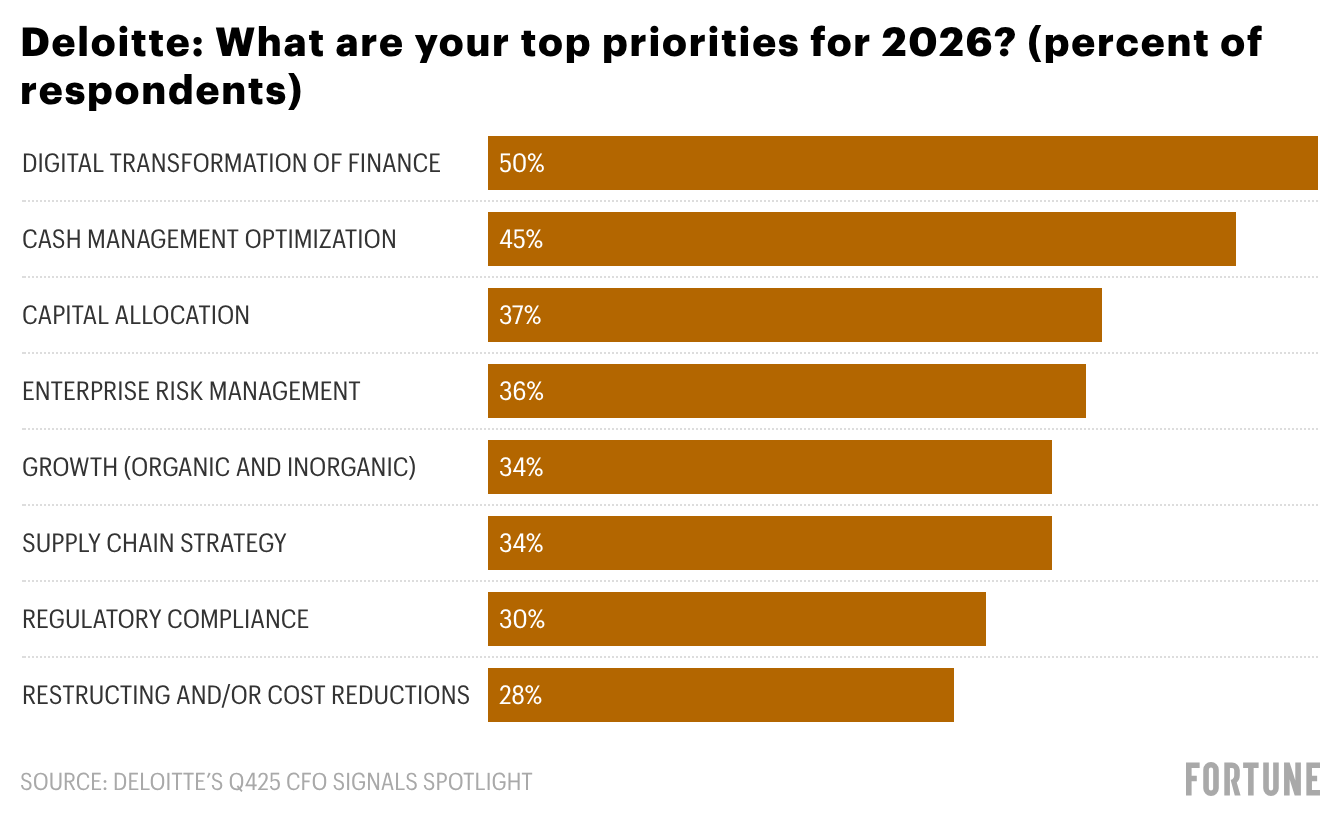

Good morning. CFO confidence is on the upswing as 2026 begins, and digital transformation in finance has overtaken enterprise risk management as the top goal for the year ahead.

That’s a key finding of Deloitte’s latest CFO Signals Spotlight report, released this morning. Half of the finance chiefs surveyed named digital transformation as their foremost priority for 2026, followed by cash management optimization and capital allocation. The findings are based on a recent Q4 survey of 200 CFOs across industries at North American companies with at least $1 billion in annual revenue.

Steve Gallucci, global and U.S. leader of Deloitte’s CFO Program, told me the shift reflects how finance leaders are moving from exploration to execution when it comes to technology—particularly AI.

“Efficiency and productivity are certainly part of the equation,” Gallucci said. “But more broadly, we’ve been on this digital evolution for some time.”

In recent years, as advanced technologies like agentic AI burst onto the scene, boards and C-suite leaders have shown increasing interest. Finance chiefs took a cautious approach to implementing these tools. Deloitte’s Finance Trends report finds that finance leaders are now influencing enterprise strategy, driving cost optimization, advancing digital transformation, and building tech-enabled teams.

Last year, many companies focused on testing, creating use cases, and developing comfort with AI, Gallucci noted. But according to the Q4 survey, 87% of CFOs said AI will be extremely or very important to how their finance departments operate in 2026.

