Key Notes

- Phantom’s new payment superapp uses Bridge-issued CASH stablecoin with upcoming Stripe integration for merchant payments.

- Industry experts predict increased competition will shift power dynamics away from issuers toward end users benefiting consumers.

- The stablecoin market approaches record $300B valuation amid launches from Plasma, Cloudflare, and payment integrations by Visa.

Phantom, a leading crypto wallet native to Solana

SOL

$206.8

24h volatility:

1.3%

Market cap:

$112.36 B

Vol. 24h:

$6.76 B

, has announced the launch of Phantom Cash, a superapp for cryptocurrency payments built on Solana and powered by the also just launched US dollar-pegged stablecoin CASH. This September 30 launch intensifies the competition among payment superapps and stablecoins, in what some experts are calling “the stablecoin supercycle” or “stablecoin wars.”

Helius co-founder Mert commented on the launch, saying, “The stablecoin wars on Solana are about to heat up. The days of issuers taking all yield for themselves or doing backrun deals that cut users out are gonna end fast,” he added, suggesting the growing competition will favor users eventually.

Phantom has released a new stablecoin on Solana

the stablecoin wars on Solana are about to heat up

the days of issuers taking all yield for themselves or doing backrun deals that cut users out are gonna end fast https://t.co/g86aG12Wul

— mert | helius.dev (@0xMert_) September 30, 2025

According to the announcement, Phantom decided to build its own stablecoin—issued by Bridge—because “existing stables weren’t built for everyday life.” The post also promises an upcoming integration to Stripe’s global merchant network, doubling down on its mission “to make crypto safe and effortless.”

Our mission to make crypto safe and effortless remains.

Phantom Cash does just that by bridging the gap between crypto and your daily life.

— Phantom (@phantom) September 30, 2025

The Stablecoin Supercycle and Wars

The narrative of a “stablecoin supercycle” is growing fast in the crypto trenches, evidenced by a search on X for this keyword. Different commentators mention that we are living in a stablecoin supercycle, where this crypto solution has gained significant product-market fit, attracting investors, builders, and users worldwide.

Meanwhile, this reality will inevitably create niche “wars,” with competitors fighting to gain market share, each counting on their customized solutions. Solana and Ethereum

ETH

$4 110

24h volatility:

1.0%

Market cap:

$495.27 B

Vol. 24h:

$32.44 B

are two likely battlegrounds, considering both chains network effect and liquidity, playing an important role in these dynamics.

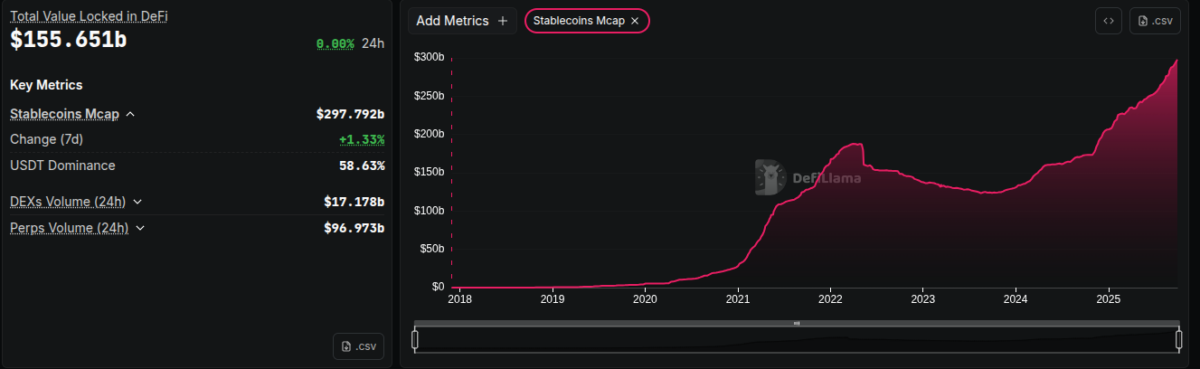

Notably, the stablecoin total market capitalization is hovering around record highs close to $300 billion. Precisely, data from DefiLlama shows a $297.79 billion market cap among all blockchains as of this writing.

Total value locked in DeFi and stablecoin market cap chart as of September 30, 2025 | Source: DefiLlama

As Coinspeaker reported, Tether-backed Plasma recently launched a stablecoin superapp, Cloudflare unveiled its own stablecoin, NET, on September 25, and today Visa kick-started a process that promises to boost cross-border stablecoin payments. Google, Coinbase, Kraken, Circle, and others are also deploying solutions to benefit from the growing demand for crypto payments.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.