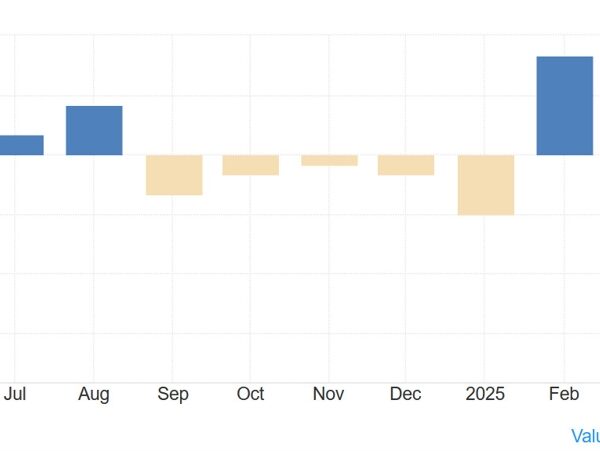

- Prior month 60.7

- Current conditions 68.0 vs 58.6 preliminary

- Expectations 57.7 vs 66.8 preliminary

Inflation expectations

- One year inflation expectations 4.5% vs 4.4% preliminary

- Five year inflation expectations 3.4% vs 3.6% preliminary

The data has been soft across the board today, including this final UMich report. The market is now pricing 59 bps of easing by year-end vs 35 bps before the NFP report. That’s a big jump and shows that the market is wary of the Fed being potentially late and therefore it’s pricing the probability of larger cuts.

This article was written by Giuseppe Dellamotta at investinglive.com.