Key Notes

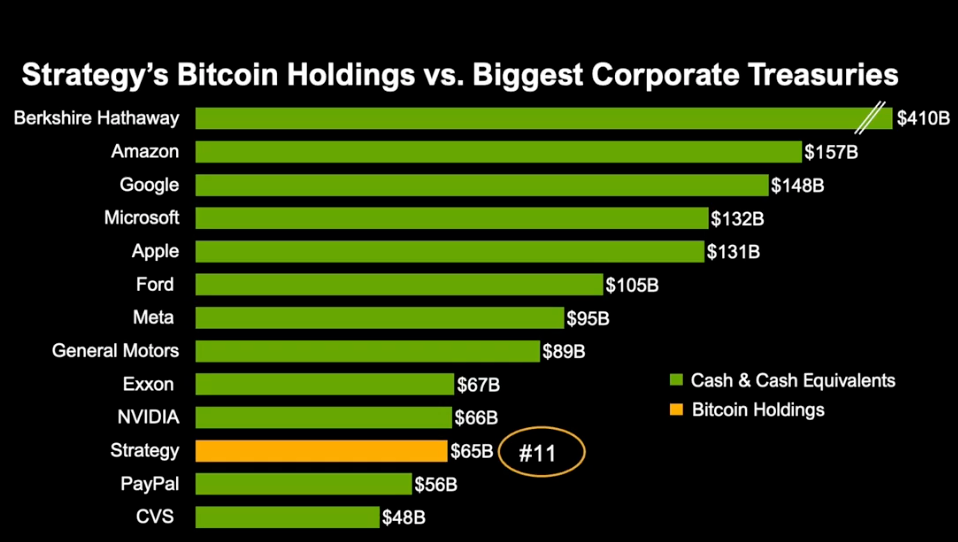

- Strategy’s Bitcoin treasury now ranks 11th globally among corporate treasuries, surpassing major corporations in value.

- The company added 69,140 BTC in Q2 alone, demonstrating aggressive accumulation strategy during market conditions.

- Michael Saylor’s firm generated $14 billion in unrealized profits, validating its Bitcoin-first treasury approach.

Strategy (formerly, MicroStrategy) announced a share-sale to double down on its Bitcoin

BTC

$108 625

24h volatility:

0.5%

Market cap:

$2.16 T

Vol. 24h:

$21.22 B

strategy after netting record-breaking unrealized gains in Q2 2025.

Strategy Files $4.2B Share Sale to Expand Bitcoin Treasury

US-based IT firm, Strategy, has announced a $4.2 billion at-the-market (ATM) share sale as part of a move to further expand its Bitcoin holdings after a profitable showing in the first half of 2025.

The latest filing, disclosed Monday, July 7, by Co-Founder Michael Sayloy, outlines plans to sell preferred STRD stock over time, with proceeds earmarked primarily for Bitcoin acquisitions and corporate operations.

Strategy Announces $4.2 Billion $STRD At-The-Market Program pic.twitter.com/JVIYQmQSpv

— Michael Saylor (@saylor) July 7, 2025

In its filing with the SEC, Strategy emphasized that share sales under the STRD program will be executed gradually, depending on market conditions. The STRD stock,10% Series A Perpetual Preferred Shares, may also be used to fund dividends and internal operations, but Bitcoin remains the headline priority.

The latest move underscores Strategy’s continued thesis that Bitcoin remains the most effective long-term store of value in a volatile macroeconomic climate.

Strategy Scores $14 billion Profits on Bitcoin Holdings in Q2

Following the fundraise press release, co-founder Michael Saylor also shared a video presentation on X (formerly Twitter), where he revealed that the company had added 69,140 BTC in Q2 alone. That purchase brought the firm’s total holdings to 594,325 BTC, now valued at approximately $64.4 billion at current prices.

Strategy Total Bitcoin Holdings vs. Largest US Corporate Treasuries | Source: Strategy, July 2025.

Saylor also reported that the firm realized $14 billion in unrealized earnings in Q2, further cementing Strategy’s position as the world’s largest corporate Bitcoin holder.

According to the company’s video presentation, Strategy’s $64.4 billion BTC treasury ranks 11th globally among all corporate treasuries, just behind Nvidia and Exxon in dollar value.

Best Wallet Gains Traction as Strategy’s Bitcoin Bet Ignites Retail Momentum

Following Strategy’s massive $4.2 billion stock sale to expand its $64.4B Bitcoin treasury, interest in secure crypto storage is on the rise. Best Wallet, a next-gen non-custodial wallet, offers reduced fees, early access to token launches, and top-tier staking rewards.

With over $13.7 million raised in its ongoing $BEST token presale, it’s becoming the go-to platform for crypto-native users. Visit the official website here, to join the $BEST token presale before the next price increase.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.