Sundry Photography/iStock Editorial via Getty Images

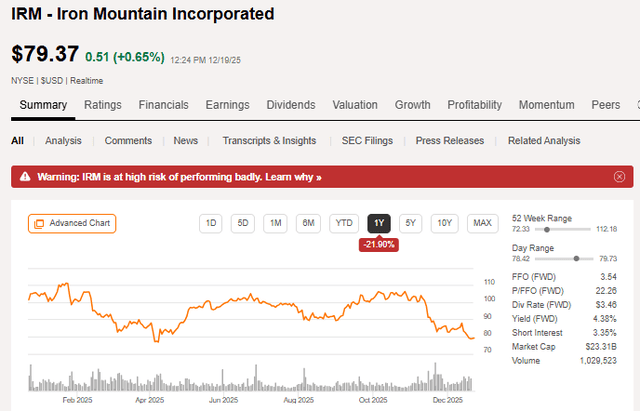

Iron Mountain Incorporated (IRM) has become a bit of a battleground stock. Bulls point toward rapid growth and a low AFFO multiple, while bears are concerned by high debt and AFFO calculations.

The truth, as usual, is somewhere in the middle.

This article will address some of the most debated aspects of Iron Mountain and try to provide a clean perspective on valuation, balance sheet, and growth.

Let us start by examining the bear thesis, as it has clearly had quite a bit of traction with regard to IRM’s stock price.

The IRM Bear Thesis:

I think there are 3 reasons IRM’s stock price has dropped substantially in the last year.

- IRM got too expensive.

- It got caught in the AI selloff.

- Short attack.

Iron Mountain is a complex business dealing with all forms of information management. Decades ago, this primarily meant physical boxes of paper that IRM would store securely in vaults.

As information usage evolved, IRM evolved with it. IRM now converts physical information to digital and is one of the world’s leading companies at managing, securing, and retrieving both physical and digital information.

Part of that digital transformation involves the building of data centers in which to store and utilize said information on behalf of its clients. In the process, the market started trading IRM as a data center REIT.

While IRM does have an active data center pipeline, it is still a relatively small portion of their business. Thus, I thought it became overvalued as it got swept up in AI/data center excitement and is now coming back down with the AI bubble partially deflating toward the end of 2025.

We will dig deeper into valuation later in this article, but with the selloff, it is starting to look quite a bit more reasonable.

The most recent leg down in IRM’s stock price seemed to be related to a short attack.

In my opinion, each point emphasized by the bear thesis can be fairly easily disproven.

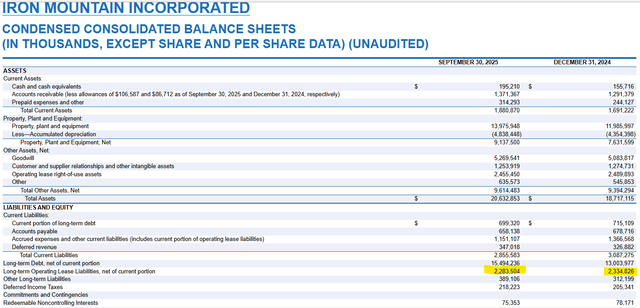

Regarding leverage, a significant portion of the discrepancy is related to operating lease liability, highlighted in yellow below.

This is $2.28B of liability that exists on the balance sheet, but it is not really debt. IRM rents a portion of their buildings, which, starting in 2016 with ASU 2016-02, gets recorded as a liability for the entire amount owned under the lease.

It’s not really debt. Sure, IRM will have to pay the rent, but it is over a very long period of time, and in exchange, they will get to use the properties and generate revenues from the properties.

- $2B of debt is a net present value of negative $2B.

- $2B of lease liability has a net present value of approximately 0.

Thus, IRM excludes this liability from their debt calculation, which I think they are right to do, and it is fairly common practice to do so.

