hobo_018/E+ through Getty Pictures

Within the sizzling IPO yr, which was 2021, lots of the firms debuting had lofty expectations (and sometimes lofty valuations).

One specific restaurant firm had such expectations and was usually in comparison with Chipotle Mexican Grill, Inc. (CMG). The corporate’s CEO even said, “We like to say we want to build the McDonald’s of our generation.”

This firm’s inventory soared on the day of its market debut, closing up 76%. Nonetheless, since that point that inventory has fallen dramatically and is down almost 80% since their 2021 IPO.

So far in 2023, the corporate’s inventory has fought again because it’s up over 30%. The corporate’s revenues have been rising as have their variety of areas.

The corporate is Sweetgreen, Inc. (NYSE:SG). Let’s dig into the small print to see if this restaurant chain can maintain off the constructive momentum of 2023 and carry it into 2024.

The Firm

Sweetgreen was based in 2007 by three Georgetown college students, Jonathan Neman, Nicolas Jammet, and Nathaniel Ru. The trio wished to create a restaurant that was quick that had good, wholesome meals from native farmers. The corporate’s mission is “Building healthier communities by connecting people to real food.”

Since that point Sweetgreen has continued to develop as some have even acknowledged, this quick informal eating shall be “the Starbucks of salads.” I do not suppose you can provide Sweetgreen such a label but however the group appears to inserting emphasis on the correct areas corresponding to being plant-forward, sourcing their meals regionally, prioritizing natural meals, avoiding faux, synthetic flavors, and guaranteeing their meals meets strict requirements.

Sweetgreen can be targeted on being a sustainable group and is dedicated to being carbon-neutral by the top of 2027. Sweetgreen appears to be doing nicely on this space as far as their plant-forward menu means their typical meal is on common already 30% much less carbon intensive than the typical American meal.

Sweetgreen’s three co-founders are nonetheless with a corporation which I view as a constructive. Neman is the corporate’s CEO, Ru is the corporate’s Chief Model Officer and Jammet is the corporate’s Chief Idea Officer.

