DINphotogallery

Expensive readers/followers,

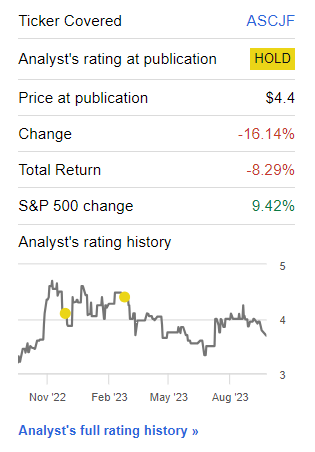

Excessive-yield transport is a sector the place I have been each burned and the place I’ve made vital quantities of revenue. I want I may say that I forecasted the current bounce on this particular firm’s upside – specifically AMSC ASA (OTCQX:ASCJF) – however the reality is, I didn’t. I am not even invested. My funding into the corporate is ancillary, by way of one in all their house owners, which has gone up as nicely, however nowhere as a lot.

I’ve acquired a query concerning the corporate – if this now signifies that the corporate is abruptly value investing in, given the sheer quantity of returns that we have seen.

This can be a follow-up piece to the next article that I revealed round 4 months again. I will change my value goal on this article – at the very least considerably, however I will not change my ranking for the corporate. If I did that and not using a good motive, and I do not assume there’s a (good) motive for this, then I would not be the type of investor most of you possible are subscribing to me for being.

So let’s examine what we’ve right here, why the corporate has outperformed, and what we will count on throughout this yr.

AMSC ASA – Upside after the newest quarter and outcomes

I wish to remind you on the preliminary stage, that my preliminary thesis of holding and never buying this enterprise was really the proper strategy to go – the corporate declined fairly a bit through the first two articles.

Searching for Alpha AMSC RoR (Searching for Alpha AMSC RoR)

Now, nonetheless, we have clearly seen the corporate revert with a vengeance, and because of the 16%+ yield, this calls out to some income-oriented buyers who imagine that maybe there’s some type of “safe 16% yield” to search out right here.

Nicely, first off, I’d say with a sure diploma of non-public conviction – that there’s nothing like a ‘secure 16% yield’. Any sentence that features “safe 16% yield” ought to embrace quite a lot of caveats because the wording of “safe”, as a result of each single 9%+ yield that I’ve coated has include a number of information that, in hindsight, had been essential to know, and I’ve really invested in fairly a number of from them.

AMSC ASA is a ship financing firm. Which means that it owns so-called bareboat charters for maritime property and leases them to varied corporations across the globe, in what could be in comparison with a triple-net lease construction for REITs. This isn’t in itself inherently a poor or dangerous enterprise mannequin, however it does come at what I take into account to be an elevated quantity of general danger.

That is very true when contemplating that AMSC ASA is a downright minimally small type of enterprise as a result of it owns lower than 20 vessels – even Ocean Yield, which I owned for a while, owned greater than twice this quantity and was nonetheless thought of to be smaller.

The one saving grace when it comes to the corporate’s size-related concerns right here is the truth that AMSC is owned by an organization many, many instances the dimensions of itself – which can be my oblique possession stake of this enterprise, specifically Aker ASA (OTCPK:AKAAF). This conglomerate is a long-term proprietor of many companies and general is an excellent allocator of capital within the Nordics.

However AMSC itself, that is barely over $230M value of market cap.

The biggest argument that buyers frequently make, past the supposed security of its transport portfolio, is the Jones Act, which I’ve described more in detail in this specific article.

To summarize it, the Jones Act limits how cargo is transported by sea, and particularly cargo shipped between U.S components can solely be carried by sure ships and sure crews – American ones. And that regulation is just not some new arcane invention, it has been round for over 123 years.

The disadvantage is after all, that AMSC lately coloured exterior the secure strains of the Jones Act.

The newest outcomes we’ve are in November, particularly the tip of November for 3Q23. A part of the rationale the corporate shot up was associated to a unprecedented dividend of $170M divided amongst shareholders. This was removed from the one related set of reports although.

The corporate additionally introduced the sale of 100% of the shares within the ATHC, or the American Tanker Holding Firm, which owns the entire firm’s Jones act companies, or 10 tankers and corresponding charters, debt, and company construction.

This transaction closed on October 18th, and that is the place the dividends got here from. On the identical time, the corporate additionally introduced a brand new settlement with Solstad, the place the vessel CVS Normand Maximus was refinanced to a subsidiary of Solstad Offshore in return for shares and possession within the father or mother firm of the brand new company construction.

In essence, what the corporate has carried out listed below are two transformative selections for the corporate’s future.

- First, leaving the Jones Act and its benefits behind. That enterprise is now bought off.

- Secondly, a conversion of possession within the vessel Normand Maximus in the direction of frequent shares in a brand new Solstad firm.

