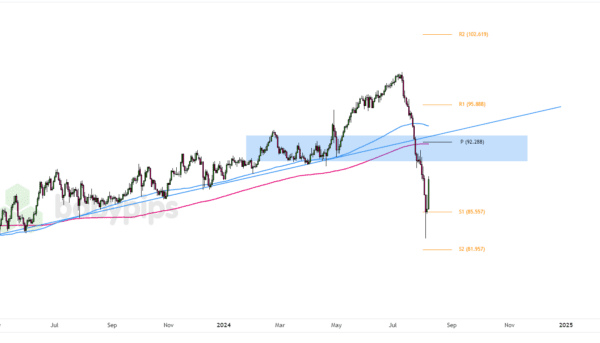

USDCHF technicals

The USDCHF is trading weaker to start the week as the U.S. dollar faces broad pressure following Moody’s downgrade of U.S. sovereign credit late Friday.

From a technical perspective, Friday’s rally attempt failed to hold above the 100-hour moving average (blue line), and sellers have since taken the pair below the 200-hour moving average (green line) at 0.83496. That level now acts as close resistance.

On the downside, today’s low found buyers within a key swing area between 0.8318 and 0.8333—a former ceiling that is now serving as a support floor. Traders will look to that zone for clues about the next directional move. Holding above it keeps the door open for a retest of resistance; a break below would open the path toward the next lower target area near 0.8272.

Key levels:

-

Resistance: 0.8349 (200-hour MA), 0.8375 (100-hour MA)

-

Support: 0.8318–0.8333 (swing area), then 0.8272 to 0.8280 (swing area)

Momentum favors sellers, but watch the 0.8318–0.8333 floor for signs of a shift.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.