Snapchat has published new data which shows that Snapchat users are increasingly seeking information on social apps to help guide their financial services decisions, which could present significant opportunity for finance marketers looking to promote their latest offerings.

The data is based on a new study conducted by Ipsos which incorporates responses from 1,100 daily social media users in the U.S. who currently hold or are seeking financial products. The study’s main aim was to identify key “trigger moments” that lead to the adoption of new products, while also exploring the key influences that drive such activity.

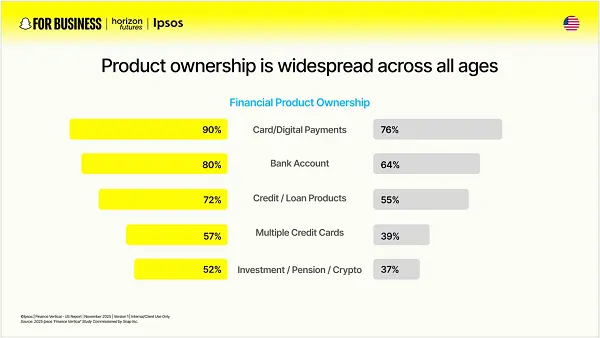

First off, the data shows that Snapchatters are more likely than non-users to hold multiple financial products.

As per Snap:

“While Millennials lead with an average of five products, Gen Z is closing the gap fast, holding an average of 3.7 products each. In particular, daily Snapchatters are in the market for new products and are 1.4x more likely to take out a new financial product in the next six months compared to non-Snapchatters.”

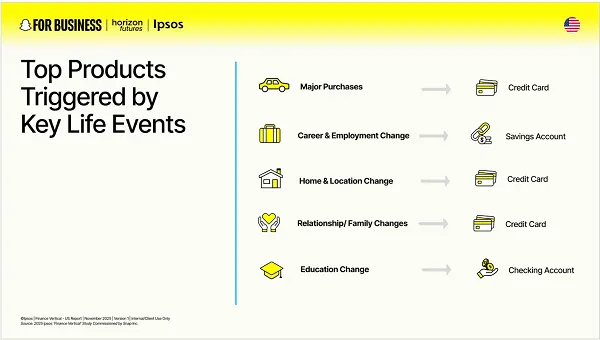

So there’s opportunity for financial marketers on Snap, while the data also shows that Snapchat’s predominantly younger audiences is more likely to be in the market for financial products based on common life events that trigger their acquisition.

“For Gen Z, almost 8 in 10 say they experienced a major life event in the past year, and 3 in 4 are anticipating at least one more in the next 12 months. They are also more inclined to adopt financial tools or products during career or educational transitions. Meanwhile, Millennials are more likely to seek them out when making major purchases, such as a new car.”

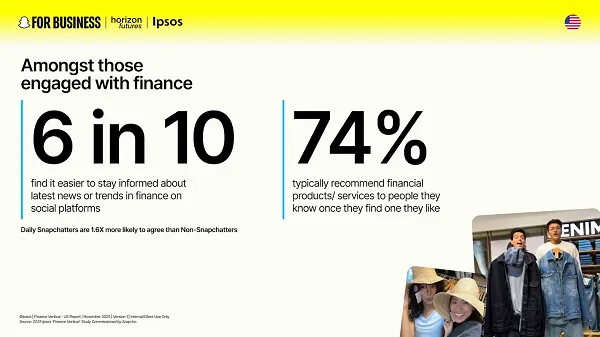

And most people are now learning about financial products online, primarily via social apps,

“Because social is the default environment for learning and decision making, it’s a must-have for brands to engage and drive action. Of those who own or are seeking financial products, 8 in 10 say they would like to see educational content from financial brands on social media.”

And Snapchat users are particularly open to this, with the data showing that Snapchatters are 2x more likely to try a new financial product or brand after seeing it on social platforms.

Underlining this further, Snapchat also says that 4 in 10 consumers want to see interactive product guides on social platforms, while half are already using AI or emerging tech more than they were a year ago.

“This shift is especially pronounced among Snapchatters, who show 2.1x higher interest in using AR to learn about financial products. By allowing consumers to visualize options and explore scenarios before committing, AR and AI can help bridge the gap between curiosity and confidence.”

I don’t know how important AI and AR are to financial decisions, and I don’t think I’d be recommending that people put too much trust in AI tools when it comes to your money. But, conceptually at least, Snapchat users are open to financial promotions and advice in the app, which could be a valuable point of note for marketers.

You can check out Snapchat’s full “Future of Finance” report here.