Fundamental

Overview

Gold remained supported since

last Thursday following an in-line US CPI report and surprisingly weak initial jobless claims. The jobless claims data stole the

show as initial claims jumped to a new cycle high and the highest level since

2021.

Eventually, it turned out

that the spike in initial claims was caused by an increase in fraudulent claim

attempts in Texas. Therefore, in light of this new information, jobless claims

still point to a resilient labour market and the fall in continuing claims

could actually be an early signal of improvement.

Nonetheless, the dovish

positioning into the FOMC decision remined a tailwind for the market and might

not end until we get to the actual decision or a catalyst triggers a pullback.

In the bigger picture, gold

should remain in an uptrend as real yields will likely continue to fall amid

the Fed’s dovish reaction function. In the short-term though, hawkish repricing

in interest rates expectations will likely keep on triggering corrections.

Gold

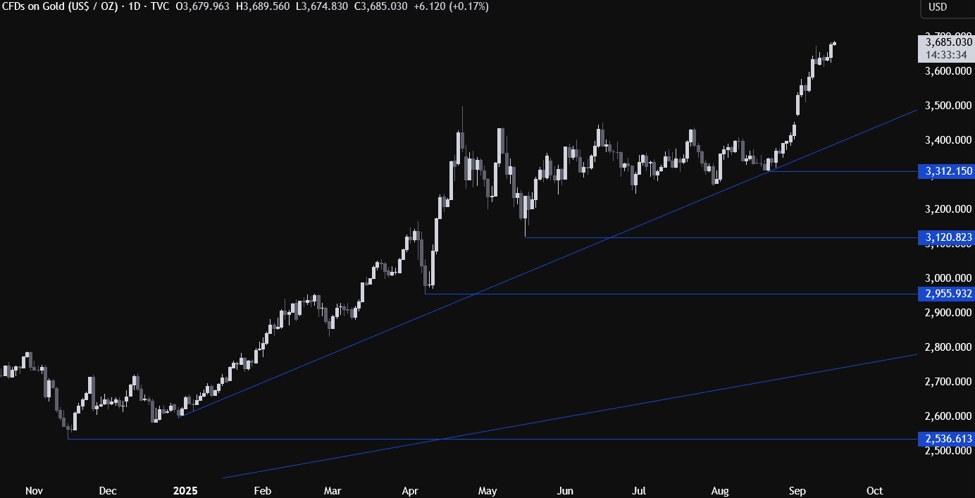

Technical Analysis – Daily Timeframe

Gold Daily

On the daily chart, we can

see that gold extended the rally into a new all-time high yesterday as the

dovish positioning into the FOMC decision continued to be a tailwind for the

buyers. From a risk management perspective, the buyers will have a better risk

to reward setup around the major trendline at the 3,400 level, while the

sellers will look for a break lower to extend the drop into the 3,120 level

next. Such a big correction looks unlikely though unless we get strong data in

the next months and a hawkish repricing in interest rates expectations.

Gold Technical Analysis

– 4 hour Timeframe

Gold 4 hour

On the 4 hour chart, we can

see that we have a minor upward trendline defining the bullish momentum. If we

get a pullback into the trendline, we can expect the buyers to lean on it with

a defined risk below it to keep pushing into new highs. The sellers, on the

other hand, will look for a break lower to increase the bearish bets into the major

trendline around the 3,400 level.

Gold Technical Analysis

– 1 hour Timeframe

Gold 1 hour

On the 1 hour chart, we can

see that the price is not consolidating right above the most recent all-time

high which is acting as a minor support.

We can expect the buyers to keep piling in around these levels with a defined

risk below the 3,675 level to keep pushing into new highs. The sellers, on the

other hand, will want to see the price falling below the level to position for

a drop back into the 3,620 support. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we get the US Retail Sales data. Tomorrow, we have

the FOMC policy announcement. On Thursday, we get the latest US Jobless Claims

figures.