Good morning. The U.S. government shutdown continues. While shutdowns aren’t new, the timing of this one may prove to be another test of resilience during uncertain times.

“The government shutdown is a symptom, not the story,” said Bridget Gainer, chief public affairs officer at Aon. “While Aon’s data shows that disruption is now a constant—from geopolitical tensions to regulatory paralysis—most businesses are still managing it like a one-off event.”

Shutdowns can delay contracts, squeeze liquidity, and reveal how unprepared many companies are to absorb shocks, Gainer said. “What we’re telling clients is that planning for resilience isn’t a reaction—it’s a strategy for survival.”

Due to the government shutdown, key economic data—such as the September jobs numbers scheduled for release on Friday by the Bureau of Labor Statistics—will be halted. U.S. employers added just 22,000 jobs in August, as the labor market continued to cool. Last month, the Labor Department said hiring decelerated from 79,000 in July. The unemployment rate ticked up to 4.3%, the highest level since 2021.

I asked Gregory Daco, EY-Parthenon’s chief economist, about the impact of the BLS not publishing the job numbers on Friday. “The absence of key data like the jobs report would temporarily blind business leaders, policymakers, and investors, heightening volatility and reinforcing the Fed’s data-dependency dilemma,” Daco said. It would also amplify economic uncertainty at a time when the economy is showing mixed signals, he added.

Regarding the impact on companies, Daco said that businesses rely on official data to inform hiring, investment, and pricing decisions. “A shutdown-induced data blackout undermines confidence and increases planning risk,” he said. “It adds friction at a time when many companies are already navigating a noisy policy and economic environment.”

In August, employers announced 85,979 job cuts, the highest August total since 2020, according to Challenger, Gray & Christmas, an outplacement firm.

ADP issues a monthly report that provides a snapshot of private sector employment based on its own payroll data, which may differ from the official BLS jobs report. On Wednesday, ADP reported that U.S. private sector employment fell by 32,000 jobs in September, the first back-to-back monthly job losses since 2020.

As the shutdown continues, CFOs should prioritize agility in scenario planning, Daco said. With potential delays in economic data and government operations, finance chiefs should prepare for market volatility and disruptions to federal contracts, permits, or tax processing, he said.

“Uncertainty breeds caution, but it can also be a strategic advantage—firms that stay nimble will be better positioned to act once clarity returns,” Daco said.

Sheryl Estrada

[email protected]

Leaderboard

Daniel Sullivan was appointed CFO of Five Below, Inc. (Nasdaq: FIVE), a retail chain. Sullivan has 35 years of experience. He most recently served as EVP and chief operating officer at Edgewell Personal Care, initially joining the company as CFO. Sullivan previously served as CFO of Party City and CFO of Ahold USA, as well as CFO and COO of Heineken USA and Heineken International.

Steve Rai was appointed EVP and CFO of Open Text Corporation (Nasdaq: OTEX), a cloud and AI company, effective Oct. 6. Rai brings over 30 years of experience. He most recently served as CFO of BlackBerry Limited. Before that, Rai held senior finance positions at PMC-Sierra and PricewaterhouseCoopers LLP.

