Data shows Dogecoin is currently leading the top cryptocurrencies in terms of Funding Rate, suggesting a spike in long positioning among traders.

Dogecoin Funding Rate Is Sitting At 0.0092% Right Now

In a new post on X, the analytics firm Glassnode has talked about how the top cryptocurrencies in the sector compare to each other in terms of the Funding Rate.

The Funding Rate refers to an indicator that keeps track of the average periodic amount of fees that perpetual futures traders of a given asset are exchanging between each other on the centralized derivatives platforms.

When the value of this metric is positive, it means the long investors are paying a premium to the short ones in order to hold onto their positions. Such a trend is a sign that the majority of the investors share a bullish mentality.

On the other hand, the indicator being under the zero mark suggests the short investors outweigh the long ones. This kind of trend implies a bearish sentiment is dominant in the sector.

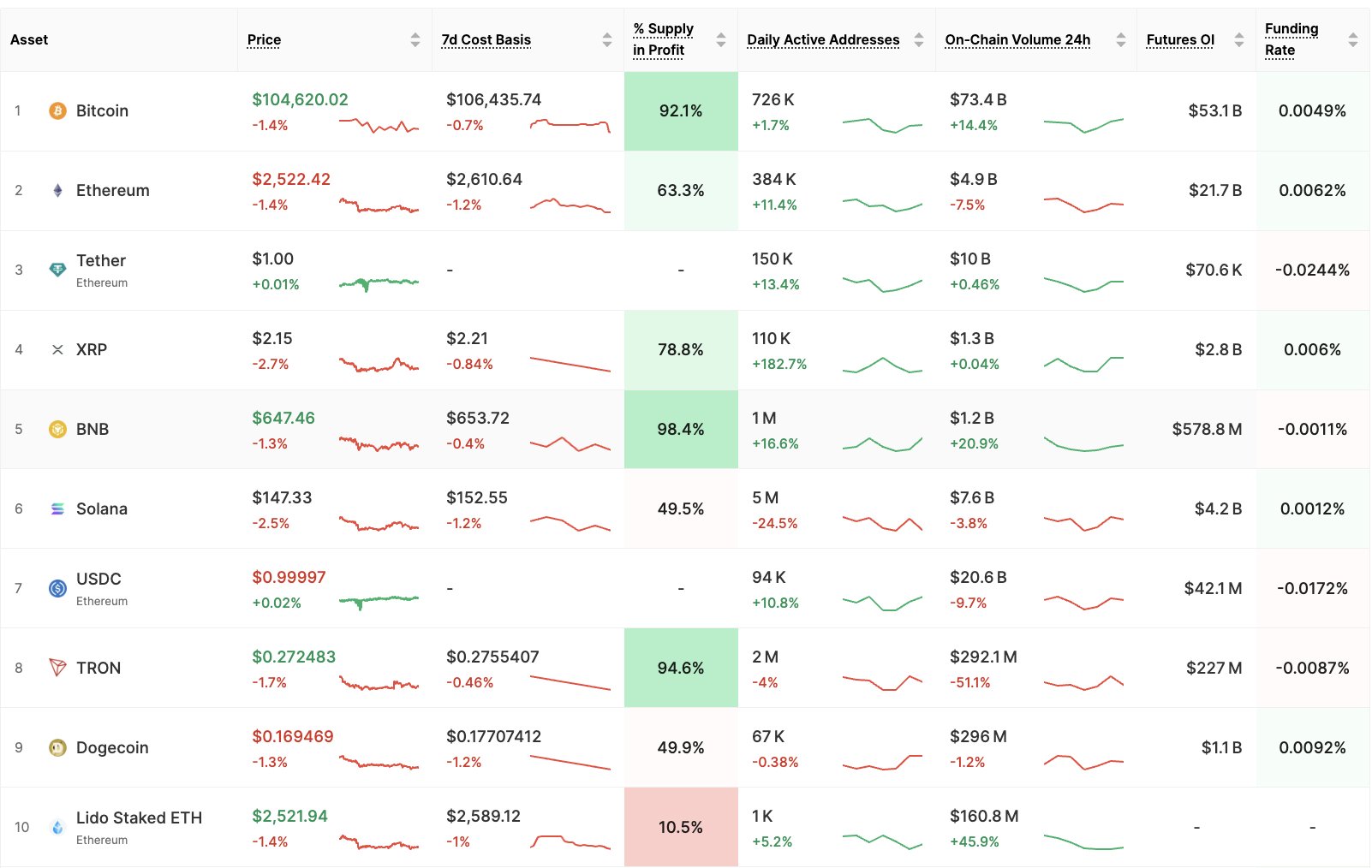

Now, here is the table shared by Glassnode that shows how the top cryptocurrencies by market cap look in terms of the Funding Rate right now:

The value of the metric seems to be the highest for Dogecoin at the moment | Source: Glassnode on X

As is visible above, the Funding Rate is currently positive for Bitcoin (BTC) and Ethereum (ETH). According to the analytics firm, this is a rebound compared to yesterday, when sentiment was bearish among the traders.

The indicator is standing at 0.0049% for BTC and 0.0062% for ETH. XRP (XRP), the fourth largest coin by market cap, also has a similar degree of bullish mood with the metric at 0.006%.

A coin that stands out for its sentiment, however, is the memecoin Dogecoin, as its Funding Rate is sitting at 0.0092%, notably higher than any other cryptocurrency

Then there is Tron (TRX) on the exact opposite side of the spectrum, with the bears paying the fee at a rate of -0.0087%. Solana (SOL) is exactly between the two with a neutral Funding Rate of 0.0012%.

Generally, the side that’s dominant on the Funding Rate is more likely to get wrapped up in a mass liquidation event. As such, for an asset like Dogecoin, where a bullish sentiment seems to be strong relative to the rest of the sector, the longs may be at more risk of getting squeezed.

In the same table, data for a few other indicators is also displayed. Among these, an interesting one is perhaps the Supply in Profit, measuring the percentage of an asset’s supply that’s currently being held at an unrealized gain.

While coins like Bitcoin, Tron, and BNB have more than 90% of their supply in the green, others like Dogecoin and Solana have the metric at less than 50%.

DOGE Price

At the time of writing, Dogecoin is trading around $0.1666, down more than 15% over the last week.

Looks like the price of the coin has been sliding down | Source: DOGEUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.