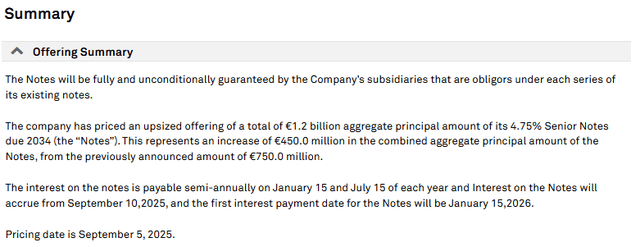

IRM’s calculations of debt to EBITDA are essentially verified by the free market. In September, they raised 1.2 billion Euros at 4.75%, which is a rate that implies a healthy credit profile.

S&P Global Market Intelligence

Finally, the other matter that seems to be bothering bears is the idea that IRM’s reported AFFO is inflated.

In this case, I agree with bears in direction, but it is something for which we can easily correct as IRM provides clear reconciliation.

Reported earnings are often inflated relative to true earnings. The fact of the matter is that GAAP accounting is not perfect at quantifying earnings in varying lines of business. Thus, companies use non-GAAP metrics to present earnings in a way that makes more sense for their specific business type.

S&P companies often use adjusted earnings per share.

REITs, like IRM, use Adjusted Funds From Operations or AFFO.

Companies are, of course, going to use adjustments that present earnings favorably. In my experience, the vast majority of companies present reported adjusted earnings that are higher than “true” earnings.

The key is that they do so in a transparent way. IRM’s adjustments are completely transparent.

In each earnings report, they concurrently submit SEC filings with a full reconciliation of non-GAAP metrics to GAAP metrics. Any investor can access this reconciliation for free and see exactly what is being added and deducted from GAAP numbers.

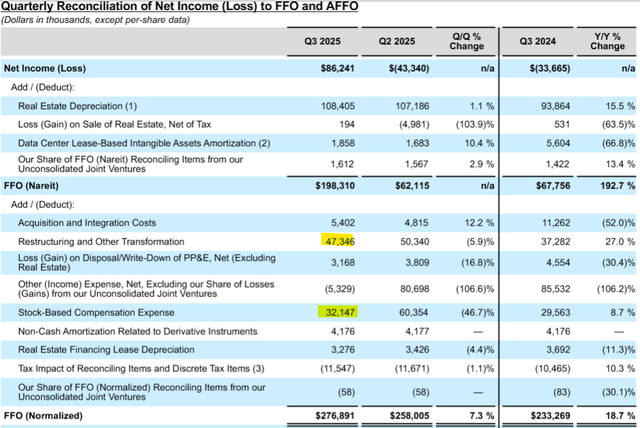

In going from GAAP income to normalized FFO, there are 2 large line items which have received some scrutiny (highlighted below).

I am entirely fine with the restructuring add-back because it is a one-time expense, and AFFO is meant to be a sort of run-rate figure. The restructuring charges are related to project Matterhorn, which involved quite a bit of leaning out of operations. In so doing, it incurred employee severance fees and other costs to clean up operations.

These charges are ending in 4Q25 as discussed by Barry Hytinen, IRM’s CFO, at the 12/11/25 conference:

“This is the last quarter of Matterhorn restructuring, and we don’t have any additional restructuring dollars. And just to kind of answer a question that might be out there, those were onetime in nature. So you should not be anticipating additional of that sort going forward. And in fact, what you should be expecting to see is significantly incremental free cash flow, which we will use to further grow our business and/or need relatively less debt for the same line of growth.”

With 4Q25 being the last quarter of restructuring charges, I think they qualify as one-time and are correctly added back to AFFO.

Stock-based comp, however, is a recurring cost and a real cost even if it is non-cash. Thus, in calculating true AFFO, I would subtract approximately $120 million from the annual reported figure.

