Key Notes

- Strategy took to X to say it holds 71 years of dividend coverage, should Bitcoin continue to underperform.

- The company still holds 649,870 BTC and has a valuation basis of $87,000/BTC.

- Michael Saylor says Strategy will continue to HODL its BTC stash.

Business intelligence software firm Strategy has announced that it has 71 years of dividend coverage if the Bitcoin

BTC

$82 669

24h volatility:

9.9%

Market cap:

$1.64 T

Vol. 24h:

$123.81 B

price decides to remain flat.

This suggests that the Michael Saylor-led firm is unbothered by the consistent drop in the price of the flagship cryptocurrency.

Cern Basher, co-founder and CIO at Brilliant Advice, believes the current market conditions are a deliberate effort to push Strategy into liquidating its holdings.

Strategy’s Valuation Basis Now at $87,000/BTC

On November 20, Strategy informed the public that Bitcoin’s price crash is insufficient to force it to liquidate its massive holdings. The firm currently holds as much as 649,870 BTC, after purchasing 8,178 BTC a few days ago.

With such a large stash, many entities expect that the company will offload a portion to minimize its unrealized losses.

Instead, the Bitcoin treasury firm responded to these speculations with a revelation that may have left several crypto critics dumbfounded. Strategy said that it has 71 years of dividend coverage, should the BTC price stay flat.

At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations. pic.twitter.com/ohN9dctpyv

— Strategy (@Strategy) November 20, 2025

The company also stated that “any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.”

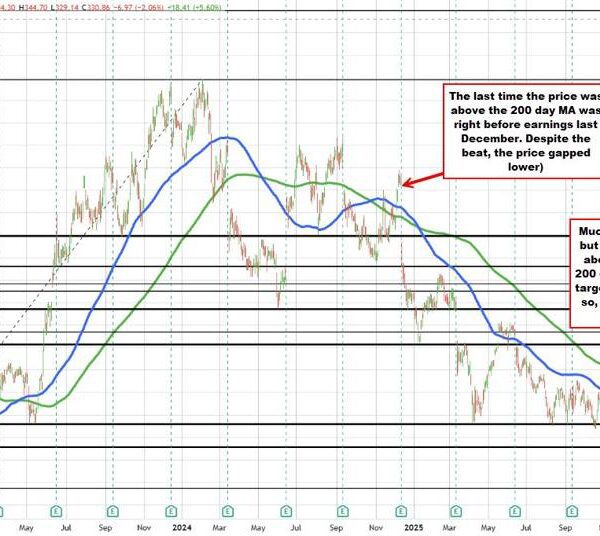

Strategy shared a chart detailing the status of the firm’s financial portfolio. The Bitcoin treasury firm has 649,870 BTC in its Bitcoin holdings, its valuation basis is $87,000/BTC, and its total BTC value at this time is $56 billion.

In addition, the company showed that its annual dividend coverage is $700 million and total debt obligations are $8.2 billion.

Michael Saylor Says Strategy Will HODL

With Bitcoin’s latest price struggle, Strategy has been in the spotlight, as market observers talk about the magnitude of losses that the firm is incurring as it continues its HODLing model.

Reports from last week, as of November 21, claimed that the business intelligence and software firm had begun offloading part of its BTC holdings.

Rekt Fencer, an X user, claimed that Strategy had already sold 33,000 BTC and was still selling more, supposedly totaling about $3.2 billion.

🚨 BREAKING:

MICHAEL SAYLOR’S STRATEGY JUST STARTED SELLING BITCOIN.

For the first time ever they fell below 1 NAV.

They already dumped 33,000 $BTC ($3.2 BILLION) and keep selling every few minutes.

IS IT OVER??? pic.twitter.com/nX4jvd3dsI

— Rekt Fencer (@rektfencer) November 14, 2025

He also pointed out that the company had fallen below 1 Net Asset Value (NAV) for the first time.

To this, Saylor responded “HODL,” debunking the offload rumors.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.