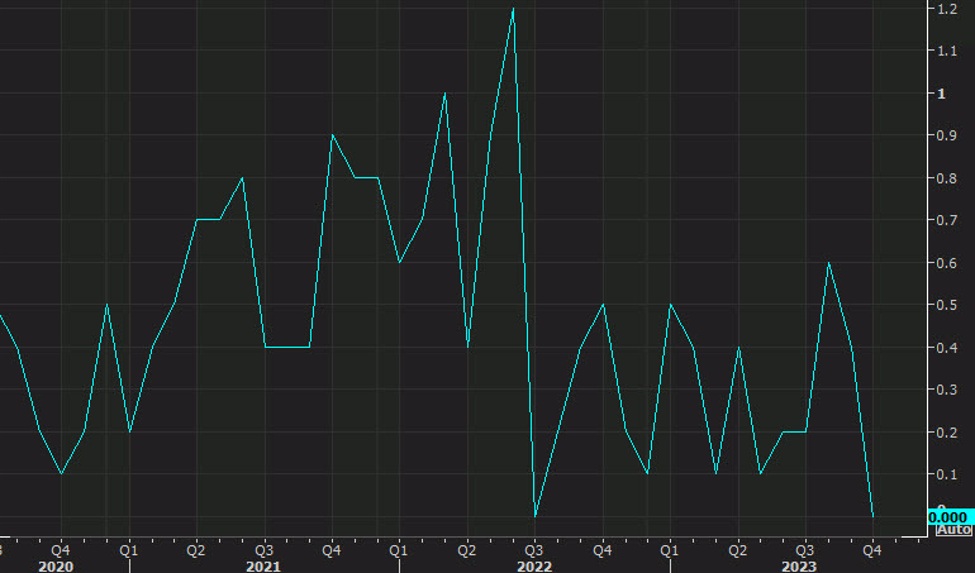

- CPI y/y +% versus 3.1% anticipated

- Prior y/y 3.2%

- CPI m/m +0.1% versus 0.0% anticipated

- Prior m/m 0.0%

Core measures:

- Core CPI m/m +0.3% versus +0.3% anticipated. Final month 0.2%

- Core CPI y/y 4.0% versus 4.0% anticipated. Final month was 4.0%

- Shelter % versus +0.3% final month.

- Providers much less hire of shelter % m/m vs +0.3% prior

- Actual weekly earnings +0.5% vs -0.1% prior

- Meals % m/m vs +0.3% m/m prior

- Power % m/m vs -2.5% m/m prior

- Rents % vs +0.5% prior

- Proprietor equal hire % vs +0.4% prior

As reminder how rapidly issues can change: On the time of the October CPI report, the market was pricing in a 33% probability of a January hike.

Now we’re pricing in 120 bps in cuts subsequent yr versus 115 bps earlier than the report. The US greenback is sliding.within the aftermath. The market is not too fearful about that 0.1 pp miss on the headline.

This text was written by Adam Button at www.forexlive.com.