Key Notes

- Strategic ICE partnership provides 2,000+ apps access to institutional-grade FX and precious metals data feeds globally.

- Total Value Secured reached a new all-time high of $93 billion across hundreds of DeFi protocols worldwide.

- Derivatives activity spiked with 33% volume increase to $3.8B and record $1.4B Open Interest on Tuesday.

Chainlink

LINK

$23.47

24h volatility:

11.2%

Market cap:

$15.92 B

Vol. 24h:

$2.17 B

price surged 10.5% on Tuesday, Aug 12, outpacing all top-20 cryptocurrencies. LINK traded as high as $24.2, its strongest level since February. The LINK price rally was driven by two key events, a data-feeds partnership with US-based Intercontinental Exchange (ICE) and a new all-time high in Total Value Secured (TVS).

On Aug. 12, Chainlink announced it had reached $93 billion in TVS across hundreds of DeFi protocols. This comes after Chainlink confirmed a strategic partnership with ICE, integrating FX and precious metals rates from ICE’s Consolidated Feed into Chainlink data streams.

Chainlink has hit a new all-time high in Total Value Secured (TVS), reaching $93+ billion across hundreds of DeFi protocols.

Chainlink: The standard for onchain finance. pic.twitter.com/hVn4t9rLWg

— Chainlink (@chainlink) August 12, 2025

This move grants over 2,000 apps, banks, and asset managers on-chain access to tamper-resistant institutional-grade data. ICE’s global reach, spanning 300 exchanges, enables developers to build tokenized assets and automated settlement systems leveraging multi-asset class feeds.

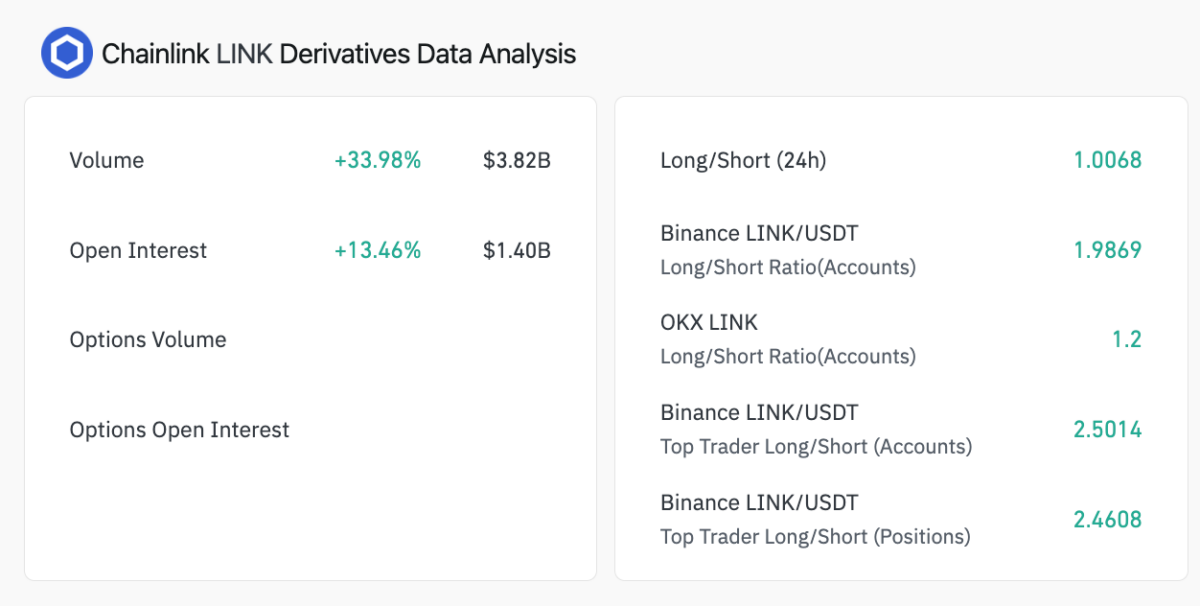

Chainlink (LINK) Derivatives Market Analysis | Coinglass, Aug 12, 2025

Speculative traders reacted positively to these news events, as Coinglass data shows derivatives volumes jumped 33% intraday to $3.8 billion, while Open Interest hit a record $1.4 billion. It remains to be seen if bulls take profits, at the $22 mark, or capitalize on the short-squeeze effect seen on Tuesday to set sights on the next long-term target at the $25 level.

Chainlink Price Forecast: Can Bulls Target 5-Month Resistance at $25?

Technical indicators show LINK price remains firmly in bullish territory after double-digit gains intraday. The daily Relative Strength Index (RSI) stands at 72.42, reflecting overbought momentum but not yet at extremes that historically precede sharp reversals. As seen below, LINK continues to trade well above the short-term SMA levels, $21.70 (5-day) and $20.01 (8-day), indicating strong upward pressure.

Chainlink Price Forecast

The immediate hurdle lies at the $25.19 resistance zone, last tested in March. A decisive breakout above this level could open room for a sustained rally toward $27, particularly if trading volumes remain elevated and market-wide sentiment supports risk-on positioning.

However, after two sessions of double-digit percentage gains in the last four days, LINK runs a high risk of widespread profit-taking. In this bearish scenario plays out, Chainlink price could find initial support at $21.70, with a deeper retracement potentially retesting the $20.01 zone.

Snorter Presale Gains Traction Amid Chainlink Ecosystem Growth

As Chainlink’s institutional adoption accelerates, traders are also turning to high-speed Solana-based projects like Snorter.

The Snorter presale highlights the lowest fees on Solana, exclusive early access to new tokens, fastest execution speeds, and advanced front-running and MEV protection.

Snorter Presale

After multiple sessions of double-digit gains in the past week, traders looking to rotate profits could consider high-growth projects like Snorter. Visit the official Snorter website to get started.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

![Meta Shares Reels Tips for Your Holiday Promotions [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/09/bG9jYWw6Ly8vZGl2ZWltYWdlL3JlZWxzX2Fkc19ob2xpZGF5X2d1aWRlMi5wbmc.webp.webp)