Key Notes

- Bitcoin fell to $120K after a 2.22% daily drop, down 3.75% from its recent peak.

- Gold hit a record $4,017 per ounce, up 53% year-to-date amid risk aversion.

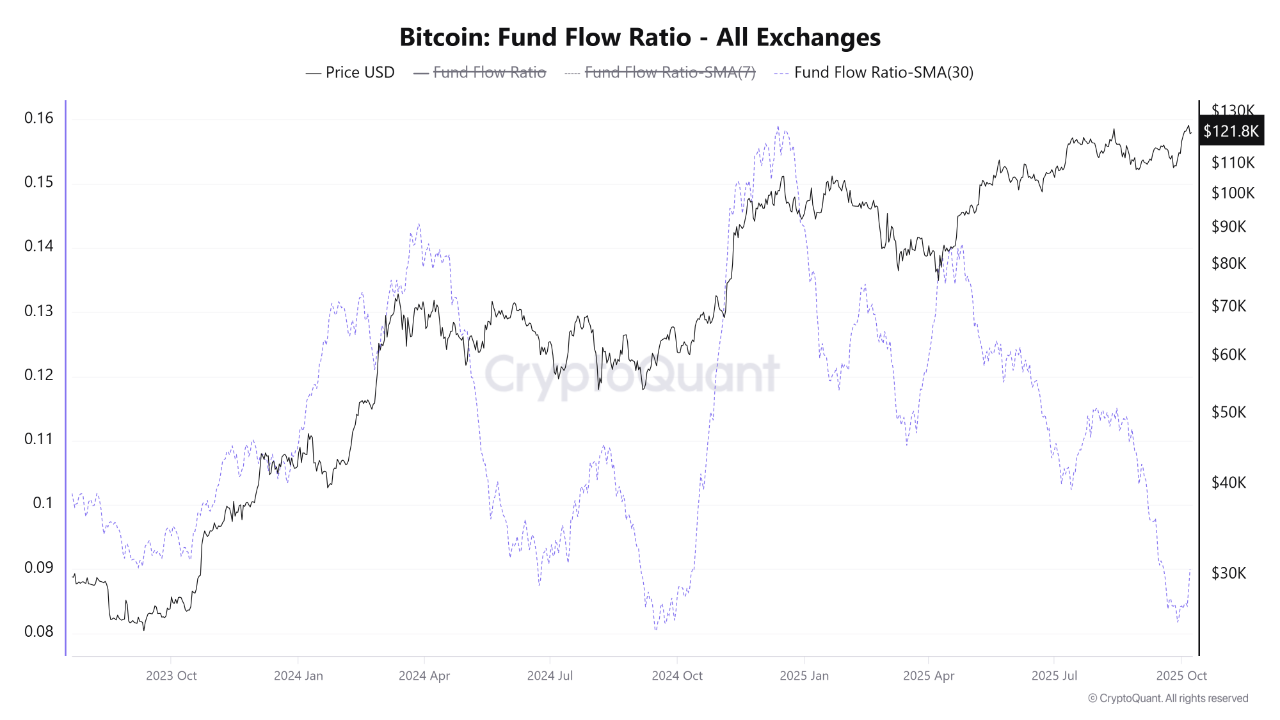

- On-chain data shows Bitcoin’s Fund Flow Ratio at historic lows as well.

Bitcoin

BTC

$121 400

24h volatility:

1.9%

Market cap:

$2.42 T

Vol. 24h:

$78.64 B

has retreated to the $120,000 level following a 2.22% drop in the past 24 hours, now trading near $121,000, down 3.75% from its all-time high of $126,000 earlier this week.

The leading digital asset is now cooling off after a strong rally that began in late September. Meanwhile, spot BTC ETFs logged the second-highest inflow since their launch in January 2024.

As reported earlier, these funds brought $1.19 billion in total inflows on Oct. 6, with BlackRock’s iShares Bitcoin Trust (IBIT) leading with $967 million. On Oct. 7, however, the ETFs saw outflows totaling $23.81 million.

$140K before the End of October

Economist Timothy Peterson noted that based on historical simulations using data from the past decade, there remains a 50% probability that Bitcoin could surpass $140,000 before the end of October.

Half of Bitcoin’s October gains may have already happened, according to this AI simulation.

There is a 50% chance Bitcoin finishes the month above $140k

But there is a 43% chance Bitcoin finishes below $136k. pic.twitter.com/LPhFr0mry9— Timothy Peterson (@nsquaredvalue) October 7, 2025

His models, derived from hundreds of simulations using real Bitcoin price data since 2015, suggest that half of the month’s potential gains may have already occurred.

However, he also highlighted a 43% chance that Bitcoin could close below $136,000, underscoring the volatility that continues to define the crypto market.

October has historically been one of Bitcoin’s strongest months, averaging gains of around 20.75% since 2013 according to CoinGlass.

If Bitcoin were to follow the pattern, it would need to gain approximately 14.7% from current levels to reach the $140,000 target.

Gold Surges to Record Highs

While Bitcoin has cooled, traditional safe-haven assets are rallying. Spot gold surged past $4,000 an ounce to reach an all-time high, trading at $4,017.16 per ounce as of the morning on Oct. 8.

Gold just broke $4,000 an ounce for the first time ever.

The US government is shut down, France is in political turmoil, Japan is changing leadership.

When every major power is in chaos, gold is the only thing investors still trust.

(a thread) pic.twitter.com/7LykS30zIu

— StockMarket.News (@_Investinq) October 7, 2025

Also, US gold futures for December delivery rose to $4,040 per ounce. Gold’s performance in 2025 has been exceptional, up 53% year-to-date following a 27% increase in 2024.

Investors have increasingly turned to gold as a hedge against inflation and currency debasement, even as Bitcoin continues to mature as a digital alternative.

On-Chain Data Hints at Weakening Selling Pressure

According to CryptoQuant, Bitcoin’s Fund Flow Ratio, which measures exchange-related activity relative to total transaction volume, has fallen to its lowest level since July 2023.

Bitcoin fund flow ratio | Source: CryptoQuant

The decline suggests that more BTC is being transferred to private wallets for long-term storage, used in DeFi applications, or traded via Over-The-Counter (OTC) channels by institutions rather than being moved for liquidation.

Such behavior typically precedes medium-term bullish reversals, where investors often search for the next best crypto to buy.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.