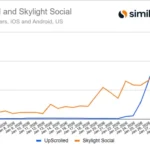

📊 Tech sector dips while semiconductors and Amazon soar: A market snapshot

Sector Overview

Today, the technology sector is facing a challenging landscape, marked by declines in major stocks like Oracle (ORCL) and Microsoft (MSFT), each dropping by 1.24% and 1.14% respectively. However, the semiconductor industry offers a more optimistic picture with Broadcom (AVGO) emerging as a significant winner, up by 1.84%, and Advanced Micro Devices (AMD) climbing 2.15%. This highlights a notable shift within the tech space.

In the consumer cyclical sector, Amazon (AMZN) posted a solid gain of 1.20%, indicating robust investor confidence in internet retail. Tesla (TSLA) also edged up slightly by 0.31%.

Market Mood and Trends

The overall market mood is mixed, with the communication services sector showing strength, particularly with Google’s parent company Alphabet (GOOG) increasing by 1.18%. Investors seem to be cautiously optimistic, absorbing recent market and economic updates with a balanced outlook. Financials reveal a divergent pattern, with JPMorgan Chase (JPM) enjoying a rise of 0.96% while other key players like Berkshire Hathaway (BRK-B) see a slight dip of 0.87%.

Despite the underperformance in the broader tech sector, the steady performance of semiconductors might suggest expected growth or specific positive news within that niche, now turning investors’ eyes to this potential hotspot.

Strategic Recommendations

Given these dynamics, investors may want to watch the semiconductor space for opportunities and monitor how resilience in consumer cyclicals and communication services unfolds. With recent tech dips, evaluating entry points for companies like Microsoft and Oracle might offer strategic opportunities once volatility stabilizes.

For those looking to balance their portfolios, incorporating a mix of tech and consumer cyclical stocks like Amazon or semiconductors such as Broadcom might provide a hedge against uncertainty, given their current performance. Stay updated with InvestingLive.com for real-time market data and strategic insights to navigate this complex landscape.