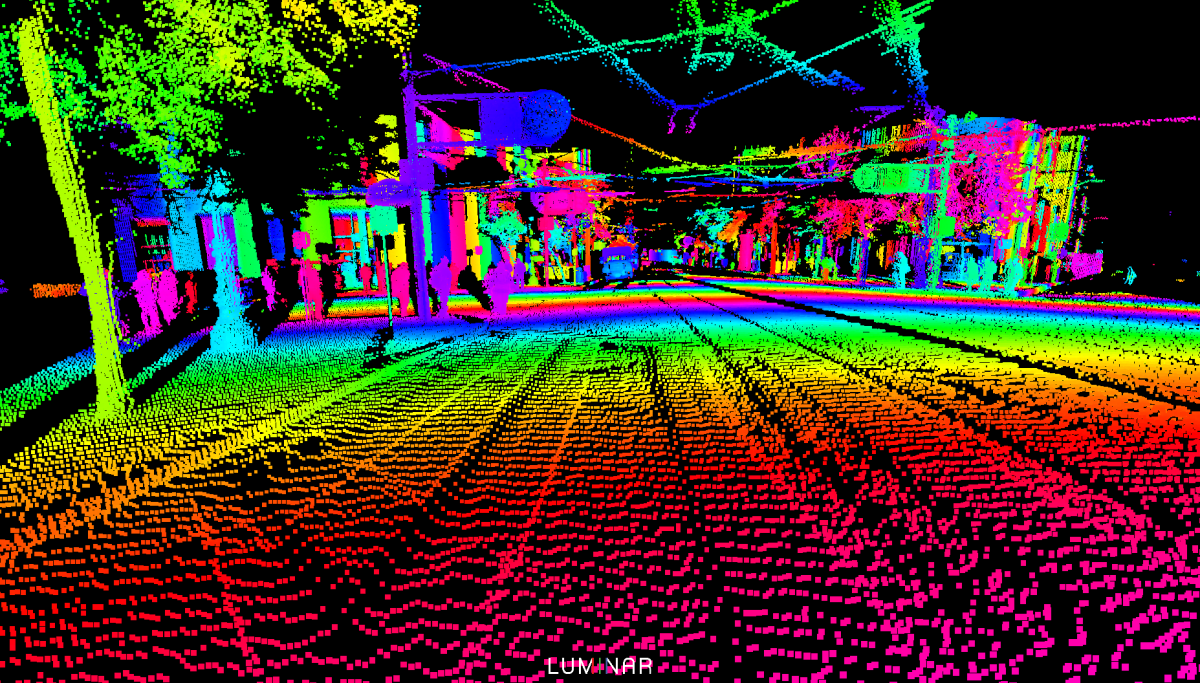

Luminar has reached a deal to sell its lidar business to a company called Quantum Computing Inc. for just $22 million, unless it receives better offers by a deadline of 5:00 p.m. CT on Monday.

The lidar-maker, which filed for Chapter 11 bankruptcy protection in December, already announced plans to sell its semiconductor subsidiary to Quantum Computing Inc. for $110 million. The deals have to be approved by the bankruptcy judge in the Southern District of Texas before they are finalized.

Luminar founder and former CEO Austin Russell has signaled interest in submitting a bid for the lidar assets and tried to buy the whole company in October, before it filed for bankruptcy. The company is currently trying to serve him with a subpoena for information stored on his cell phone, as Luminar evaluates whether it wants to make any legal claims against him related to the board-run ethics inquiry that led to his resignation last May. It’s not known how many other bids Luminar might receive by Monday’s deadline.

Quantum Computing Inc. has been designated as a “stalking horse bidder,” which helps establish a baseline for the value of the assets and helps prevent low-ball bids. Luminar has said it wants to move through the bankruptcy case quickly, as its largest creditors — mostly financial institutions that loaned the company money over the last few years — are helping fund the proceedings.

Even if Luminar receives a higher offer, the stalking horse bid represents a monumental fall from the company’s peak market cap in 2021, when it was worth around $11 billion. That valuation was propped up by the promise that Luminar’s lidar sensors were going to become widely adopted by major automakers like Volvo, which at one point planned to buy more than 1 million of them before ultimately walking away from the deal in 2025. Other deals with Mercedes-Benz and Polestar fell apart along the way, too.

Quantum Computing Inc. was founded in 2001 as a company called Ticketcart that sold ink-jet cartridges, according to its filings with the Securities and Exchange Commission. It bought a beverage company in 2007, went through its own restructuring process 10 years later, and pivoted to making optic technology for the budding world of quantum computing. The company raised more than $700 million by selling shares in 2025, though its revenue for the first nine months of last year was just $384,000.

Techcrunch event

San Francisco

|

October 13-15, 2026