- The corporate selected dividend funds of $0.05/share for 4Q and 3Q of this yr, in December and march respectively. This might come, primarily based on the native NOK dividend funds, to a yield of about 8%, and a discount within the quarterly dividend of about 50% from the standard earlier stage of about 1.1-1.3 NOK per quarter.

The corporate has acknowledged its intention to search out new investments to spice up its dividend capability with.

I see a number of issues with this.

First off, this type of transfer is strictly why these kinds of small corporations could be each very advantageous investments, but in addition nice deteriorations within the “wrong” type of conditions, as we have seen earlier than.

Secondly, I do not view a sans-jones portfolio AMSC as something type of “safe” to put money into, particularly with precisely zero concrete indications as to how they will change the misplaced dividend-basing earnings. That is the precise verbiage used within the quarterly report.

We’re additionally proactively searching for new investments within the maritime house so as to add to our dividend capability going ahead. We’re excited in regards to the developments over the previous few months and are wanting ahead to proceed creating shareholder worth.

(Supply: AMSC 3Q23)

After all, the corporate won’t be capable to convey all that a lot when it comes to concrete plans simply but, however the transfer that we have seen right here, whereas short-term constructive, nonetheless has the corporate needing to show itself going ahead.

So general, as we shut 3Q23 and take a look at going into 2024 and ending 2023, I do not see AMSC in a materially improved place of having the ability to present any type of secure dividend upside or equal money move to how they have been in a position to function beforehand.

As a result of this firm was dangerous to start with, and now has taken one more step to the place I view it as even riskier than earlier than (until we see some adjustments as we go ahead to the place it may be argued that it is really equal or similar to the Jones-sort of security we noticed earlier than), I view this as a motive for materially altering my value goal down right here to account for this enhance in danger.

Right here is my present valuation outlook for the corporate because it at the moment stands.

AMSC Valuation – A decrease PT after the divestment of the Jones portfolio

Once I beforehand coated AMCS, I thought of the corporate a “HOLD”, fulfilling solely 2 out of 5 of my funding standards regardless of a major, 12%+ yield. The native P/E on the time was over 15x, which I didn’t take into account low-cost and even interesting. There have been cheaper and higher transport corporations on the market, and alternatives to get in on a excessive yield. I additionally thought of the dimensions prohibitive. Then the corporate did this in 3Q23, and now it is exhausting to even use the identical metrics to judge the enterprise right here.

A roughly 8%-yielding earnings funding is just not in any approach a beautiful earnings funding. Some insurance coverage corporations are about 100x this dimension and with an A-rating when it comes to credit score commerce at comparable ranges of yield. In case you’re keen to go to a 6-7% yield, you possibly can actually get a number of the greatest telcos in sure geographies on the market at such a yield.

So why would you, in a state of affairs the place you need yield, put money into an organization like this above that?

No motive that I can consider.

AMSC nonetheless holds a 5-year RoR of adverse 18.7% even with the current type of upside we have seen following the extraordinary dividend. With an annual revenue stage of 1.42, although that is trailing, not even this newest dividend stage if we annualize it, is roofed by that revenue, coming nearer to 2 NOK/share.

The corporate is neither conservative when it comes to leverage, and I do not see it as having any specific particular outlying type of argument as to why it must be thought of extra of a “BUY” right here.

Analysts have the corporate at a goal vary of round 20 NOK, lowered from round 45-50 NOK again in September. So most analysts would agree with the evaluation that the corporate is value round half now that this newest set of measures has gone by way of.

I’d impair the corporate additional and put this right down to 18 NOK/share – no increased than that, till I see the place the corporate’s future plans take it. That corresponds to roughly 1x the e book worth of the corporate’s tangibles, which I nonetheless can take into account is considerably excessive – however a value I’d settle for, with a historic common nearer to 1.6x or 1.8x.

Right here is my renewed thesis for 2024 for the corporate.

Thesis

- AMSC is a lately reworked firm, as soon as a play on the conservative US-based Jones Act, now your commonplace transport leasing firm with a fleet of probably engaging vessels with a hopeful upside producing a dividend yield of about 8%.

- For that motive, I am cautious right here. I would not purchase the corporate at at the moment’s valuation however would wait, if , for a little bit of a drop.

- My PT for the corporate now involves 18 NOK/share, which is the place I transfer my 2024E protection right here.

- The probability of the corporate dropping to this stage with out macro impacts is doubtlessly low – however this signifies simply what I am searching for earlier than I’d be keen to “BUY” a spec inventory like this right here. Particularly one which as of 3Q23 has materially modified its danger/reward issue, and never for the higher, as I at the moment see it.

Bear in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital positive aspects and dividends within the meantime.

- If the corporate goes nicely past normalization and goes into overvaluation, I harvest positive aspects and rotate my place into different undervalued shares, repeating #1.

- If the corporate would not go into overvaluation however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is basically secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at the moment low-cost.

- This firm has a sensible upside primarily based on earnings development or a number of growth/reversion.

The corporate fulfills 2 out of my 5 standards, making it a “Hold” right here.

This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.