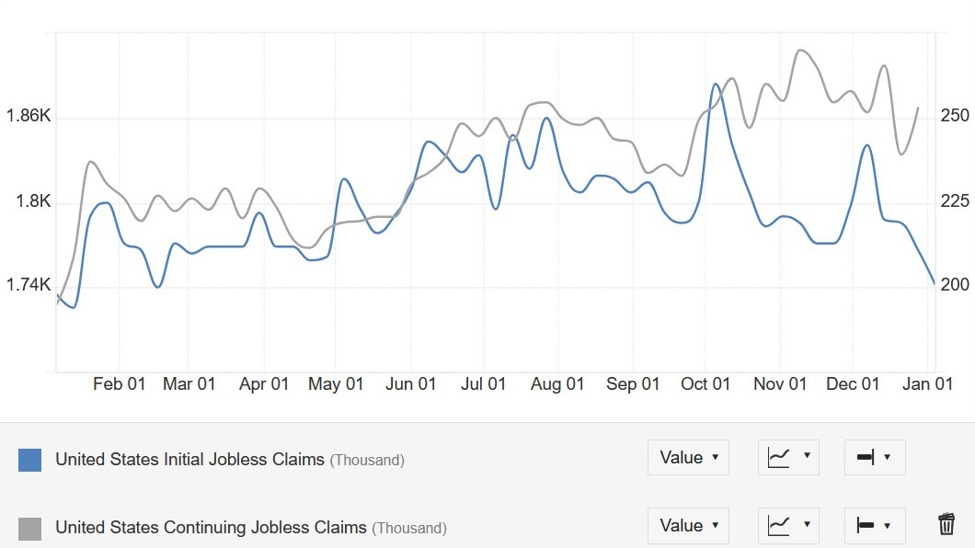

The US Jobless

Claims continue to be one of the most important releases to follow every week

as it’s a timelier indicator on the state of the labour market.

Initial Claims

remain inside the 200K-260K range created since 2022, while Continuing Claims

continue to hover around cycle highs although we’ve seen some easing recently.

This week Initial

Claims are expected at 210K vs. 201K prior, while

Continuing Claims are seen at 1871K vs 1867K prior.

US Jobless Claims

13:30 GMT/08:30 ET – US December Retail Sales

The US Retail

Sales M/M is expected at 0.6% vs. 0.7% prior, while the ex-Autos M/M measure is

seen at 0.4% vs. 0.2% prior. The focus will be on the Control Group figure

which is expected at 0.4% vs. 0.4% prior.

Consumer spending

has been stable which is something you would expect given the positive real

wage growth and resilient labour market. We’ve also been seeing a steady pickup

in consumer sentiment which suggests that consumers’ financial situation is

stable/improving.

US Retail Sales YoY

Central bank speakers:

- 09:00 GMT – ECB’s Patsalides (dove – non voter in Jan)

- 22:00 GMT/18:00 ET – ECB’s Centeno (dove – voter)