“What we’re seeing in some of the answers to the Q4 survey questions is that continued evolution,” Gallucci said. Finance leaders are taking a more deliberate, enterprise-wide approach to transformation and AI is accelerating that commitment, he added.

The report outlines six key areas CFOs plan to prioritize this year: Leveraging digital tools to transform finance operations; going all in on AI; embedding AI agents directly into finance workflows; keeping close watch on changes in buyer behavior; tapping internal talent to manage costs; and exploring more deal-making opportunities.

CFOs also appear focused on redeploying existing finance talent to work alongside AI-driven systems. About half of respondents said their organizations plan to hire or promote internally to help keep worker costs in line for 2026.

As CFOs and finance leaders lean into digital transformation, there’s an expectation that they’re going to have to reskill their existing talent, Gallucci said.

“We’re not seeing a decline in the number of finance professionals as a result of investments in technology and AI,” he said. But as leaders look to the future—both in finance and across the broader enterprise—they are increasingly focused on boosting productivity through technology and combining those tools with the skills of their existing workforce and an agentic digital workforce, he explained.

Competition and consumer dynamics add pressure

While technology transformation tops the agenda, competitive pressure remains a driving force. About half of CFOs cited rising competition as having the biggest impact on their companies, followed closely by shifts in customer behavior and demographics.

Competitive pressures are always near the top of CFOs’ minds, Gallucci said. But what’s different now is how they’re responding—looking across industries to see how others are using AI and digital tools, and applying those lessons quickly, he said.

Gallucci also pointed to evolving consumer demand as a key factor to watch, particularly as major banks and retailers release their fourth-quarter earnings.

There’s evidence of a K-shaped economy, he added. “CFOs are paying close attention to what that means for growth, pricing, and investment strategy.”

Sheryl Estrada

[email protected]

Leaderboard

Clare Kennedy was appointed CFO of Spencer Stuart, a global advisory firm, effective Jan. 12. Kennedy succeeds Christine Laurens as part of a planned succession and in support of Laurens’ retirement from full-time executive work. Kennedy, who is based in London, joins Spencer Stuart from Maples Group, an international advisory firm, where she served as global chief operating officer. She joined Maples Group from Freshfields, an international law firm, where she served as its global CFO. Kennedy previously spent 18 years at Linklaters, an international law firm, where she held a variety of senior finance and commercial leadership roles. She began her career at Arthur Andersen and EY as a chartered accountant, specializing in tax.

Gillian Munson was appointed CFO of Duolingo, Inc. (NASDAQ: DUOL), a mobile learning platform, effective Feb. 23. Matt Skaruppa will step down after nearly six years with the company; he will remain CFO until Munson starts her new role, at which time he will assume an advisory role. Munson assumes the CFO role after serving on the Duolingo board of directors since 2019 as chair of the audit, risk and compliance committee. She was most recently the CFO of Vimeo and previously held CFO positions at Iora Health, Inc. and XO Group Inc.

Big Deal

A joint statement on Monday from tech giants Apple and Google announced that they have entered into a multi-year collaboration under which the next generation of Apple Foundation Models will be based on Google’s Gemini models and cloud technology. These models are said to power future Apple Intelligence features, including a more personalized Siri coming this year.

The tech giants stated: “After careful evaluation, Apple determined that Google’s AI technology provides the most capable foundation for Apple Foundation Models and is excited about the innovative new experiences it will unlock for Apple users. Apple Intelligence will continue to run on Apple devices and Private Cloud Compute, while maintaining Apple’s industry-leading privacy standards.”

Google and others took the early lead in the AI race, while Apple’s iPhone has lagged rivals on some AI features. Following earlier AI missteps, the Cupertino, Calif.-based company acknowledged last year that a major Siri upgrade would not arrive until sometime in 2026.

“This is what the Street has been waiting for with the elephant in the room for Cupertino revolving around its invisible AI strategy, but we believe this is an incremental positive to both AAPL and GOOGL,” Wedbush Securities analysts wrote in a Monday note on the Apple–Google partnership. Wedbush maintains an Outperform rating on Apple and continues to target a $350 price for the stock.

Going deeper

“Trump threatens to keep ‘too cute’ Exxon out of Venezuela after CEO provides reality check on ‘uninvestable’ industry” is a Fortune article by Jordan Blum.

Blum writes: “As other oil executives lavished President Trump with praise at the White House, Exxon Mobil CEO Darren Woods bluntly said the Venezuelan oil industry is currently ‘uninvestable,’ and that major reforms are required before even considering committing the many billions of dollars required to revitalize the country’s dilapidated crude business. Read the complete article here.

Overheard

“Buying a movie studio is hardly buying secure, hard assets.”

—Jeffrey Sonnenfeld, Yale professor and founder of the Yale Chief Executive Leadership Institute, and Stephen Henriques, a senior research fellow, write in a Fortune opinion piece titled “A Cautionary Hollywood Tale: The Ellisons’ Lose-Lose Paramount Positioning” regarding the multiple bids for Warner Bros. Discovery.