The first supposed ‘rate check’ took place in European trading on Friday and then there was another late on in US trading. Although on the latter, the dollar was already crumbling across the board so USD/JPY traders also took that as a sign to abandon long positions. The nerves are continuing to Asia trading today with the pair opening with a sharp gap lower of roughly 100 pips.

The selling has continued since the open, with the pair now down 1% to near 154.00. That’s the lowest level since mid-November last year with the 100-day moving average nearby now at 153.55. For some context, the pair hasn’t tested any of its key daily moving averages since September last year. That reflects on the Takaichi trade for the most part, after she officially won the prime minister race in October.

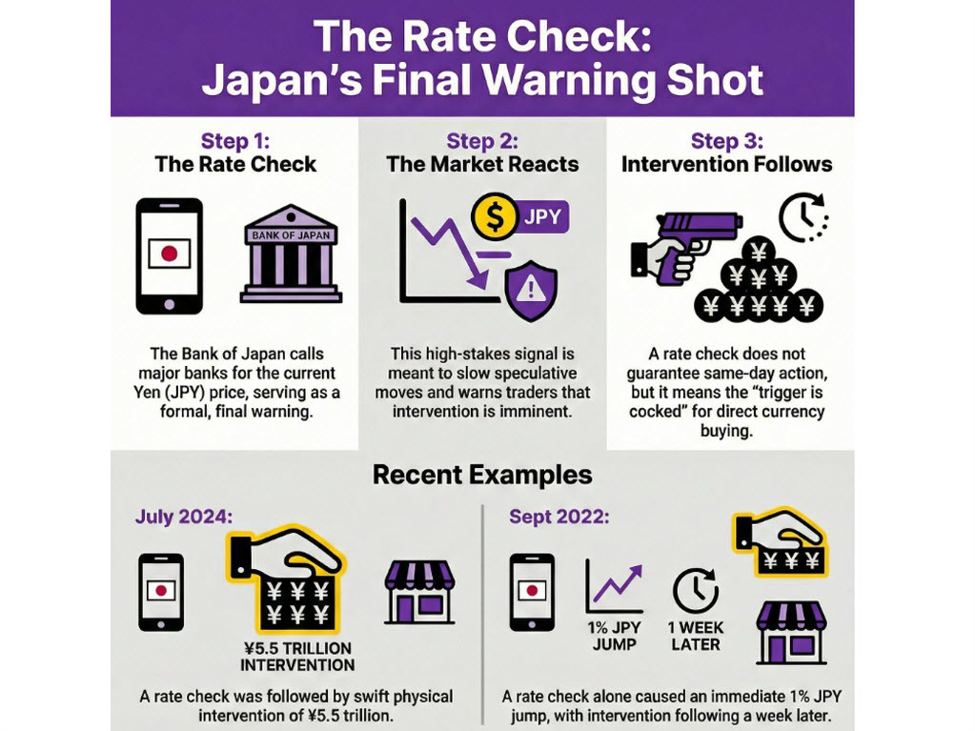

After the ‘rate check’ on Friday, markets know very well that actual intervention is on the cards next. That was the case back in September 2022 and July 2024. So, that’s likely causing those piling on yen shorts to rush for the exits.

Adding to the positive news for the yen today is Japan prime minister Takaichi seeing a drop in approval ratings ahead of the snap election.

Her administration’s public approval rating in a survey via the Nikkei newspaper dropped to 67% from 75% in December. And that’s the first time the figure dipped below 70% since she took over as prime minister in October.

Meanwhile, a separate poll by Kyodo news showed her approval rating declining to 63% from 68%. And another one from the Mainichi newspaper showed a drop to 57% from 67% before.

As a reminder, Takaichi’s goal in calling for the snap election is to consolidate power. But evidently, her economic and fiscal plans are being met with heavy and growing skepticism it would seem. Fears continue to grow over her proposed stimulus package, with worries that it won’t be enough to address the cost of living crisis among Japanese households.

Then, there’s also market concerns that the additional debt that the government will be taking on will break the bond market – more so than it already has.

So, that’s setting the stage for how things are going to play out this week with traders surely expecting possible action if USD/JPY continues to keep on the higher side. As a reminder, the pair is still up ~650 pips following the gap higher in the early stages of October last year.