tadamichi/iStock via Getty Images

By Paul Woolman

Risk management is a continuous dialogue in financial markets. While there are countless theories on achieving diversification, the core challenge remains the same: how do you ensure the heavy lifting in your portfolio doesn’t rest on too few hands?

For years, the performance of the main U.S. equity indices, such as the S&P 500, has been overwhelmingly driven by a handful of mega-cap stocks. These giants have carried the market’s weight, delivering outsized returns that have helped propel markets to new highs this year. However, this market leadership also creates a critical risk: concentration.

The “Pane of Glass” Analogy

To illustrate the risks associated with high concentration, some financial professionals have used the analogy of trying to carry a large, delicate pane of glass:

-

The High-Risk Strategy (Concentration): You could hire one super-strong individual – let’s call them “Mega Joe” – to carry the entire pane alone. Mega Joe might manage it, but the effort and responsibility are immense. Crucially, if Joe slips or tires, the entire pane shatters. This is a high-risk, high-concentration strategy – where a single point of failure can lead to massive loss.

- An Alternate Strategy (Diversification): A far more robust approach is to share the load by hiring a team of people to carry the pane. If one member, like Joe, stumbles, the other team members are strong enough to stabilize the load, preventing the pane from falling and shattering. The risk is distributed; the whole system is more resilient.

Where Market Risk is Concentrated Today

In equity investing, the “Mega Joe” stocks have been the handful of mega-cap names leading the S&P 500. This has led to stretched valuations in these names, which is why surveys like the recent Bank of America Fund Manager Survey have flagged sentiment on U.S. equities as highly overbought – a direct result of this mega-cap concentration.

Investors today are asking, what happens when the leadership tires, or the glass pane slips? How can we proactively diversify away from this high-risk concentration before a potential rollover?

One of the most straightforward and capital-efficient ways to diversify within the S&P 500 universe is to shift from a capitalization-weighted strategy to an equal-weighted one.

E-mini S&P 500 Equal Weight futures contracts offer a way to gain exposure to every name in the S&P 500 index, but with the key difference that each stock is weighted equally, not by its market capitalization.

This instrument helps to “share the load” by ensuring that portfolio performance is not solely dependent on a few stocks:

Client utilization of E-mini S&P 500 Equal Weight futures is rapidly accelerating, evidenced by a 34% year-over-year increase in average daily volume as traders pursue greater diversification. The demand is also reflected in open interest, which is at 17.5K contracts.

This momentum was recently highlighted when we observed several large derived block trades in the contract, totaling approximately $1.5 billion in notional value.

This significant, sustained intra-day activity confirms that informed investors are actively leveraging both the contract and the execution benefits of CME Group’s derived block functionality to efficiently source liquidity and implement large-scale diversification strategies.

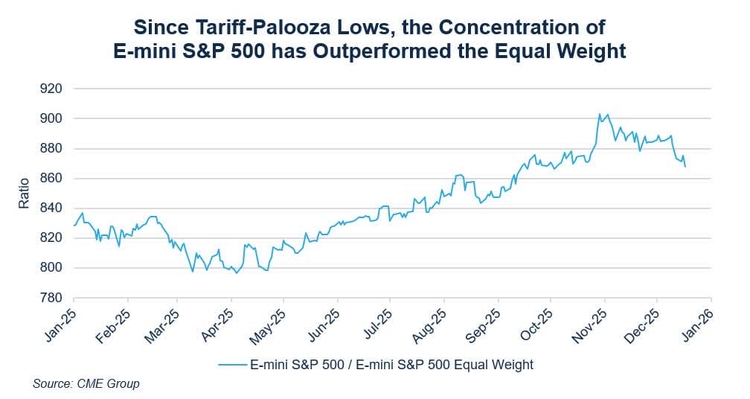

Since the liberation day/tariff event earlier in the year, we have seen outperformance continue to occur in the megacap names/Mag 7. This has led to significant outperformance in the ratio of the S&P 500 vs. the S&P 500 Equal Weight Index (see chart) up until the end of October 2025. The question on many investors’ minds: Can this be sustained, or is it time for a change of leadership on what is powering the market.

In the last few weeks we have seen this leadership trend revert slightly, with the S&P 500 Equal Weight outperforming the S&P 500. For those that believe this trend will be longer lasting, diversifying into products such as E-mini S&P 500 Equal Weight futures may be appealing.

As the concentration risk debate continues, the “pane of glass” analogy serves as a powerful reminder: you don’t have to carry the load with just one or two concentrated investments.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.