- China will suspend 24% US tariffs for a year from November 10, to maintain 10% US tariffs

- ICYMI: Trump administration reportedly considers Venezuela strikes, oil-field seizures

- North Korea may be on the brink of an imminent nuclear test says South Korean intelligence

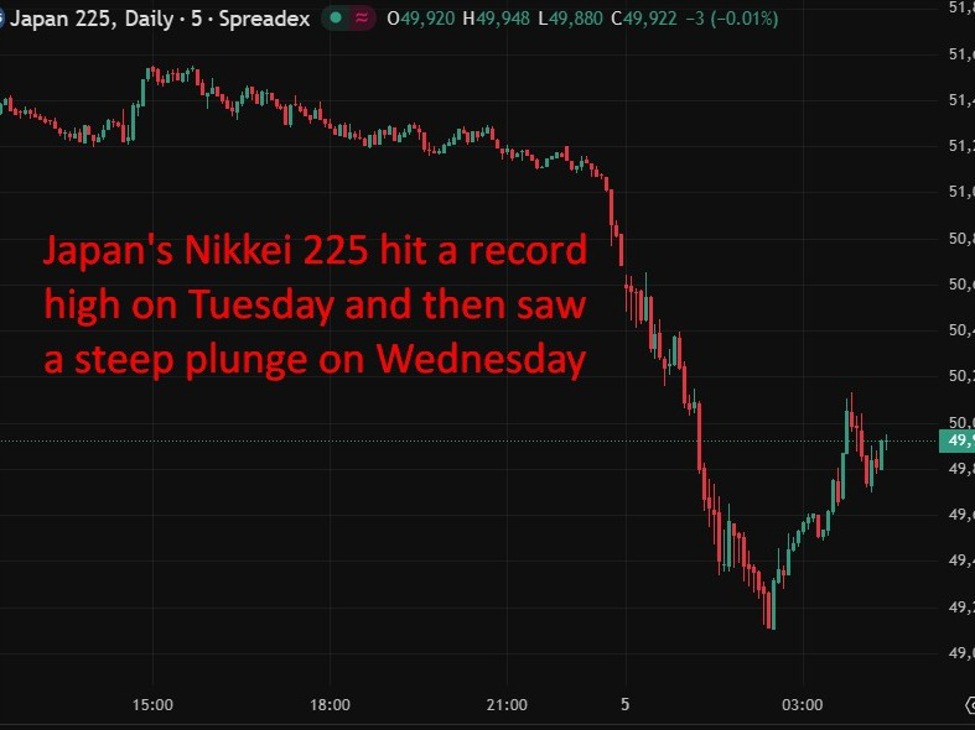

- Asian equity markets see their biggest losses in half a year

- MUFG lifts EUR/GBP targets to 0.90

- China Premier Li urges fairer global trade rules, warns protectionism harms world economy

- Decision Desk HQ projects Zohran Mamdani to win the New York City Mayor election.

- China Rating Dog Services PMI 52.6 (October) (vs. expected 52.6, prior 52.9)

- Chinese shares opening lower: Shanghai Composite -0.95%, Hong Kong’s Hang Seng -0.97%

- Bitcoin is back below US$100,000

- South Korea halted KOSPI equity index futures trade after a 5% drop

- PBOC sets USD/ CNY mid-point today at 7.0901 (vs. estimate at 7.1336)

- The yen is gaining despite wishy-washy Bank of Japan minutes

- ICYMI: Goldman, Morgan Stanley CEOs warn equity correction likely, room for 10–15% drop

- New Zealand ANZ Commodity Price Index October: -0.3% m/m (prior -1.1%)

- RBNZ Governor Hawkesby says house prices and credit growth not raising red flags

- BoJ Sept minutes: Current real interest rates are very low, will hike if data indicates

- Trump meets Swiss officials, signals progress on tariff dispute

- Trump signs order to formally cut China fentanyl tariff to 10% under new trade deal

- Plane crash near Louisville’s Muhammad Ali airport sparks fire and injuries

- TD says RBA’s neutral stance cools AUD; dip-buying still favoured

- investingLive Americas FX news wrap 4 Nov.Bitcoin moves back below 100K on risk off sales.

