Key Notes

- The 2Z token crashed from $1.68 to $0.50 within hours as 2.77 billion unexpected tokens flooded the market beyond stated supply.

- Early CoinList investors at $0.075 briefly saw 2,140% gains before the collapse wiped out most returns for latecomers.

- Despite backing from major exchanges and SEC approval, the team remains silent on the supply discrepancy and chaotic launch.

The launch of DoubleZero, a high-performance network on the Solana blockchain, descended into chaos on Oct. 2 as the price of its native token collapsed by over 65%. The crisis is linked to a massive discrepancy in the token’s circulating supply, which appeared to be nearly five times higher than what the project’s official documents suggested.

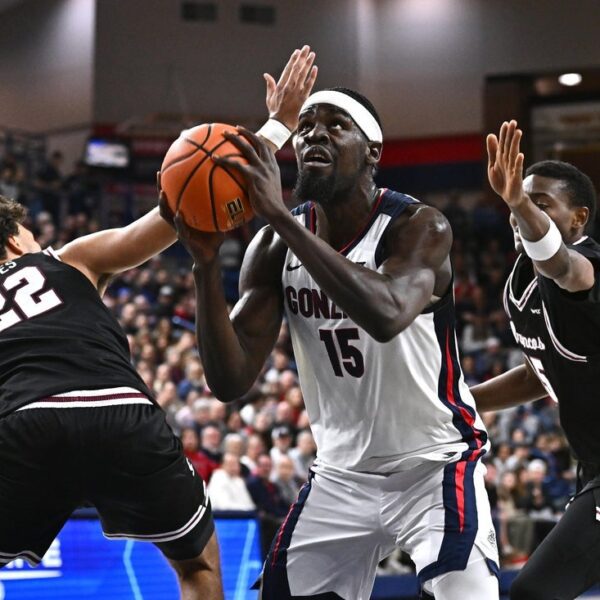

The DoubleZero token began trading on several top-tier exchanges, including Coinbase for perpetual futures and Binance Alpha for spot trading. It quickly reached an all-time high of $1.68 before an intense wave of selling pressure drove it to a low of $0.4961 within hours. The rapid price decline left the community stunned and searching for answers.

A new, faster internet is here.

DoubleZero’s high-performance global network is now live on mainnet-beta powered by 2Z.

Welcome to the world of high-performance networking. pic.twitter.com/RrlM95ZP7s

— DoubleZero IBRL/acc (@doublezero) October 2, 2025

At the heart of the controversy is a major question mark over the project’s tokenomics. The project’s MICA whitepaper, a regulatory document filed in the EU, indicated that the initial circulating supply would be approximately 700 million 2Z, or 7% of the 10 billion total supply. However, data aggregators like CoinMarketCap reported a circulating supply of 3.47 billion 2Z at launch.

DoubleZero price | Source: CoinMarketCap

This addition of roughly 2.77 billion unexpected tokens into the market is the most likely cause for the sell-off. The source of these tokens remains unclear, creating an information vacuum that has fueled negative sentiment online. The project raised $28 million in a private sale in March 2025, but the unlock schedule for these investors has not been clearly communicated.

A Launch Marred by Confusion and Criticism

The contrast between DoubleZero’s A-list partners and its disastrous launch execution has become the core narrative. The project had secured listings on a half-dozen major exchanges and even had a “HODLer Airdrop” planned with Binance. It also obtained a rare No-Action Letter from the US Securities and Exchange Commission, signaling a high degree of legal and regulatory planning.

However, the launch day was defined by technical complaints and mass confusion. Users on X, formerly Twitter, reported issues with trading, while others questioned who was responsible for the enormous selling pressure. The potential for a significant return on investment for early participants was clear. Non-US validators who participated in a CoinList sale bought tokens at a final price of $0.075. At the token’s peak of $1.68, this represented a potential gain of over 2,140%.

So far, the DoubleZero team has not issued a public statement to address the circulating supply numbers, the price collapse, or the technical issues reported by users. The team’s silence has only intensified the community’s frustration and the scrutiny of its complex corporate structure, which includes entities in Panama, the Cayman Islands, and the British Virgin Islands. As the project’s market cap continues to suffer, the crypto community is waiting for clarity on one of the most chaotic token launches of the year.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

As a Web3 marketing strategist and former CMO of DuckDAO, Zoran Spirkovski translates complex crypto concepts into compelling narratives that drive growth. With a background in crypto journalism, he excels in developing go-to-market strategies for DeFi, L2, and GameFi projects.