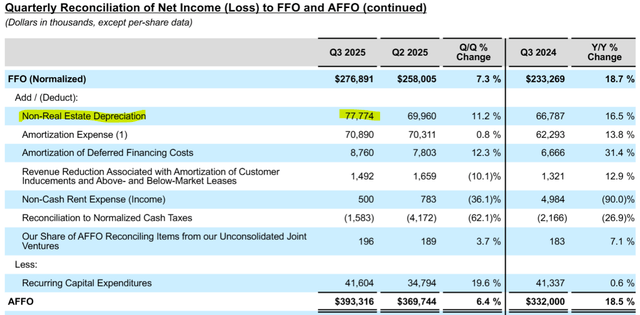

IRM also reconciles the adjustments from normalized FFO to AFFO.

Non-real estate depreciation is a tricky line item. While real estate depreciation is and should be added back for REITs due to buildings usually holding their value, it is less clear to me that the same would hold true for non-real estate.

Much of IRM’s non-real estate depreciation is related to its large fleet of vehicles, which do indeed lose value over time. I think the pace of true value loss is a bit slower than the pace at which they depreciate in accounting terms. As such, I would count this as a $200 million deduction to AFFO ($50 million quarterly) from IRM’s reported figure.

Adding this to the stock-based comp add-back, I calculate IRM’s true AFFO as $320 million lower than reported AFFO. Divided over 295.6 million shares, that is $1.08 lower AFFO/share.

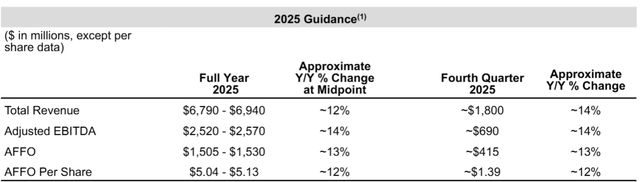

So, IRM’s guided AFFO/share is $5.08 at the midpoint.

True AFFO/share by my calculation is $4.00 in 2025. We will discuss this further in the valuation section.

The IRM Bull Case

Iron Mountain has put together a strong track record of growth coming from a variety of business segments.

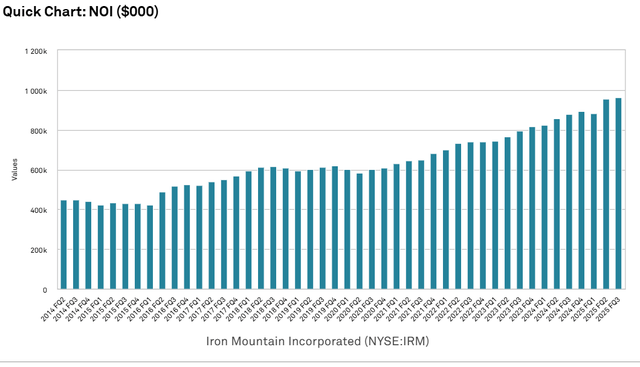

Even though the RIM business (records information management) has been considered a legacy paper business, IRM has impressive pricing power and is able to significantly increase the prices it charges each year. This has led to it being as much of a growth engine as the data center builds. NOI for IRM has improved rapidly and consistently.

S&P Global Market Intelligence

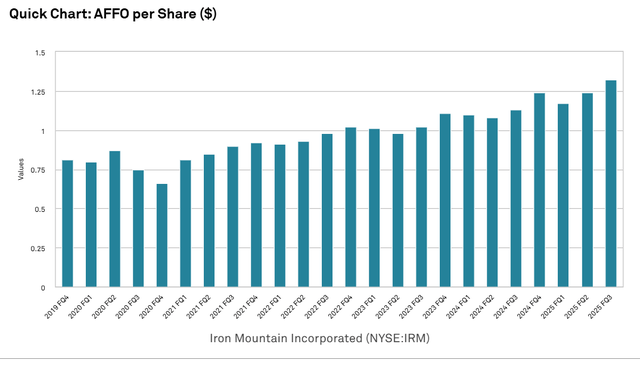

While some share issuance was involved in the capital outlay, the rates of return were sufficiently high that it was accretive on a per share basis. IRM’s data center builds have cash on cash IRRs in the low double digits, which easily overcome IRM’s cost of capital.

Thus, the external growth has led to healthy AFFO/share growth.

