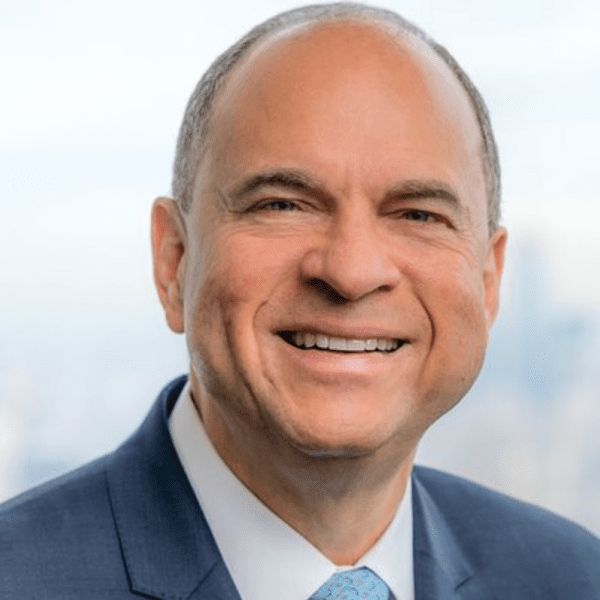

Adani Enterprises Ltd.’s shares gained as much as 5.2% after India’s securities market regulator cleared the group’s billionaire-founder Gautam Adani of some allegations of impropriety raised by the U.S. short seller Hindenburg Research in early 2023.

The flagship firm’s stock climbed the most since Aug. 11 on Friday. Securities and Exchange Board of India, or Sebi, said the evening before that there was no evidence of the Indian conglomerate using so-called related party transactions to route funds into its listed units in two orders on its website. Adani Group has repeatedly denied the accusations first made by Hindenburg, which has since disbanded.

Shares of all 10 firms controlled by the group gained, led by Adani Total Gas Ltd. which jumped over 13%.

While the regulator’s orders do not clear the ports-to-power conglomerate of other allegations raised by the short seller, they still mark a reprieve for Adani’s empire and validate its stance of not being in violation of local laws. Asia’s second-richest person continues to face a regulatory overhang from an indictment by the U.S. Department of Justice last year in an alleged $250 million bribery scheme.

Sebi’s investigation was related to short-seller’s allegations that Adicorp Enterprises Pvt., Milestone Tradelinks Pvt. and Rehvar Infrastructure Pvt. were used as a conduit to route funds from various Adani Group companies to fund publicly listed Adani Power Ltd. and Adani Enterprises Ltd.

Not a related party

There was no violation of Sebi’s disclosure norms as the transactions between Adicorp, Milestone Tradelinks and Rehvar Infrastructure with the conglomerate’s firms did not meet the definition of a related party, Sebi board member Kamlesh C. Varshney said in the two orders.

The scathing short-seller report in January 2023 had alleged large-scale corporate fraud and stock price manipulation, triggering a stock rout that at one point eroded over $150 billion in market value for the listed Adani entities and led to a court-directed local regulatory probe. It also halted Adani’s debt-fueled expansion spree.

The conglomerate, which often aligns itself with Prime Minister Narendra Modi’s development goals and controls vast swathes of India’s infrastructure sector, is yet to fully recover from the market value erosion caused by the short seller’s accusations.

The group market capitalization was $156 billion early Friday, as against $235 billion on the eve of Hindenburg’s report in January 2023.

The Supreme Court of India said in January 2024 that no further probes into this were needed after Sebi closed its investigation. Adani had cheered that verdict as well.

Adani now faces the biggest risk from the U.S. probe where his efforts to get those fraud charges against him resolved have stalled in recent months, Bloomberg News reported earlier this month, citing people familiar with the matter.

Sebi’s findings “could lead Adani’s bond spreads to tighten slightly, though U.S. charges against Gautam Adani could remain an overhang,” Sharon Chen, Bloomberg Intelligence Credit Analyst, said in a note.