Key Notes

- Gold’s record-breaking surge to $3,700 reflects investor rotation into defensive assets amid Fed uncertainty and geopolitical tensions.

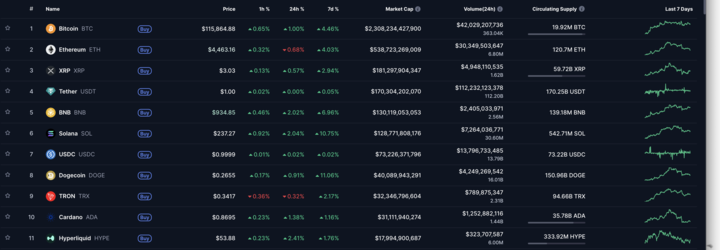

- Bitcoin struggles below $115,000 while altcoins like XRP, Solana, and Dogecoin posted moderate gains during Tuesday’s session.

- Hyperliquid and BNB emerged as top performers, signaling potential speculative positioning ahead of expected market volatility.

Gold price broke above $3,700 an ounce for the first time on Tuesday, September 16, as global investors rotated capital into safe-haven assets ahead of the Federal Reserve’s upcoming policy decision.

With markets still widely anticipating a Fed rate cut, recent sticky inflation readings and rising geopolitical tensions have seen investors sideline risk assets for gold’s defensive hedge.

The breakout in gold reverberated through cryptocurrency markets, where momentum remained mixed on Tuesday. Bitcoin

BTC

$116 622

24h volatility:

1.5%

Market cap:

$2.32 T

Vol. 24h:

$40.37 B

price remains below $115,000 at press time, after multiple failed breakout attempts since the turn of the week.

Ethereum posted a 0.81% intraday decline, while Tron slipped 0.3%, according to CoinMarketCap data. In contrast, altcoins such as

XRP

$3.05

24h volatility:

1.7%

Market cap:

$182.08 B

Vol. 24h:

$4.55 B

, Solana

SOL

$238.8

24h volatility:

2.7%

Market cap:

$129.41 B

Vol. 24h:

$7.49 B

, Dogecoin

DOGE

$0.27

24h volatility:

1.2%

Market cap:

$40.31 B

Vol. 24h:

$4.14 B

, and Cardano

ADA

$0.88

24h volatility:

2.5%

Market cap:

$32.05 B

Vol. 24h:

$1.55 B

notched moderate gains, benefiting from the intraday capital rotation.

Cryptocurrency markets’ reaction after gold hit all-time highs above $3,700 | CoinMarketCap, Sept. 16, 2025

BNB Coin

BNB

$954.7

24h volatility:

3.9%

Market cap:

$132.73 B

Vol. 24h:

$1.62 B

and Hyperliquid

HYPE

$54.02

24h volatility:

3.2%

Market cap:

$14.64 B

Vol. 24h:

$526.90 M

also stood out among the top gainers. Binance Coin advanced 2% to $935, reaching a $128 billion valuation. Similarly, Hyperliquid gained 1.8% to $53, pushing its market cap to $17.9 billion.

This may offer early signals of speculative positioning, as traders often accumulate exchange tokens to earn fee discounts or rewards in anticipation of heightened market activity.

Hyperliquid Price Forecast: Can Bulls Hold Out for $60 Breakout?

Hyperliquid price has maintained strong upward momentum toward $55 after its recent breakout, before consolidating near $53 at press time. The token’s resilience above the $50 psychological level emphasizes active demand among decentralized exchange users.

Moreover, the Bollinger Bands show HYPE consolidating between $49.27 support and $58.56 resistance. Despite weakening volumes, MACD readings remain bullish, with the blue MACD line at 2.75 still positioned above the red signal line at 2.36, confirming buyer dominance.

Hyperliquid (HYPE) Technical Price Analysis | TradingView

If bulls defend the $52–$50 range, HYPE price could attempt a retest of $58.56, the upper Bollinger resistance. A decisive breakout above this level would open the path toward $62, the next resistance zone. On the downside, failure to hold $50 may trigger profit-taking, exposing the $49.27 middle-band support.

If speculative trading activity intensifies around the Fed rate decision, HYPE price could witness another breakout toward the $60 area in the days ahead.

Best Wallet Presale Gains Momentum Alongside Hyperliquid Rally

As Hyperliquid and BNB flash bullish signals amid gold’s recent all-time high rally, early-stage projects like Best Wallet are also gaining traction. Best Wallet, designed as a secure multi-chain solution with institutional-grade security, has attracted significant traction as investors seek diversification beyond exchange tokens.

Best Wallet (BEST) Presale

At press time, Best Wallet’s presale has raised over $15.8 million, fueled by inflows from traders rotating out of stagnating large-cap altcoins into projects with stronger upside potential. Prospective participants can still visit the Best Wallet website to join the BEST presale before the token price increases from the current $0.0256 level.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.