Fundamental

Overview

The FOMC decision last week

was mostly in line with expectations with a 25 bps rate cut and the Fed placing

more focus on the labour market now given the recent weakness in the data. The

dot plot was more hawkish compared to market’s pricing, which makes sense given

that Fed Chair Powell labelled the rate cut as a “risk management” move.

This means that they are

cutting rates just because of the recent weakness in the labour market. If the

labour market were to improve, the Fed would start turning more hawkish and

might even hold off on the expected rate cuts. For now though, this Fed support

is bullish for the stock market.

Problems arise when the

economy gets too hot and that’s when the Fed support wanes and the central bank

starts to work against the market. And this is where we could get the pullbacks

(and eventually even a crash).

Right now, the market is

pricing 109 bps of easing by the end of 2026 compared to just 75 bps projected

by the Fed. This means that the market is too optimistic. Therefore, a hawkish

repricing in those expectations should in theory trigger pullbacks in all

asset classes. So, if you are waiting for a pullback, then wait for US data. If

we get strong US data (especially with the NFP report next week), then we will likely get a deeper pullback which could take us back to the FOMC low.

Once the market pricing gets back in line with

the Fed’s projections, then the stock market should restart its rally. In fact, as long as the

Fed’s reaction function remains dovish, the downside will remain limited. This

“melt-up” phase will likely go on as long as the Fed remains more

focused on the labour market. Once inflation starts to become a serious worry (most likely if it moves above 3%),

that’s when we will finally get a meaningful correction (or even a bear market

if the Fed opens the door for rate hikes). Until then, the pullbacks will just be

dip-buying opportunities.

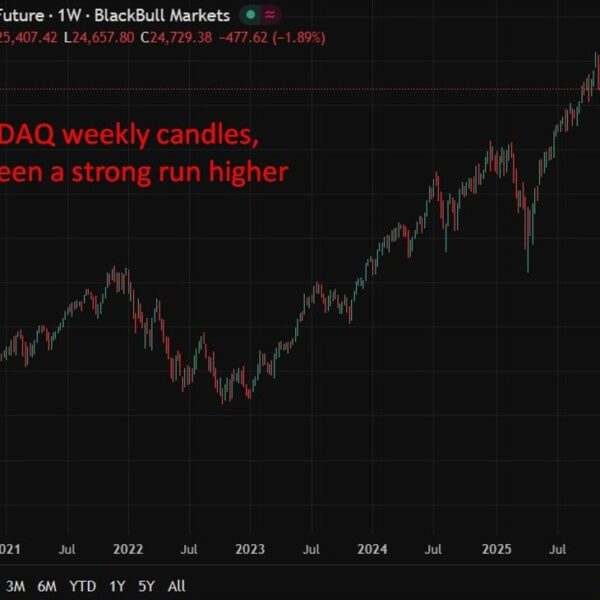

Nasdaq

Technical Analysis – Daily Timeframe

Nasdaq daily

On the daily chart, we can

see that the Nasdaq pulled back a bit from the all-time highs. From a risk management

perspective, the buyers will have a much better risk to reward setup around the

major trendline

where they can pile in with a defined risk below the trendline and target a new

all-time high. The sellers, on the other hand, will want to see the price

breaking below the trendline to extend the drop into the 23,000 level next.

Nasdaq Technical

Analysis – 4 hour Timeframe

Nasdaq 4 hour

On the 4 hour chart, we can

see that we had a minor upward trendline defining the bullish momentum on this

timeframe. Yesterday, we got a break to the downside. We can expect the sellers

to pile in around these levels with a defined risk above the trendline to keep

targeting a deeper pullback into the 24,245 level. The buyers, on the other

hand, will want to see the price rising back above the trendline to pile in for

a rally into a new all-time high.

Nasdaq Technical Analysis – 1 hour Timeframe

Nasdaq 1 hour

On the 1 hour chart, we can

see that we have a minor downward trendline defining the current pullback. The

sellers will likely lean on the trendline with a defined risk above it to

position for a drop into the 24,245 level, while the buyers will look for a

break higher to pile in for a rally into a new all-time high. The red lines

define the average daily range for today.

Upcoming Catalysts

Today we get the latest US Jobless Claims figures. Tomorrow,

we conclude the week with the US PCE report.