While TikTok’s in-stream sales push is seemingly gaining some traction, it’s clearly not happening fast enough, with the platform undertaking a new round of layoffs in its U.S. eCommerce division.

As reported by Bloomberg, TikTok has initiated a third round of layoffs in its Shop department, which comes after the platform failed to meet its performance goals in 2024.

Which must have been significant.

TikTok has repeatedly noted that its U.S. sales are rising, with the app reporting a 3x increase in sales on Black Friday last year. For the full year 2024, TikTok reportedly generated around $US30 billion in total GMV, up significantly on 2023.

Yet, that’s clearly not enough. TikTok’s parent company ByteDance is pushing for a global expansion of its eCommerce elements, as it seeks to replicate the success it’s seen with in-stream shopping in its homeland, and as such, it’s set some ambitious targets for its sales push, in line with past success.

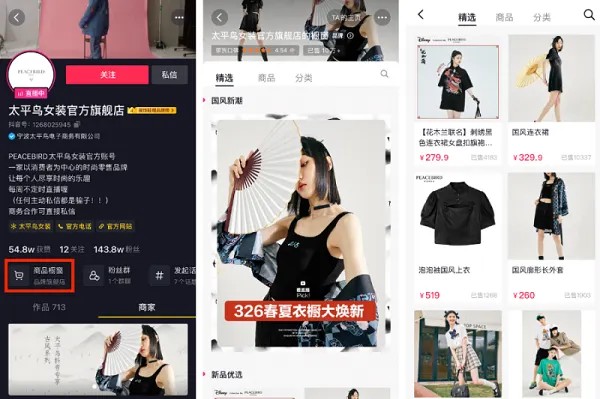

In China, the local version of TikTok, called “Douyin,” is now a shopping mega-power, and a key player in the nation’s rising online sales shift.

Douyin generated $US490 billion in gross merchandise sales (GMV) in 2024, a 30% increase year-over-year, with live-stream sales being the key driver of in-stream shopping activity.

That’s why TikTok’s so keen to follow the same blueprint, because it knows the potential if it can get it right. And with hundreds of billions on the line, it makes sense why TikTok has been so keen to push its in-stream shopping options, even as Western consumers have been less enamored with the opportunity.

That’s why TikTok continues to promote more and more in-app sales tools, and expand its Shop options to more regions.

Japan is the latest market to get access, with the nation becoming the 17th region to get access to TikTok Shop earlier this week. Japan is more likely to see better take-up of TikTok’s in-stream shopping tools, as Asian markets have been more open to such. But it’s Western nations that still seem hesitant, or less interested, in buying products in-stream.

That could be because Western shoppers are more aligned with dedicated functionality in different apps. You shop on Amazon, you check in on friends and family on Facebook, and you watch videos on TikTok. That separation seems to be a more cultural approach, with Asian consumers clearly more open to integrating as many functionalities as possible into a single platform.

Why that is, no one seems to have an answer, but as yet, no platform has successfully integrated various functionalities in this respect, at least not at the scale that TikTok’s seeking with its shopping push.

But TikTok’s still pushing. Just this week, TikTok has announced a range of upcoming shopping events for U.S. consumers, including a “Shop Locally Made” push and a “Deals for You” event.

Again, with the Chinese consumer numbers as a guideline, you can see why TikTok’s so keen to push on, and it’ll be interesting to see if it can make it happen, and how it plans to expand its shopping push to align with these goals.

It’ll now be doing so with fewer staff, though it may look to bring over experts from Douyin to assist with its promotions.