Big Deal

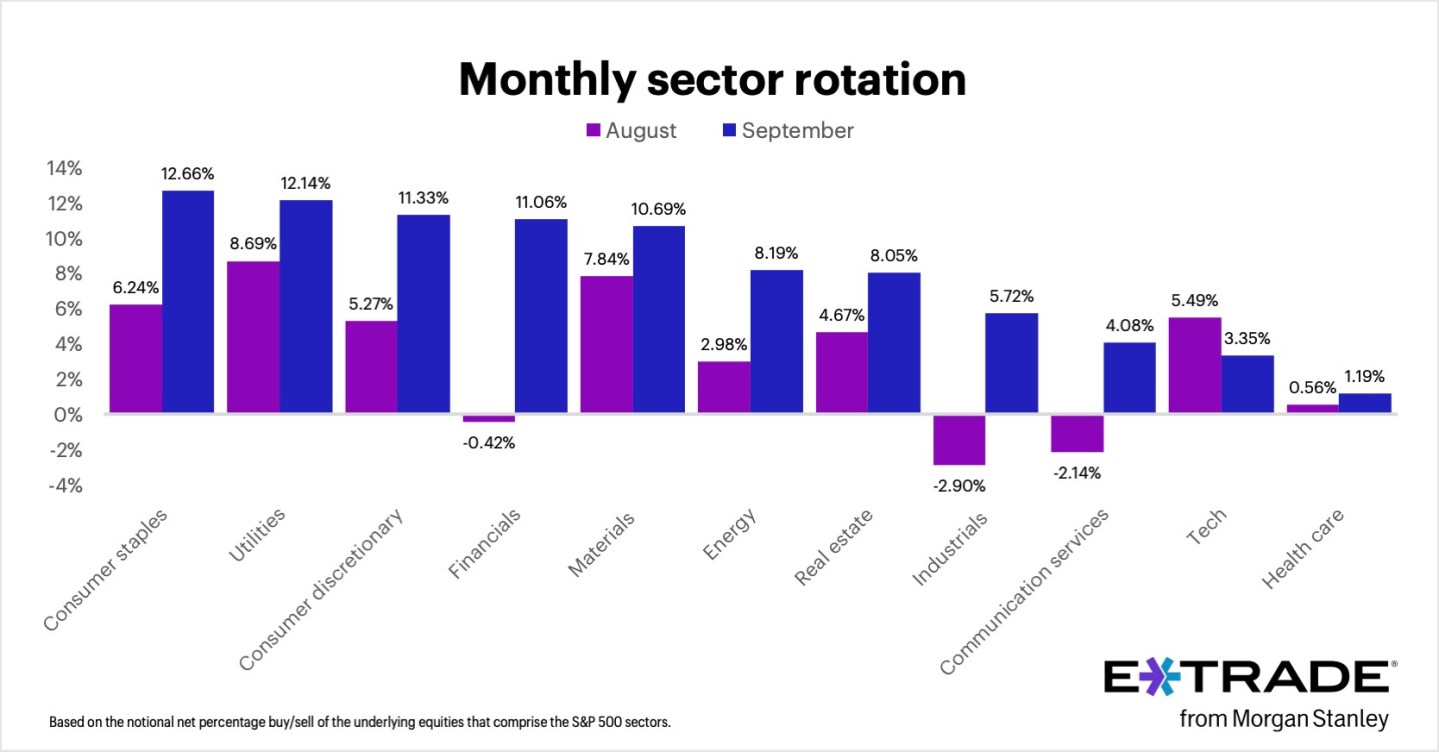

E*TRADE from Morgan Stanley has released its monthly analysis. “In the U.S. stock market’s strongest September since 2010, E*TRADE from Morgan Stanley clients were net buyers in all 11 S&P 500 sectors,” according to Chris Larkin, managing director of trading and investing.

Although the tech sector was September’s biggest gainer, the top three sectors for net buying activity were consumer staples (+12.66%), utilities (+12.14%), and consumer discretionary (+11.33%).

However, that activity wasn’t necessarily as defensive as it may appear, Larkin noted. His assessment: “While utility stocks are a classic defensive play, a significant portion of last month’s buying occurred in nuclear power stocks, some of which were among September’s biggest gainers. Also, activity in the consumer discretionary sector revolved largely around megacap stocks—both those that pulled back in September, and those that posted strong rallies.”

Going deeper

Aon plc has released the 2025 edition of its Global Risk Management Survey, now in its 19th year. The survey reveals a sharp rise in risks associated with geopolitical volatility, which climbed 12 places since 2023 to enter the top 10 global risks for the first time. The current top three risks are cyber attacks, business interruption, and economic slowdown or recovery.

The growth of trade and geopolitical challenges reflects instability across global regions, affecting supply chains, regulations, and financial performance. However, only 14% of organizations track their exposure to the top 10 risks, and just 19% use analytics to evaluate their insurance programs.

The report also offers a forward-looking view: by 2028, cyber risk is expected to remain the most critical, while artificial intelligence and climate change join the top 10 concerns, reinforcing the impact of technology and extreme weather on business.

Findings are based on nearly 3,000 responses from risk managers and executives in 63 countries.

Overheard

“Every company wants to make breakthroughs with AI. But if your data is bad, your AI initiatives are doomed from the start.”

— Brian Moore, co-founder and CEO of AI startup Voxel51, writes in a Fortune opinion piece.