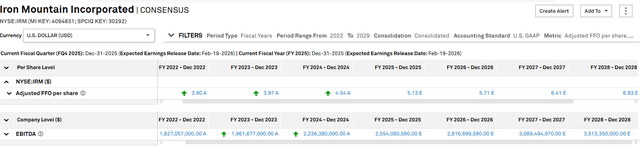

S&P Global Market Intelligence

Analysts are projecting similarly strong growth through 2028.

S&P Global Market Intelligence

I largely agree with the consensus analysts, at least directionally.

Since IRM’s data center builds have a contract in place before even being built, the returns are largely derisked.

The information management business also looks ironclad, as data retrieval is integral to clients. It is also quite cumbersome to switch providers, which gives IRM continued pricing power.

My biggest gripe about the bull case and analyst forecasts is that they aren’t reconciled to true AFFO, which has implications for valuation.

IRM Valuation

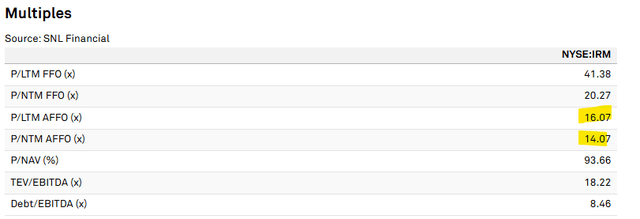

At face value, IRM is trading at 14X forward AFFO and 16X trailing AFFO.

S&P Global Market Intelligence

With IRM’s growth rate, that multiple would be extremely undervalued.

Recall, however, that sell-side analysts are incented to accurately predict AFFO. If they forecast 2026 AFFO/share of $5.71 and then IRM reports $5.71, they look prescient, and it helps their businesses.

This means that analysts typically use the same calculations as the company’s reported figures.

Thus, we should adjust forecasted AFFO numbers in the same way we adjusted IRM’s reported AFFO to “true” AFFO.

The figures we adjusted, stock comp and non-real estate depreciation, are largely recurring and flat. As such, I would take a similar $1.08 off the AFFO/share forecasts going forward. This takes, 2026 AFFO/share to $4.63, which implies a forward multiple of 17.23X.

Overall, I think the selloff in combination with IRM’s growth has taken IRM to a reasonably attractive valuation. While I would be hesitant to call Equinix (EQIX) and Digital Realty (DLR) peers since IRM is only partially a data center, Iron Mountain’s multiple is substantially lower.

IRM’s information management business is more akin to the IT sector, and indeed IRM appears to be valued cheaper than most of those companies, although I will admit to being less well versed in IT as it is outside of my wheelhouse.

A 17X true AFFO multiple is an attractive valuation for a company growing at about 11% with a 4.4% dividend yield. As long as the fundamentals hold up, it should be a recipe for outperformance.

With that in mind, let us look at a few risks that could derail the fundamentals.

Risks To IRM

It has long been speculated that paper storage volumes would decline. I think there is some merit to the concept, as paper usage has certainly declined. The outcome for IRM will be a matter of how effectively they can transition paper storage to full digital, including picking up new storage volume directly as digital.

So far, IRM seems to be executing well on that pathway and is actually at the highest storage volume they have ever had.

There is some risk in mix shift. Revenue per volume is much higher in the U.S., while their storage volume is growing faster outside the U.S. If this trend continues, it could cause some margin compression. So far, they have been able to offset and actually grow margins by raising prices. Going forward, it will be a matter of whether price increases or mix shift winds up being a bigger factor.

On the data center side of the business, I see minimal risk to existing revenues, as they are mostly contracts with extremely high-credit tenants. The risk instead would be to future growth. Data center demand is hot right now, but in future scenarios where data centers get overbuilt, incremental leasing demand could drop off.

The Bottom Line

While adjustments should be made to IRM’s AFFO to get a more accurate view of valuation, their operations are clean. IRM operates effectively and transparently. Given the recent drop in stock price, IRM is now trading at an opportunistic valuation relative to their high-growth rate.

We are long IRM.