Key Notes

- XRP price rallied above $3.50 on Fed rate-cut hints but retreated to $3.02 on Sunday Aug 24, after missing the $3.84 target.

- Ripple and SEC officially settle, ending appeals and affirming XRP is not a security for secondary trades.

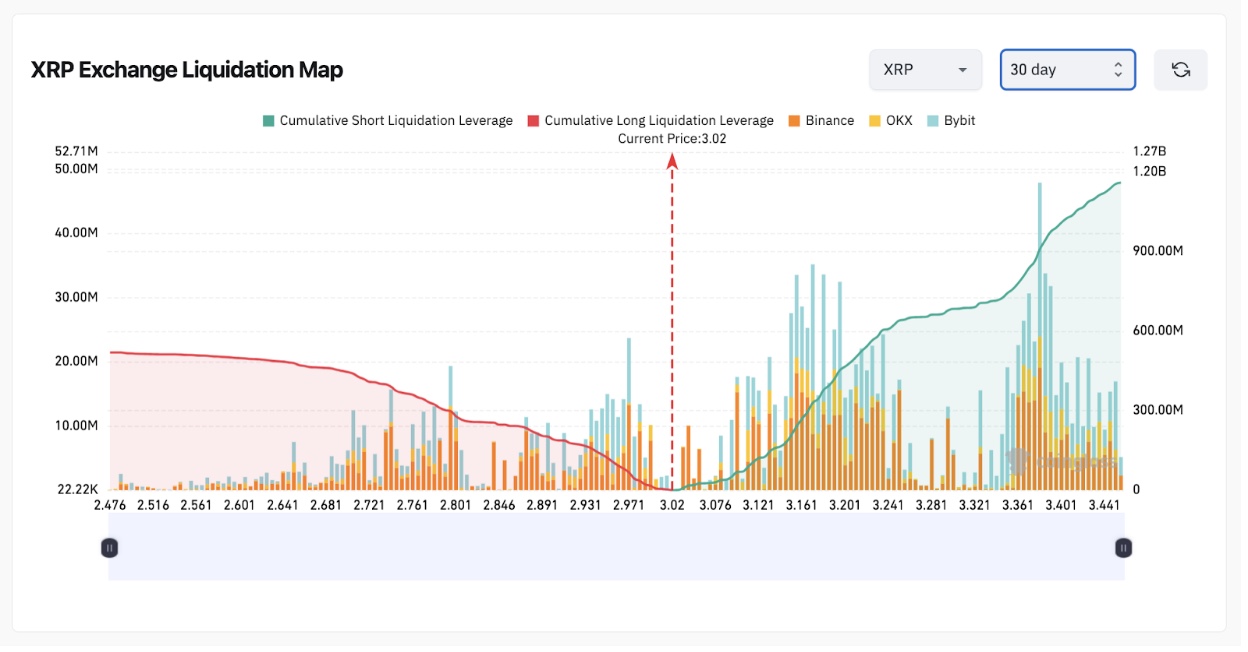

- Coinglass data shows $1.16 billion in XRP shorts vs $519 million longs, signaling heightened bearish pressure.

Ripple (XRP) price closed strongly last week, rallying to $3.50 for the first time since 2021. Two factors drove the upside momentum. First, US Fed Chair Jerome Powell hinted at rate cuts in the upcoming Federal Open Market Committee (FOMC) meeting on September 17, instantly sparking market-wide rallies.

Second, the Securities and Exchange Commission (SEC) and Ripple finally resolved their legal dispute, ending all appeals and clearing the way for final enforcement actions.

The settlement includes Ripple’s $125 million penalty and affirms the court’s ruling that XRP is not a security in secondary market transactions.

#XRPCommunity #SECGov v. #Ripple #XRP The Second Circuit has approved the Joint Stipulation of Dismissal. pic.twitter.com/v796dAtfiZ

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) August 22, 2025

On Friday, Defense lawyer James Filan confirmed that the US Court of Appeals for the Second Circuit formally dismissed the parties’ appeals, marking the conclusion of appellate proceedings and shifting the case to the district court for enforcement.

Despite these bullish legal and macro drivers, XRP underperformed. Rather than join rivals Bitcoin and Ethereum, which surged to fresh all-time highs of $124,000 and $4,890, respectively, in August. XRP instead fell short of its $3.84 target, retracing 4% to trade at $3 at the time of publication on Sunday.

Derivatives markets data shows how short traders converged on XRP markets, after the Ripple-issued coin missed the all-time high target on Friday.

Ripple (XRP) 30-Day Derivatives Liquidation Map | Source: Coinglass, August 24, 2025

Coinglass’ 30-day Liquidation Map data reveals XRP short positions at $1.16 billion, far outweighing longs worth just $519 million. When shorts outweigh longs after a rally, it reflects profit-taking among bullish traders while bears look to exploit overbought conditions.

This overwhelming dominance of short positions could keep the XRP price under pressure in the coming trading sessions unless fresh bullish triggers emerge

XRP Price Forecast: Can Bulls Reclaim Momentum Above $3.50?

XRP price action is consolidating around $3.01 at press time, with the latest retracement reflecting both profit-taking and heavy short positioning.

Technical indicators highlight the indecision. The short-term moving averages are converging, with the 5-day SMA ($2.99) and 13-day SMA ($3.05) creating a narrow zone of resistance. The MACD remains in negative territory, showing weak bullish momentum and signaling caution for buyers.

Ripple (XRP) Price Forecast | Source: TradingView

On the bullish side, XRP must reclaim the $3.10 range with conviction to challenge $3.50 again. A breakout above $3.50 would open the path to $3.84, the level rejected last week, and potentially extend toward $4.00 if renewed institutional interest follows the recent SEC settlement.

In a bearish scenario, failure to hold $3.00 could expose XRP to downside risks toward $2.88, with deeper losses targeting the $2.70 support level, where a significant rebound occurred in early August. Until a decisive move unfolds, traders can expect range-bound action, with short positioning amplifying volatility in both directions.

SUBBD Presale Crosses $1M as XRP Faces Bearish Pressure

As XRP struggles under $3.10 with short sellers dominating, speculative traders are turning to high-risk tokens. The spotlight has shifted toward SUBBD ($SUBBD), a platform positioned as the No.1 AI Agent Creator ecosystem.

At press time, the project has already raised $1.05 million of its $1.26 million cap, signaling strong early adoption. At a presale price of $0.05625 per token, SUBBD aims to reshape creator-fan relationships through AI-powered experiences and tokenized engagement.

SUBBD Presale

Beyond speculative appeal, the token offers practical utilities: exclusive access to AI-enhanced, influencer-approved content, staking rewards tied to VIP livestreams and behind-the-scenes perks, as well as platform-wide discounts. Holders also gain early beta access to new tools, XP multipliers for rewards, and a loyalty system designed to keep fans engaged.

Visit the official SUBBD website to secure early access.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.