- Oil – private survey of inventory shows a huge headline crude oil build (10x expected)

- New Zealand Q3 unemployment rate rises to 5.3% (expected 5.3%, prior 5.2%)

- AMD tops estimates with strong Q3 revenue and profit guidance

- NASDAQ index falls over -2%. S&P declines -1.17%

- Canada widens deficit forecasts, slashes growth forecasts: debt-to-GDP seen rising to 43%

Asian equities slide as tech rout deepens; yen, franc rise on safe-haven demand.

–

It was a bloodbath in local equities through the morning session as Asia-Pacific stocks slumped amid a tech-sector rout, following losses on Wall Street where high-valuation concerns drove a sharp decline.

In Japan, equities posted their steepest drop in more than six months, led by tech names. The Topix tumbled as SoftBank Group plunged as much as 14%, its worst fall since August 2024. The Nikkei 225 slid below the 50,000 level, weighed by heavy selling across technology-related shares.

South Korea’s Kospi index fell as much as 4.8%, dragged down by Samsung Electronics and SK Hynix, as valuation jitters spread to recent winners such as defense and shipbuilding stocks. The benchmark broke below the 4,000 mark, extending its two-day slide to 7% — the sharpest since August 2024. The won weakened 0.6% to its lowest since April as foreign investors dumped local shares, triggering a brief program-trading halt after Kospi 200 futures dropped more than 5%.

Copper fell for a fifth straight session, while AUD, CAD, and NZD traded heavily. The risk-off tone sent flows into safe-haven currencies — JPY and CHF advanced early in the day.

Later in the session, however, a China trade-tariff announcement helped trim losses and pare yen gains. Beijing said it would suspend 24% U.S. tariffs and maintain 10% for a year, and from November 10 would cease imposing additional duties on certain U.S. imports. These moves came after Trump officially signed an order to halve his fentanyl-related tariffs on Chinese goods

– Notable news:

From North America, Canada’s fiscal update after Tuesday’s close showed Ottawa widening its deficit outlook and projecting a higher debt-to-GDP ratio above 43%, even as borrowing eases. The C$78.3 billion deficit for 2025/26 and C$65.4 billion for 2026/27 are roughly double prior estimates. The figures, alongside weaker growth forecasts, weighed modestly on the CAD during the session.

Oil markets news was private-sector inventory data, which showed a 6.5 million-barrel crude build, well above expectations, even as gasoline and distillates posted larger-than-forecast draws.

In New Zealand, labour data confirmed further softening. The jobless rate rose to 5.3% in Q3, employment was flat, and the participation rate slipped to 70.3%. Wages rose 0.5% q/q, leaving the NZD under pressure and pushing AUD/NZD to a 12-year high.

From Japan, the BOJ’s September meeting minutes reinforced its cautious stance on normalisation, with policymakers agreeing that real rates remain low but citing uncertainty over U.S. tariffs and global trade. Views differed on timing, yet officials acknowledged underlying inflation is broadening and the impact of tariffs smaller than feared.

For the franc, sentiment was lifted by Trump’s social-media comments noting “progress” in trade talks with Swiss officials, signalling potential relief in the U.S.–Swiss tariff dispute.

In China, the RatingDog/S&P Global services PMI slipped to 52.6 in October, a three-month low, as export orders contracted and employment declined. Rising costs and weaker optimism pointed to lingering pressure on smaller exporters, though the index still signalled stronger growth than the official PMI measure.

Asia-Pac

stocks:

- Japan

(Nikkei 225) -3% - Hong

Kong (Hang Seng) -0.28% - Shanghai

Composite +0.05% - Australia

(S&P/ASX 200) -0.24%