J Studios/DigitalVision via Getty Images

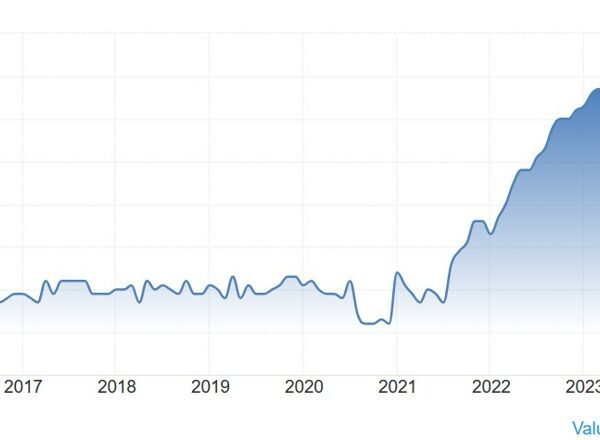

In no understatement, REIT investment fell out of favor as soon as the Fed started raising rates in March of 2022.

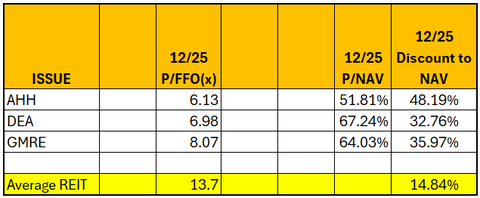

With all the world excited about the Magnificent 7 and the hypothetical riches that Artificial Intelligence will bring, real estate currently musters very little investor interest. In December of 2021, the average REIT traded at a Price to FFO of 20.7x and a 6.98% discount to Net Asset Value. According to data from The State of REITs: December 2025 Edition, the average REIT traded at a P/FFO multiple of 13.7x and a discount to NAV of 14.84%.

The multiple compression and discounting describe the present unpopularity of real estate investment. What isn’t detailed is that the discounting extends far beyond the averages and existing bargains might warrant further study.

The Venn Diagram of REIT Investment Doom

Experts who thoroughly know the whole real estate/REIT/homebuilder/land sector can expound for hours about what has gone wrong operationally for these companies over the last several years. Today, we simply want to highlight a potential opportunity, so we will touch on just a few of the triggers that doomed the share prices of some companies.

Many issues can initiate uncertainty in real estate investment. Among them:

- Perception of too much leverage in a compromised interest rate environment

- Large dividend reduction

- Reduced stock prices in a protracted bull market

Dozens of companies have been affected by one of these issues. Today we will spotlight companies that in 2025 were afflicted by all three.

The Dubious Winners

2MCAC

In Alphabetical Order

Armada Hoffler (AHH)

2MC has been trading Armada Hoffler shares since shortly after its 2013 IPO. Led by Lou Haddad (recently retired), AHH bought, and often built, premier mixed-use commercial real estate in its geographically targeted markets of Virginia Beach, Baltimore Harbor, Charlotte, and other major Virginia metros.

Armada Hoffler made good/profitable use of low-cost, variable rate debt to finance their portfolio and development pipeline. When the Fed began raising interest rates in 2022, AHH hedged their loans and hoped that lower lending rates would soon return. The market reacted with fears of higher interest expense and punished the stock in anticipation of a dividend cut. When Armada finally capitulated and cut the dividend by almost 32 percent in 1Q25, the stock declined further. Here in the 4Q, AHH became an appealing target for tax loss selling to produce losses that could shelter a lot of Magnificent Seven gains.

At this writing, AHH shares are changing hands at about $6.58. That’s about 52% of a $12.57 consensus NAV estimate. Analysts estimate $1.08 2026 FFO/share or pricing at about 6x earnings. If AHH can trade up to “average” REIT NAV discounts and FFO multiples, Armada Hoffler shares would trade in the $10.70 to $14.80 range (60% to 125% capital appreciation potential).

Couple that potential appreciation with AHH’s now more affordable $0.56 annual dividend (8.51% yield) and you are approaching what might be described as profitable real estate investment.

Easterly Government Properties (DEA)

Easterly Government Properties is basically an office REIT with a specific focus on leasing mission critical properties to US government agencies.

With the advent of DOGE (Department of Government Efficiency) earlier this year, DEA put on a campaign to prove that they actually facilitated government efficiency and they would not be the victim of broken leases. Management largely failed to convince the stock market of this claim and their shares declined. Slashing the dividend by more than 30% in 2Q25 pushed the shares down further, and tax-loss selling has recently made it hard for Easterly to keep its head above water.

Its current price of $21.20 represents just 65% of consensus NAV estimates of $32.42/share (reverse split adjusted). That price also equates to an FFO multiple of just 6.86x as measured against consensus estimates of $3.09. If Easterly can trade up to average market multiples, shares could hit a range of $27.60 to $42.33.

If the government makes good on their leases, DEA’s new, reduced $1.80 dividend (8.50% yield) will help keep us patient while we wait for the share price to run up.

Global Medical REIT (GMRE)

Global Medical REIT currently holds a portfolio of 129 medical office and healthcare facilities scattered across the United States. With its IPO in 2016, GMRE took advantage of the prevailing zero-interest-rate-policy and borrowed to assemble its property holdings. Like all real estate investors, Global Medical management hoped interest rates would decline significantly before loans were due to be refinanced. When rates didn’t fall, GMRE, prudently, cut the dividend by 29% to afford the possibility of rising interest expense. Predictably, shares fell.

At $33.40, shares are currently trading at 2/3s of $51.11 consensus NAV and just 8.16x 2026 FFO estimate of $4.08/share. If GMRE can trade up to average market multiples, shares could see pricing in the $43.44 to $55.90 range. GMRE’s new $3.00 dividend produces an 8.98% yield at current market prices.

A potential catalyst to price appreciation is a $50M stock repurchase program announced August 13th.

Summation of Opportunity

2nd Market Capital has been trading REITs for most of its 36-year existence. Opportunities in tax-loss harvesting season are an annual pastime, but this year is different.

First of all, the discounts are more extreme and follow a multi-year experience of outsized stock market gains. The Artificial Intelligence hype is only outpaced by the amount of money chasing AI and AI-tangential opportunities. Regardless of strenuous efforts, real estate management teams can’t put enough AI spin on a REIT to make its perceived value exceed that of its tax loss generation.

Secondly, this year and heading into 2026, there are more than the typical few bargain hunters looking at REITs. Private equity of all stripes sees the market price discounts and realizes they can deploy billions in discounted portfolio acquisitions that make everyone feel like a winner. Just ask Blackstone (BX) (buyer of Alexander and Baldwin (ALEX) or MCME Carol Holdings (buyer of City Office REIT (CIO). Buyers have been patient, but in growing numbers they feel the time to strike has arrived.

There is the risk that REITs may turn in yet another underperformance in 2026. The discounting is so extreme now, however, that treasure hunting may prove more profitable than ever.