Moat and Alternative

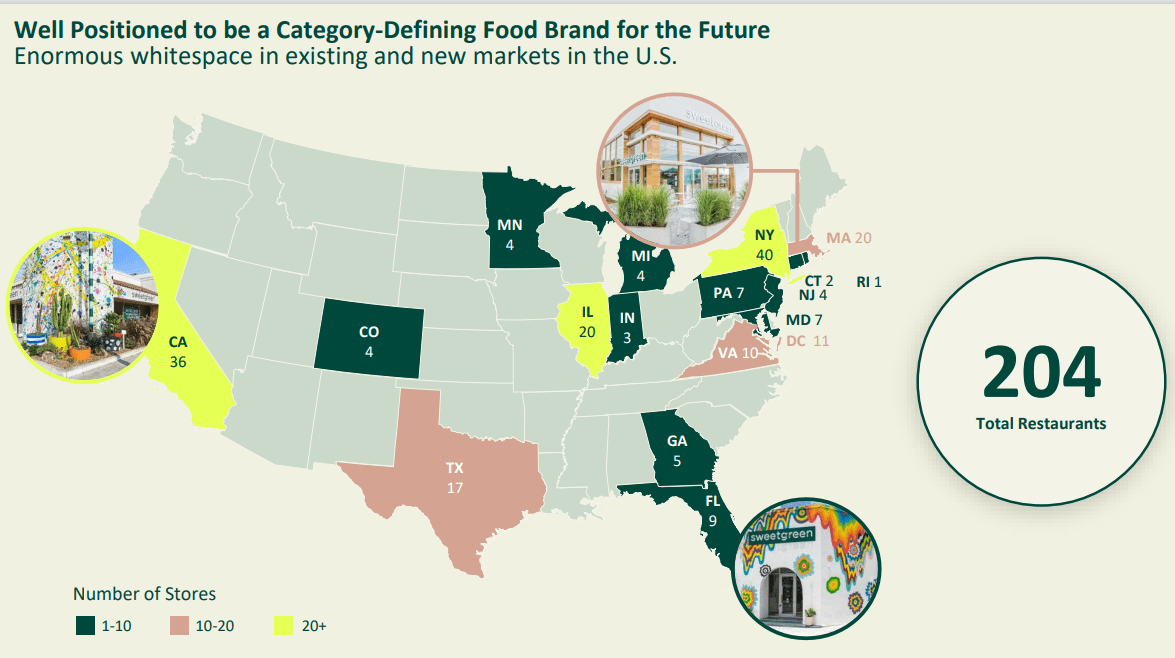

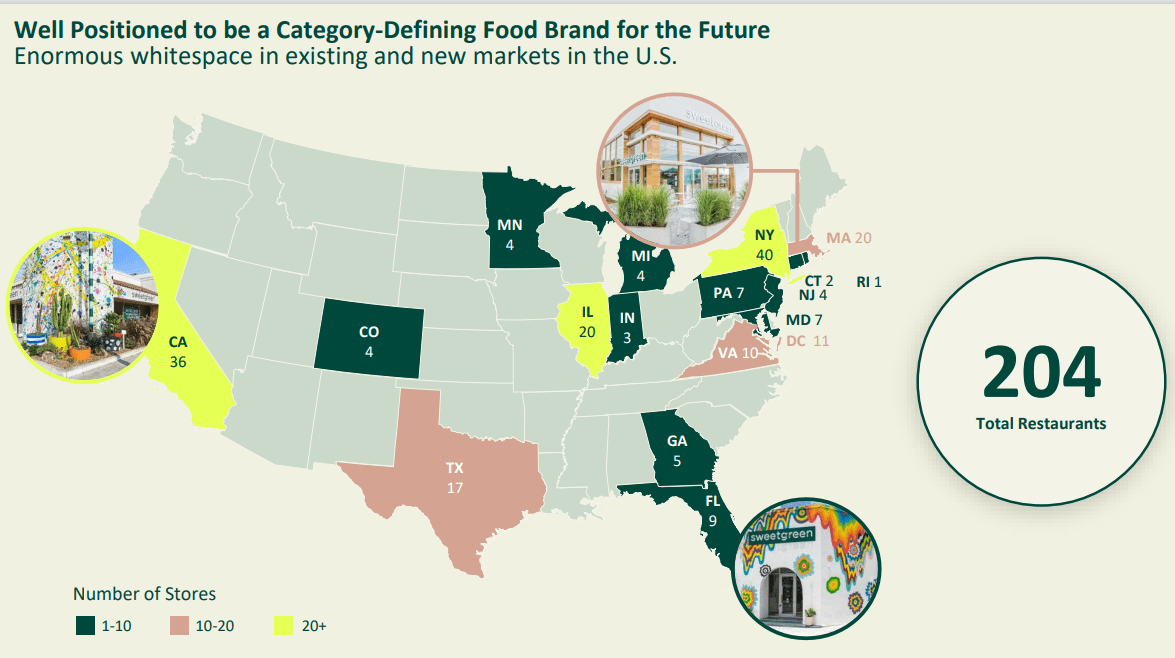

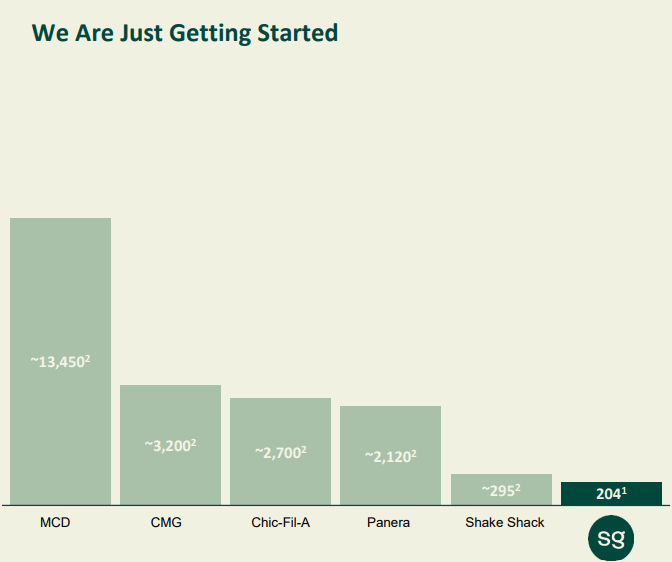

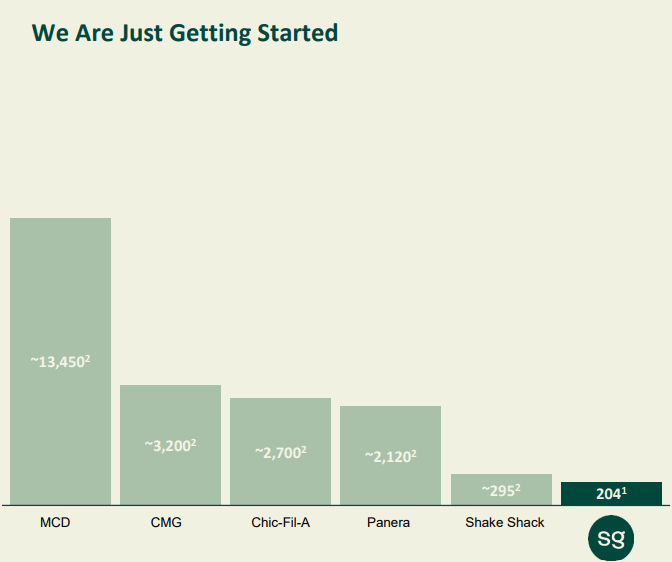

I consider Sweetgreen has alternatives to proceed to broaden operations. As you’ll be able to see from this graphic from an investor presentation which occurred in June of this yr the corporate had 204 whole eating places:

Investor Presentation

There’s actually room for Sweetgreen so as to add extra areas, particularly in areas such because the South, Midwest, and West the place there are restricted shops or no areas in sure states.

As you’ll be able to see below the corporate has a small retailer footprint in comparison with many different quick meals and quick informal firms:

Investor Presentation

I feel it is a bit untimely to be evaluating Sweetgreen to Chipotle or McDonald’s Company (MCD). On the Q3 2023 earnings call administration famous they may add someplace round 23-28 new shops in 2024. There’s a lengthy method to go to catch as much as these extra established gamers however because the map above illustrates there are many alternatives to broaden.

