Bank of America’s latest internal data suggests the U.S. labour market continued to lose momentum through September, showing weaker job growth and rising unemployment claims.

In the absence of US government produced data, eyes are focused on private surveys such as that from Bank of America. More:

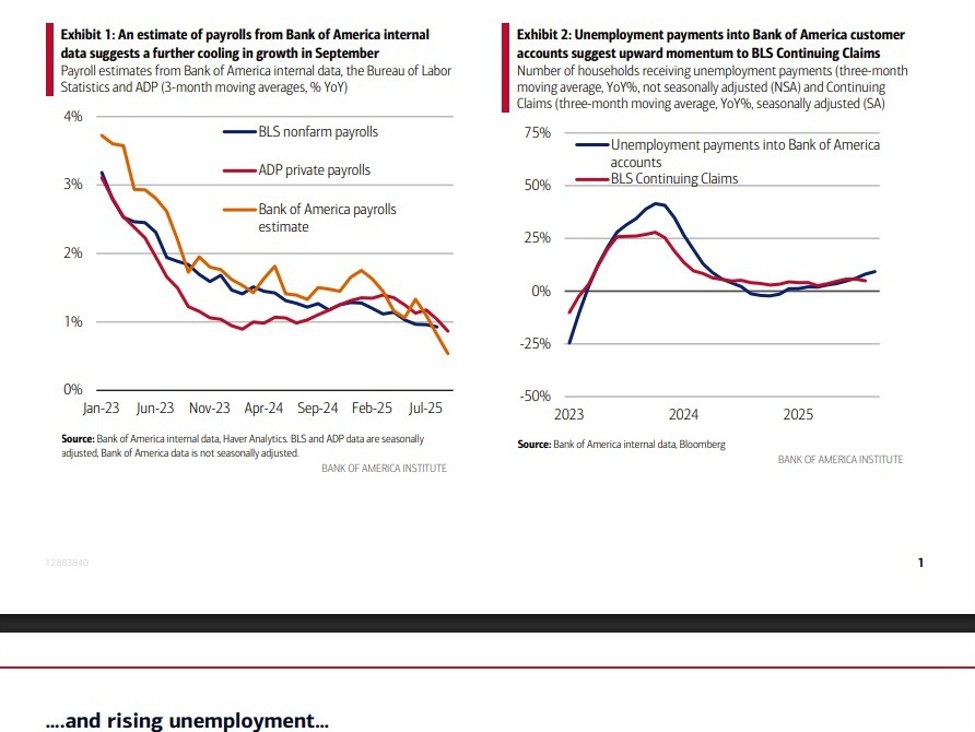

- The bank’s proprietary payroll tracker — based on the number of customer accounts receiving paychecks — indicates a slowdown in employment growth on a three-month moving average basis. The trend, which has softened more than the ADP private payrolls data, points to a continued easing in hiring momentum across the economy.

- Meanwhile, Bank of America’s analysis of unemployment payments into customer accounts shows a roughly 10% year-on-year rise in October, double the 5% increase seen in the official Bureau of Labor Statistics (BLS) continuing claims data for August. The bank interprets this as evidence of upward pressure on unemployment.

- On wages, the picture is more mixed. The data show after-tax wage and salary growth in September of 4.0% for higher-income households, 2.4% for middle-income, and 1.4% for lower-income households — an acceleration across the board but still revealing a wide gap between income groups. While the divergence did not widen further last month, lower-income earners continue to lag behind.

Overall, Bank of America concludes that its internal data remain consistent with a gradual cooling of the labour market — slower job creation and higher unemployment claims — even as pay growth trends remain relatively firm, particularly among higher-income households.

—

Impacts to eye:

-

FX: Signs of labour market cooling could strengthen expectations for Fed rate cuts, pressuring the U.S. dollar.

-

Rates: Softer employment signals may push Treasury yields lower as investors price in weaker growth momentum.

-

Equities: Moderating wage pressures and higher unemployment could support rate-sensitive sectors but highlight slowing demand.