Snapchat has reported its Q3 performance update, which shows positive progress on a couple of key fronts, though some concerns still remain, particularly in terms of rising costs, which are only set to jump higher in the new year.

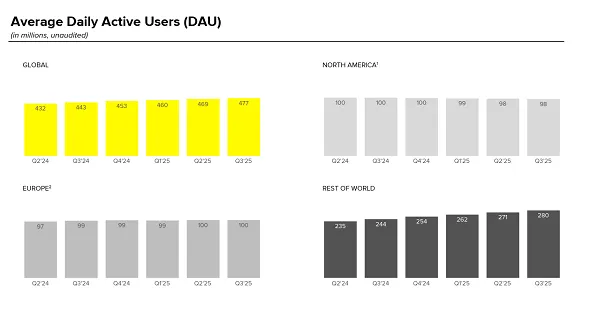

First off, on users. Snapchat is now up to 477 million daily actives, which is an increase of 8 million on Q2.

Which is pretty much the same as the increase that it’s posted each of the last few quarters, with all of Snap’s user growth coming in the “Rest of World” category. Indeed, Snap added no new users in the U.S. or Europe, with both regions looking to have stalled out, or reached saturation point for the app.

Which caps Snapchat’s growth, and with more regions now considering higher age restrictions for social media use, that’s not a great sign for Snap’s ongoing opportunities.

Snapchat has addressed this concern in its accompanying notes, explaining that:

“These policy developments, combined with potential platform-level age verification, are likely to have negative impacts on user engagement metrics that we cannot currently predict.”

Yeah, that’s not a good sign, and while Snap does also note that it’s using new signals from Apple and Google to determine user ages (?), that will likely have a big impact on platform usage, especially in markets where Snapchat’s not adding any more users.

That’ll limit the platform’s monetization potential. And while building in developing markets will provide longer-term opportunities, its immediate intake could take a hit.

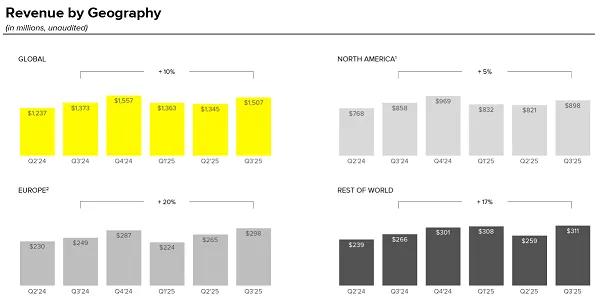

But right now on the revenue front, things are looking okay:

Snapchat brought in $1.5 billion in revenue for the quarter, driven, it says, by:

“Continued growth in our small- and medium-sized business (SMBs) customers, and improvements in direct response advertising performance”

Snapchat’s been working to improve its ad targeting tools, and placement options, and it seems like those efforts are having a positive impact, with more advertisers looking to tap into the app’s popularity with younger users to expand their reach.

Snapchat’s also now bringing in $750 million per year from Snapchat+ subscriptions. So even with less growth in its core revenue markets, it is making the most of what it’s got.

And it’s also reassessing its business approach to put more focus on its key revenue markets:

“This includes testing changes to our infrastructure that will lower costs in regions with less long-term monetization potential, allowing us to better align our resources with the financial opportunity of each geography, but potentially coming at the cost of adverse trade-offs with engagement in these countries.”

Because again, while adding more users, as a top line number, looks great, the fact is that Snap is not going to be earning as much revenue from those users, due to regional revenue variances. Snap is addressing this, but it’s an important acknowledgement, which highlights this as a key concern, as opposed to seemingly hoping the user count will distract investors.

In terms of usage, Snap says that global time spent watching content has increased year-over-year, “reflecting our multi-year investment in machine learning and the continued strength of Spotlight.” Snap says that it’s launched its largest content recommendation model to date, “improving freshness and relevance across the platform,” while it’s also upgraded its infrastructure to “get a step closer to delivering content in near real-time, reducing latency and cutting model training cycles from days to just two hours.”

Spotlight has become a key engagement driver for the app, with views in its short-form video feed rising more than 300% year-over-year in the U.S.

Short-form video is the most engaging format on all social apps, so this is no real surprise, but it’s interesting to see Snap re-purposing TikTok’s core offering, in the same way that Instagram repurposed Stories.

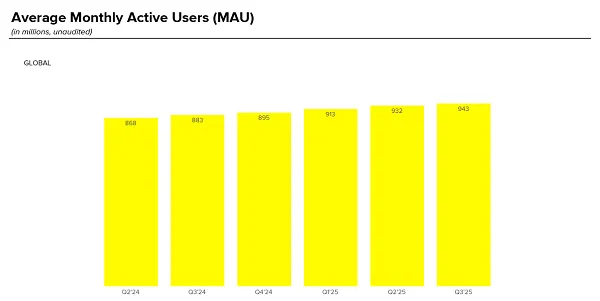

Snap has also reported that monthly active users are now up to 943 million, closing in on that one billion user milestone.

So some good signs, with Snapchat looking to refocus its business around its core opportunities, while it’s also announced a new deal with Perplexity to integrate Perplexity’s AI-powered answer engine directly into Snapchat.

More opportunities for more engagement, and maximize its audience potential. Though there is one other element that’s also of concern.

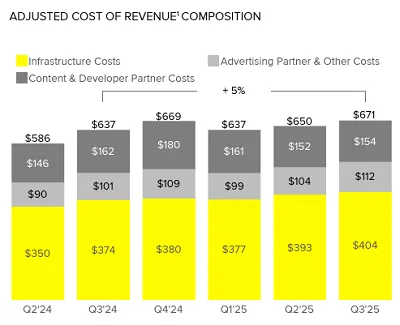

Snapchat’s costs are still rising, and with the company looking to launch its AR-enabled Specs next year, those costs are inevitably going to rise even further, for a product that still seems unlikely to be the best option on the market.

Meta’s AI glasses already offer better functionality, and with both Meta and Apple launching their own AR glasses in the near future, the opportunity for AR Specs seems limited.

Still, Snap’s sticking with it, though it has also, at least reportedly, considered spinning off Spectacles into its own business, in order to limit the impacts on Snap.

That seems like a good approach, albeit a complex one, because I continue to believe that AR Specs are going to become an albatross for the company, which will tank its valuation by the end of next year. And it doesn’t have the robust ad business of its competitors to fall back on, so it could be looking at a tough time ahead, unless Specs are an absolute hit out of the gate.

I don’t see that happening, but the hype around its original Spectacles was high when it first launched them back in 2016 (even if they did end up costing Snap money due to unsold inventory).

Maybe, that initial hype will lead to a more positive opportunity for AR Specs.

We’ll find out in a few months.