I feel the corporate’s Infinite Kitchens are an attention-grabbing idea which ought to assist the corporate reduce down on prices. As the corporate’s CEO, Neman famous on the earnings name, “…The Infinite Kitchen was recognized by time as one of 2023’s best inventions in the food and drink category. It was selected as one of 200 groundbreaking inventions for leveraging automation technology to create a speedier, more precise way to assemble menu items while bettering the customer-employee experience.”

Sweetgreen is planning on deploying about 7-9 Infinite Kitchens subsequent yr and can retrofit a couple of older shops as nicely.

That is completely no moat for Sweetgreen. Not solely are they competing towards different quick informal eating places corresponding to Panera and Chipotle, however they’re additionally competing towards fellow salad firm rivals corresponding to Chopt and Simply Salad.

Their efforts to work with native farmers and cook dinner, wholesome natural merchandise are actually commendable however not a differentiator for my part as quite a few different restaurant chains have an identical, if not equivalent, playbook.

Administration

Jonathan Neman is the present CEO of Sweetgreen and as famous above is among the firm’s co-founders.

Mitch Reback is the corporate’s present CFO. Reback has labored at Sweetgreen since 2015. Previous to Sweetgreen Reback was the CFO at Drybar and has held quite a few management positions at firms corresponding to Johnson & Johnson and Neutrogena.

