The American Bankers Association (ABA), along with 52 state bankers associations nationwide, has submitted a letter to the US Department of the Treasury, urging an implementation of the GENIUS Act’s prohibition on interest for payment stablecoins.

This letter responds to the Treasury’s advance notice of proposed rulemaking concerning the country’s stablecoin bill and underscores the importance of maintaining the law’s primary objective: to ensure that stablecoins function as payment instruments rather than investment options.

Associations Warn Of Risks To Traditional Banking

The associations articulated that the GENIUS Act’s ban on payment stablecoin issuers offering interest or yield reflects Congress’s intention for these stablecoins to be used primarily for transactions. They emphasized that the Treasury must uphold this intent to prevent any potential “exploitation of the law.”

They assert that without a comprehensive interpretation of the interest ban, digital asset platforms might take advantage of loopholes to provide high-yield incentives, thereby undermining the law’s purpose and posing risks to the traditional banking ecosystem.

Community banks, which are key in serving rural and underserved populations, might be particularly affected by deposit outflows resulting from interest-bearing stablecoins.

The letter alleges that this disintermediation could lead to a 25.9% loss in deposits, translating to about $1.5 trillion in diminished lending capacity. It also estimates that small business and farm credit could shrink by $110 billion and $62 billion, respectively.

To ensure effective enforcement of the GENIUS Act, the associations called on the Treasury to adopt a broad definition of “interest or yield,” encompassing any economic benefit, regardless of terminology.

They also urged the prevention of evasion through affiliates or partners, positing that any indirect payments should be treated as issuer payments.

Additionally, they requested that interpretations of the term “solely” not be overly restrictive, asserting that any benefit associated with holding a stablecoin should activate the prohibition.

Debate Over Stablecoins Delays Market Structure Bill

The groups also stress the need for thoughtful and balanced rulemaking that supports the financial system rather than disrupts it.

However, the ongoing debate surrounding stablecoin interest has also contributed to delays in passing the Market Structure Bill, which pro-crypto Senator Cynthia Lummis has labeled as the “most important piece of digital asset legislation in United States history.”

Recent updates to the draft of this bill by Senate Banking Republicans, led by Chairman Tim Scott, aimed for advancement by the end of September, but this timeline was missed due to various challenges, notably conflicts between banking and crypto lobbies regarding stablecoin interest and the bill’s stance on decentralized finance (DeFi).

In response, a group of crypto-friendly Senate Democrats proposed amendments to the bill that were ultimately rejected by Republicans and the crypto industry. These amendments sought to ensure that the legislation would uphold the prohibition on interest or yield paid by stablecoin issuers, whether directly or indirectly via affiliates.

Crypto advocates are now pushing for prompt action on market structure legislation this year. Mason Lynaugh, community director for Stand with Crypto, emphasized the necessity for the Senate to act swiftly and deliberately.

He noted that Congress has a unique opportunity to position the United States as a leader in the global crypto industry, achievable only through effective market structure legislation.

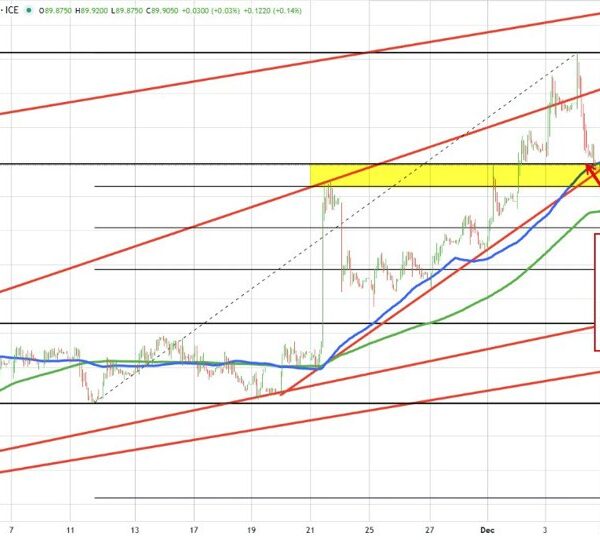

Featured image from DALL-E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.