Key Notes

-

Strategy established a $1.44 billion USD reserve using proceeds from its at-the-market equity offering to secure dividend payments. - To meet debt obligations, Michael Saylor’s firm plans to maintain at least 12 months of coverage and extend it to 24 months.

- Michael Saylor defended the move, calling it essential for financial stability.

Michael Saylor, the executive Chairman of Strategy (MSTR), announced the purchase of an additional 130 Bitcoin

BTC

$84 672

24h volatility:

7.4%

Market cap:

$1.69 T

Vol. 24h:

$78.80 B

for the company for an investment value of $11.7 million.

Strategy Adds 130 BTC as Holdings Rise to 650,000 Bitcoins

Following the recent purchase, Michael Saylor noted that the company’s total holdings have reached 650,000 BTC. Moreover, the latest purchase comes at an average price of about $89,960 per BTC.

The company’s cumulative investment stands at roughly $48.38 billion, with an average purchase price of $74,436 per BTC. Despite the latest price correction, Michael Saylor continues to remain bullish about Bitcoin. Last week, he already notified that the company is prepared to handle BTC price crash up to $25,000.

On Dec. 1, the crypto market saw yet another flash crash with BTC dropping to $86,000, triggering over $600 million in liquidations. This comes amid the surge in two-year Japanese bond yields to over 1%, for the first time since the 2008 financial crisis.

Despite the fresh purchase, the MSTR stock is down 4.6% in the pre-market trading hours on Dec. 1. The share price has once again slipped under $170 level, amid the broader market drawdown.

Michael Saylor Builds $1.44 Billion USD Reserve for Dividend Payout

Michael Saylor has shut his critics by addressing the concerns over dividend payouts and forced Bitcoin liquidations.

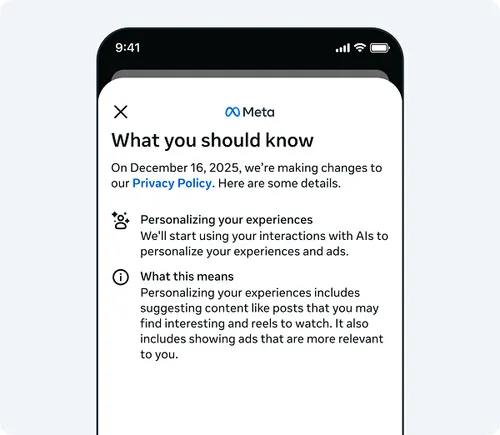

On Dec. 1, Strategy (MSTR) disclosed that it has created a $1.44 billion US dollar reserve to fund preferred stock dividend payments and meet its debt commitments, according to a filing submitted to the US Securities and Exchange Commission (SEC).

The company said the new “USD Reserve” was funded using proceeds from its at-the-market equity offering. MicroStrategy plans to maintain a balance sufficient to cover at least 12 months of dividend payments. The long-term goal is to extend the coverage to 24 months. Speaking on the development, Michael Saylor said:

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution. We believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit,” Michael Saylor said.

However, Bitcoin critic Peter Schiff slammed Saylor for this approach.

Today is the beginning of the end of $MSTR. Saylor was forced to sell stock not to buy Bitcoin, but to buy U.S. dollars merely to fund MSTR’s interest and dividend obligations. The stock is broken. The business model is a fraud, and @Saylor is the biggest con man on Wall Street.

— Peter Schiff (@PeterSchiff) December 1, 2025

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.