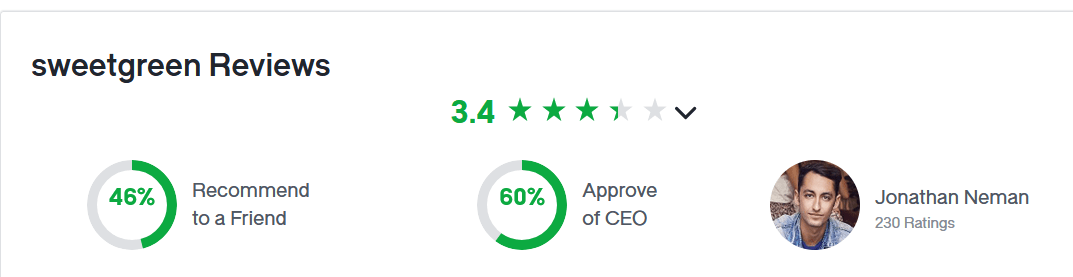

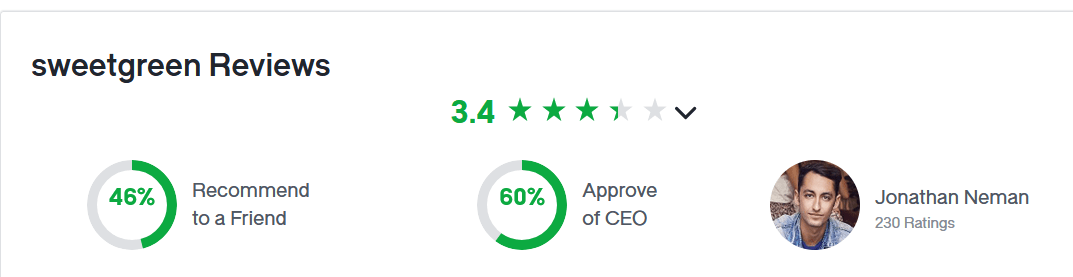

The Glassdoor ratings for Sweetgreen had been a bit shocking to me. As you’ll be able to see beneath most staff do not advocate the corporate and Neman’s rankings aren’t stellar both:

Glassdoor

I do perceive that is quick meals (or quick informal if you happen to favor that time period) however Sweetgreen scored decrease than Chipotle and even McDonald’s. For a health-conscious restaurant with the co-founders nonetheless onboard, I discover these poor opinions shocking.

Financials

In Q3 2023, Sweetgreen generated income of roughly $153 million which was a rise of almost 24% in comparison with Q3 2022. Identical-store gross sales additionally elevated by 4%.

The corporate’s working bills have additionally come down as administration famous stock-based compensation has come down in 2023 and can proceed to say no in 2024 and 2025 which I view as a constructive.

Nonetheless, the corporate remains to be producing web losses as Sweetgreen has but to change into worthwhile since their IPO.

