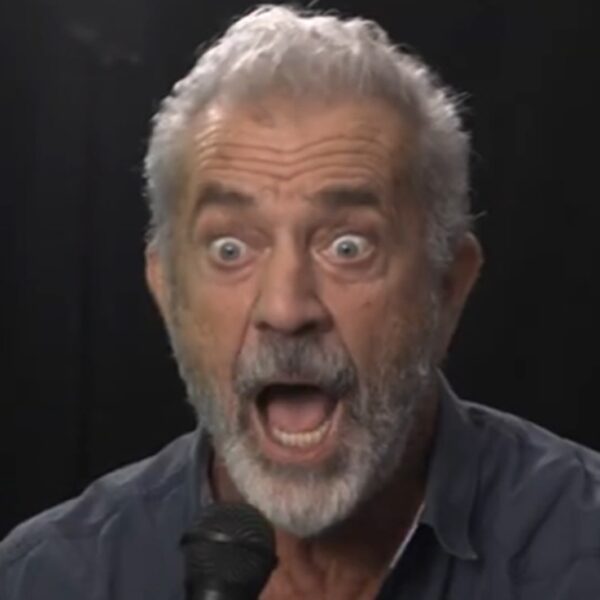

BlackRock’s chief investment officer for global fixed income, Rick Rieder, is bullish. He says the landscape has never looked so good for investing and believes Jerome Powell should be cutting interest rates.

Rieder also happens to be in the running for Fed chairman, according to numerous reports.

While the White House will be mindful of the fact that Jerome Powell’s successor will need to be a credible economic force, President Trump has also been clear that the next chairman will be more dovish than the current.

Trump has been waging a one-sided war against the Fed since winning the Oval Office (and indeed began criticizing Powell even before the election), aggressively lobbying the Federal Open Market Committee (FOMC) to cut rates.

Having awarded the Fed chairman the nickname of “Too Late Powell,” Trump has turned his attention to Powell’s replacement when his term ends in May 2026. Trump has said he will name that individual shortly, potentially in a move to shift the market’s attention to the incumbent, dovish power.

Rieder appears on a list of candidates in the running for that job, according to reports from CNBC and Fox Business.

And the CIO is saying many of the things the Trump camp will want to hear. Speaking to CNBC’s ‘Closing Bell’ yesterday, Rieder said a few “extraordinary things” in the economy had convinced him that now is the “best investing environment ever.”

“First of all the technicals and equities are crazy,” Rieder said. “[The] amount of cash on the sideline, the amount of buybacks relative to the IPO calendar—i.e. the demand versus supply—is pretty extraordinary.

“Then you take the other side of it in fixed income—I think the Fed can cut rates but until then—you got yield levels, you can create a portfolio with a 6.5%, 7% yield. That’s pretty good.”

Rieder added that volatility in equities is relatively low at the moment, minimizing downside risks.

As well as bullish signals on the Wall Street side (a token of approval which President Trump has demonstrated is important to him) Rieder is also confident of the need to cut the base rate from its current level of 4.25% to 4.5%.

“I think it’s almost a given that they cut [in September],” Rieder said. “You’re seeing some sogginess around job hires, around job openings, … more slack coming into the labor market. I still think the funds rate, you can get it down faster and more aggressively than where they are today.”

Rieder did say the Fed will have to remain “respectful” of tariff costs. Markets will like this if he wins the Fed role, as they too are pricing in some level of inflation as a result of the White House’s import cost regime. It will also be a check beside his name in the eyes of analysts, who will see it as a mark of independence from the political rhetoric, which is to insist that foreign governments will “eat” the hikes.

President Trump, on the other hand, won’t like hearing talk of tariff inflation.

In a note previously reported by Fortune, Goldman Sachs economist Elsie Peng wrote the majority of tariff costs are likely to be passed through to consumers. This sparked fury from President Trump, who urged Goldman’s CEO David Solomon to “get a new economist” or consider resigning.

Interest rates aren’t ‘terribly significant’

The Fed sticks closely to its dual mandate of inflation at a target rate of 2% and maximum employment. The base interest rate is its lever to control these two factors.

Breaking with tradition, Rieder suggested the base rate isn’t that useful when it comes to controlling price rises.

He justified: “The interest rate tool doesn’t do a lot today. You think about how companies finance CapEx … you’re not borrowing. The banks are asset liability. The interest rate tool is not that important except for a couple of big factors. What it does to housing, and you look at mortgage applications, building permits, housing starts, new home sales—it’s stuck.

“The mortgage rate has to come down, you drop the funds rate, there’s some yield curve (steepening) that probably happens. And then the other side of it is the low income people who are borrowers. They are getting hurt by this, high savings older people are actually benefitting from the high rates.”

BlackRock declined Fortune’s request for comment.