Hello, tech editor Alexei Oreskovic here, pitching in for Allie today. As you gather around the Thanksgiving table tomorrow, you may find yourself debating the state of the AI bubble with your guests. There’s plenty to chew over, from sky-high valuations and capital expenditures to circular business models and mouth-watering salaries.

So allow me to flag one new item on the table that may have gone unnoticed: Warner Music Group’s legal settlement with AI music startup Suno. The deal, announced on Tuesday, ends Warner’s copyright lawsuit against Suno and establishes a partnership that will let consumers create AI-generated music with the voices, compositions, names, and likenesses of any Warner Music artists who choose to participate.

This is a big deal not just for Suno, which raised $250 million at a $2.45 billion valuation earlier this month, and for its investors (including Menlo Ventures, Lightspeed, and Nvidia’s NVentures), but for AI in general. I’m not making a judgement here about whether the deal is good or bad for musicians or for the future of music as an art form; I’m simply recognizing how remarkable of a statement it is about the business world’s attitude towards artificial intelligence.

Consider the marquee copyright battle of the last big technology shift, when Viacom sued YouTube in 2007 over users uploading clips to the video site. That case dragged on for seven years before finally settling in 2014.

In AI, everything moves faster. And so, just one year after Warner sued Suno, the music label is now ready to embrace the startup and AI. Warner and Universal Music Group also each settled with Udio, another AI-generated music platform, in recent weeks. These record labels are in the intellectual property business. IP is their most important asset, and they instinctively fight tooth and nail to stop others from getting anywhere close to it.

The fact that they’re folding so soon, instead of digging in for a long fight, suggests they don’t expect the AI bubble to burst anytime soon.

We’re off until Monday. Happy Thanksgiving!

Alexei Oreskovic

X:@lexnfx

Email:[email protected]

Submit a deal for the Term Sheet newsletter here.

Joey Abrams curated the deals section of today’s newsletter.Subscribe here.

Venture Deals

– Range, a McLean Va. and New York City-based AI-powered wealth management platform, raised $60 million in Series C funding. Scale VenturePartners led the round and was joined by GradientVentures, CathayInnovation, and others.

– CoPlane, a San Francisco-based developer of AI software designed to streamline back office operations, raised $14 million in seed funding. Ribbit led the round and was joined by Stripe, OptumVentures, and Terrain.

– Mnzil, a Riyadh, Saudi Arabia-based workforce housing solutions company, raised SAR 44 million ($11.7 million). FoundersFund led the round and was joined by existing investor COTUInvestors.

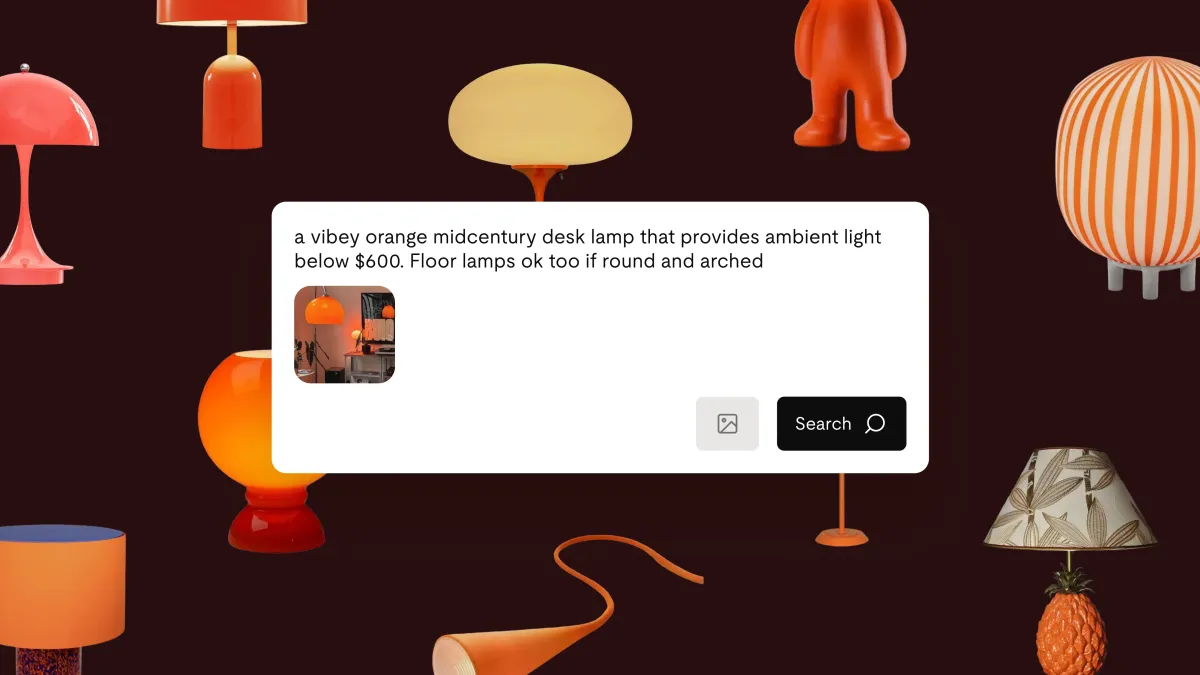

– Onton, a San Francisco-based AI-powered ecommerce platform, raised $7.5 million in seed funding. Footwork led the round and was joined by Liquid2, ParableVentures, 43, and others.

– Juo, a Warsaw, Poland-based developer of a dev-first toolkit for non-digital product subscriptions, raised €4 million ($4.6 million) in seed funding. MarketOneCapital and Peak led the round and were joined by SmokVentures, BADideas, and others.

– Monq, a London, U.K.-based AI-powered negotiation platform for sales teams, raised $3 million in pre-seed funding. OutwardVC led the round and was joined by CornerstoneVC, PortfolioVentures, OctopusVentures, and others.

– SportAI, a Oslo, Norway-based sports technology company, raised $3 million in funding from AltitudeCapital and others.

PRIVATE EQUITY

– CourizonPartners acquired AirBurners, a Palm City, Fla.-based provider of air curtain burner systems used for the disposal of wood and vegetable waste. Financial terms were not disclosed.

EXITS

– EMKCapital agreed to acquire ProjectInformatica, a Milan, Italy-based IT infrastructure and services provider, from H.I.G.Capital. Financial terms were not disclosed.

OTHER

– S&PGlobal acquired WithIntelligence, a London, U.K.-based private markets data provider, for $1.8 billion from a group of investors led by Motive Partners.