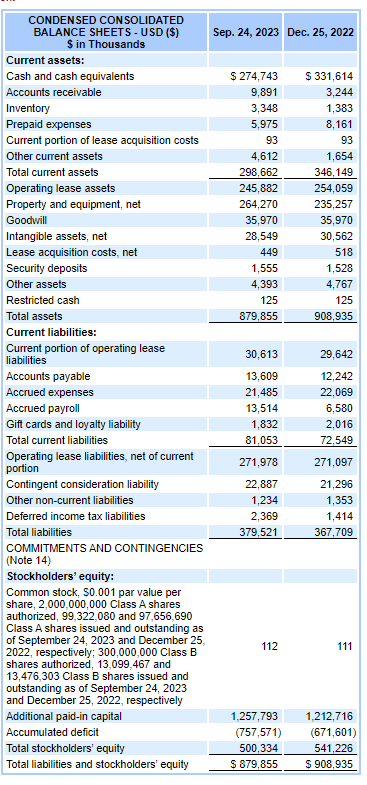

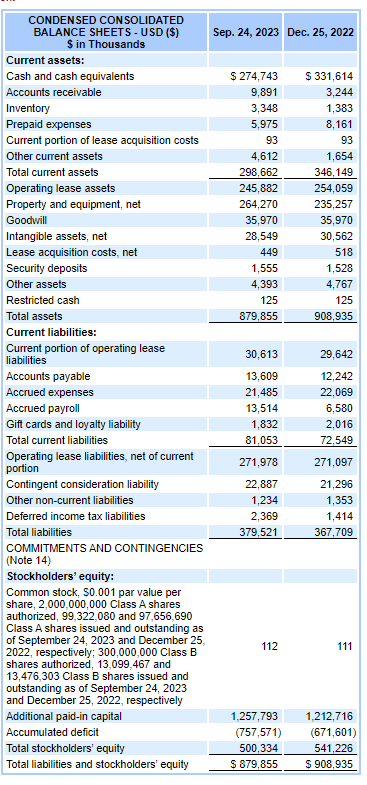

Sweetgreen does have a strong balance sheet as you see beneath:

SEC.gov

The corporate’s money stability is sort of $275 million, and their present property stability can cowl all of the group’s present liabilities. Sweetgreen additionally has no debt.

Dangers

Sweetgreen lists quite a few dangers to the enterprise of their annual report. I’ll talk about two dangers which I consider might damage the group.

One apparent threat for a restaurant firm is meals security. Quite a few restaurant firms corresponding to Chipotle have had food safety issues. I feel given the meals Sweetgreen is serving it places them at the next threat. For instance, rice and beans are two important components for Chipotle. Each are comparatively protected, and simple to retailer and preserve. Then again, Sweetgreen has quite a few produce merchandise which can go dangerous a lot faster.

For all public firms, it is now important to take care of their model picture. Corporations corresponding to Bud Gentle and Goal have been damage in 2023 as their manufacturers suffered because of firm mishaps. A advertising blunder or meals security challenge might actually damage the Sweetgreen model. Moreover, I feel sustaining a constructive working atmosphere for workers issues. I get that this can be a low-paying job within the meals trade, however the opinions on Glassdoor had been shocking to me. Workers are Sweetgreen are far much less extremely to advocate working there in comparison with McDonald’s, Starbucks, and Chipotle.

Valuation

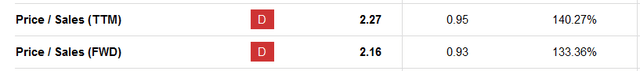

As you’ll be able to see from the beneath valuation metrics from Searching for Alpha, the general worth grade for Sweetgreen a “D-.”

Searching for Alpha

As Sweetgreen is unprofitable, I feel value to gross sales is the very best metric to view this group.

On this case, Sweetgreen seems to have a excessive price-to-sales ratio in comparison with friends on this sector thus I concur with Searching for Alpha’s evaluation that this inventory is probably going overvalued. Like a lot of the market, Sweetgreen’s inventory has risen considerably this month because it’s up over 15%. I would advocate traders ready for the inventory to drop again to November ranges earlier than contemplating including shares.

Conclusion

I feel Sweetgreen is an attention-grabbing firm with each positives and negatives. I like the corporate’s three co-founders are nonetheless with the group. Income has been rising as the corporate continues to broaden and launch new areas. The Infinite Kitchen idea sounds promising and can hopefully be capable to assist the group reduce prices.

For negatives, I fear about competitors as this can be a extremely aggressive trade. Additionally, I ponder if wholesome, regionally sourced meals is mostly a differentiator. If the patron is confronted with reducing prices because of this macro-environment, I might simply see shoppers opting out of getting a salad that is $15. Moreover, the corporate tradition worries me as nicely given the adverse Glassdoor opinions. Additionally, Sweetgreen is not worthwhile, and I doubt the corporate shall be within the close to future.

For now, I’ll wait and see how Sweetgreen continues to carry out. I would prefer to see the corporate get nearer to profitability, proceed so as to add new shops, and work to raised the experiences for his or her staff.