One of the key themes emerging from the latest round of earnings reports from social media companies has been the projected impact of tariffs, and how the additional fees that the Trump Administration is imposing on some regions will affect their bottom line.

Though most are keen to avoid any discussion of tariffs specifically, after Trump reacted angrily to reports that Amazon may look to start displaying the impact of the tariffs on their item prices.

Instead, Meta, LinkedIn, and Snap have tried to talk around the specifics, while still warning of how they’ll hit revenue intake.

Meta’s CFO Susan Li, for example, addressed several questions about the Trump tariffs in Meta’s earnings call, and graciously side-stepped them with careful wording.

“We have reflected the change in spend from those Asia-based e-commerce advertisers already into the revenue guidance. Otherwise, there’s just really a lot of puts and takes in the economic environment. So it’s pretty difficult to try to parse out very specific assumptions and how they translate.”

In other words Meta’s bottom line will be hurt by the tariffs, with big Chinese retailers like Temu and Shein already cutting ad spend. Indeed, Temu has been Meta’s single biggest advertiser over the past couple of years, spending billions in 2023 and 2024, so inevitably, reduced market demand in the U.S., due to necessarily higher prices, is going to have an impact. But Li and Meta remain confident that most of the impacts will be offset by alternative opportunities, and other advertisers filling the gaps.

“In terms of impact on the auction, we, of course, lose some revenue if large advertisers reduce spend. And that, of course, puts downward pressure on price, all things equal. But we do have a broad and diverse business. So, if some advertisers reduce their spend and prices fall, it creates an opportunity for other advertisers to step in.”

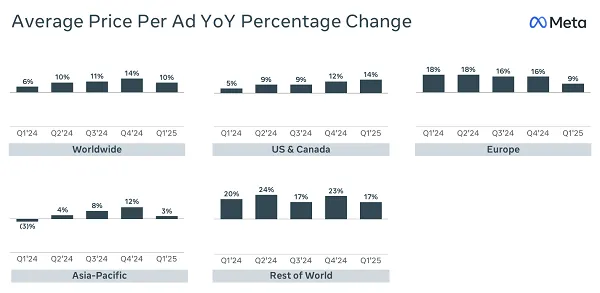

The benefit for marketers, then, is that your Meta ads are about to come down in price. And with Meta’s ad prices steadily creeping up, that’ll be a net positive for the majority of U.S. brands.

Snapchat, meanwhile, is being more cautious with its guidance, after noting that a range of advertisers have reduced their ad spend due to the Trump Administration’s decision to end the “de minimis” exemption, which enabled Chinese providers to proliferate, either via the big corporations or drop-shippers.

The de-minimis exemption has meant that imported goods valued at less than $800 can avoid certain taxes, which has been a blessing for these same providers importing goods from China specifically. But The White House has now excluded Chinese-made imports from the exemption, as of May 2nd.

Which, again, will reduce ad spend at social platforms as a result.

As reported by The Wall Street Journal:

“Revenue at Snap, Meta Platforms and other tech giants surged by billions in recent years, in part from China-based digital advertising. Shap shares fell 20% in after-hours trading. The company declined to share formal guidance for the second quarter, and executives said the Snapchat-operator had experienced headwinds in the current quarter.”

The impact, from a business standpoint, will inevitably be less revenue, but for U.S. advertisers, again, this will mean lower prices for ads, due to reduced competition for ad slots.

Though, the longer that these impacts are felt, the more likely that the platforms will seek to inject more and more ads, which could also lead to problems.

Ad overload can turn users off, and as the platforms seek to prop-up their revenue, there is a risk that users won’t respond as favorably to over-saturated promotions. Or the platforms will invariably reduce ad standards due to lack of competition. In other words, more crypto scam ads, and more fake celebrity-endorsed meme coin promotions, making other platforms more akin to the ad chaos at X, where seemingly anything goes at the moment.

That’s probably a good example of the likely impact. X has lost a significant portion of its advertisers since Elon Musk took over, and as a result, its ad auctions are now flooded with low quality junk ads, that can be just as off-putting as having too many ads displayed in-stream.

That also, presumably, reduces attention on, and engagement with the platform’s ads overall, with users becoming more attuned to just scrolling past. Which, eventually, will also impact performance.

But in terms of direct impacts for marketers, from a general perspective, the tariff pressures are likely to reduce competition within ad auctions due to big Chinese brands and drop-shippers reducing their focus on the U.S.

Conversely, that could increase ad prices in other markets, as these brands look to other opportunities. But the U.S. remains their key target, and the impact will be more significant in this respect.