Key Notes

- The case against Binance is backed by more than 300 victims and families and has been filed under the Justice Against Sponsors of Terrorism Act.

- The lawsuit claims Binance enabled transactions linked to sanctioned terrorist groups, including Hamas, Hezbollah, and Iran’s Islamic Revolutionary Guard Corps.

- It argues that the platform prioritized profit over compliance and intentionally operated as a channel for illicit finance.

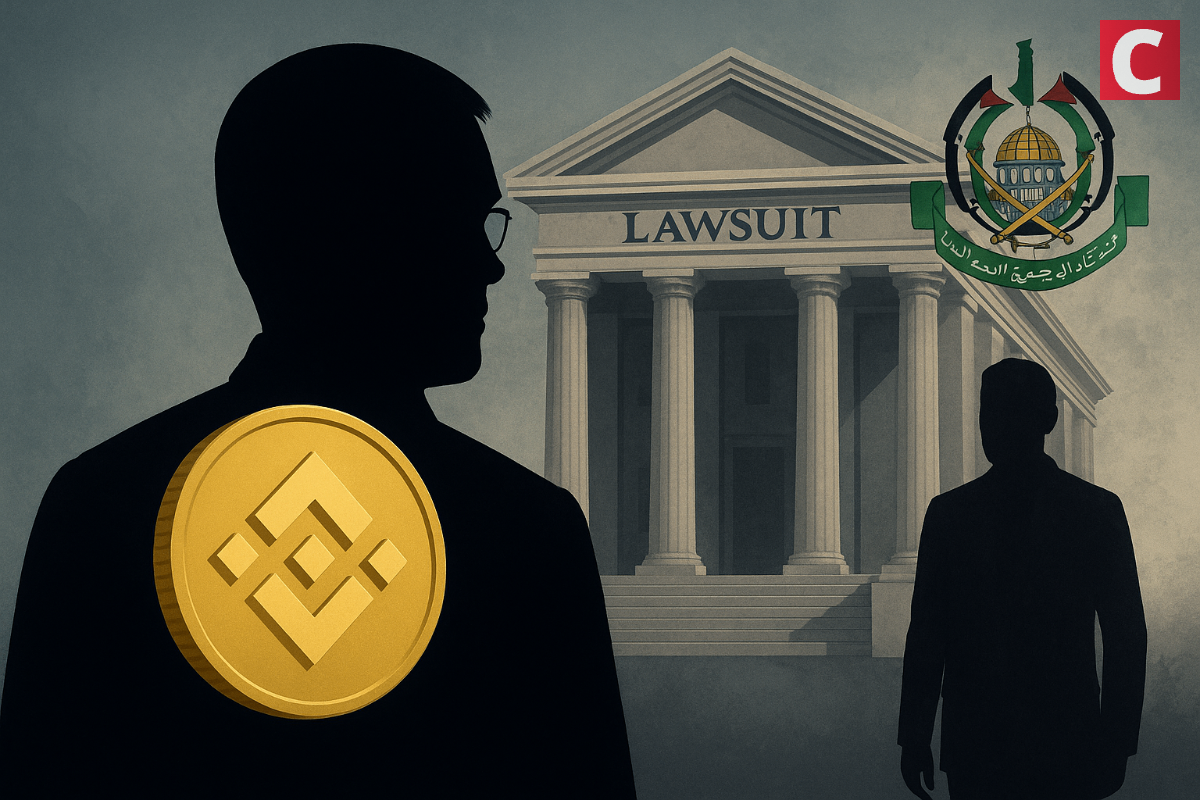

Changpeng Zhao (CZ), the founder of Binance, is facing another lawsuit alleging that the exchange facilitated transactions linked to Hamas ahead of the October 7 attack on Israel.

Along with Zhao, the federal lawsuit names Binance Holdings Ltd. and executive Guangying Chen.

The lawsuit has the support of 300 victims, and families of individuals killed or injured in the attack have joined the civil action.

The case, led by attorney Lee Wolosky, has been filed under the Justice Against Sponsors of Terrorism Act.

This latest development comes within a month of the Trump administration granting a pardon to CZ, over previous charges of money laundering.

Lawsuit Alleges Binance Facilitating Over $1 Billion to Terror Groups

The lawsuit alleges Binance facilitated more than $1 billion in transactions tied to sanctioned terrorist organizations, including Hamas, Hezbollah, and Iran’s Islamic Revolutionary Guard Corps.

Attorney Lee Wolosky, representing victims, said the platform prioritized revenue over compliance. Speaking to the New York Post, Wolosky said:

“The lawsuit details how Binance knowingly facilitated hundreds of millions of dollars that helped those responsible for the atrocities of the Oct 7 attack,” he said. “When a company chooses profit over even the most basic counter-terrorism obligations, it must be held accountable and it will be.”

The claims reference Hamas’s October 7, 2023 attack in southern Israel, which resulted in more than 1,200 deaths.

In the lawsuit, the plaintiffs argue Binance “intentionally structured itself as a refuge for illicit activity.”

It also alleges that the exchange knowingly hosted accounts linked to terrorist groups and enabled financial flows that could support future attacks.

Binance and its founder, Changpeng Zhao, have previously faced U.S. enforcement actions over similar issues.

The company paid a $4.3 billion criminal penalty for violations related to inadequate anti-money laundering controls, including transactions connected to Hamas and al-Qaeda.

In October, even French regulators charged Binance over a lack of compliance.

Failing to Maintain Adequate Controls

The latest lawsuit also states that between 2017 and 2023, Binance failed to implement sufficient compliance measures.

It blames the exchange for allowing sanctioned entities to transfer significant amounts undetected.

The plaintiffs argue the exchange relied on a network of offshore entities with limited regulatory oversight and minimal record keeping, which allowed transactions to occur outside standard monitoring frameworks.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.