Housing finance accelerated into Q4, supporting the “still-warm” domestic demand narrative, but the RBA’s next hike is still more likely May than March.

Summary:

-

Q4 housing finance strengthened across owner-occupiers, investors and first-home buyers

-

Value growth outpaced volumes, pointing to larger average loan sizes

-

Investor value growth cooled sharply from Q3’s surge

-

RBA hiked to 3.85% in February, citing sticky inflation and capacity pressures

-

Market consensus leans May for the next move; March remains a lower-probability risk

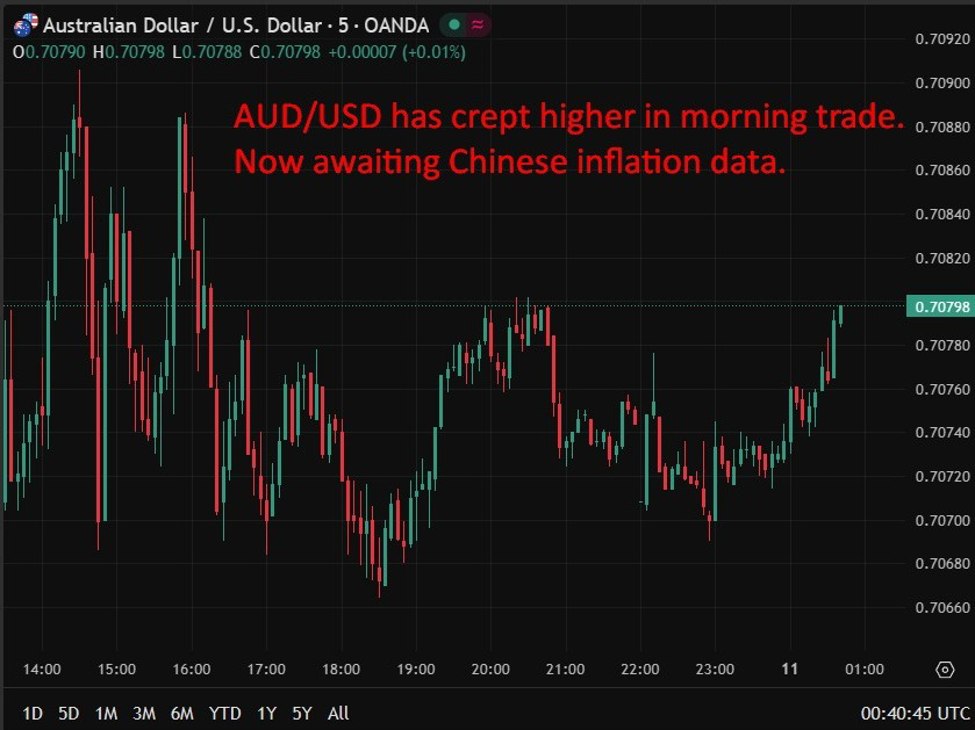

Australia’s latest housing finance figures point to a clear pickup in credit demand into the end of 2025, but the signal for near-term Reserve Bank of Australia policy is likely to be modest.

The Australian Bureau of Statistics said the number of new dwelling loan commitments rose 5.1% q/q in Q4 2025, while the value lifted 9.5%. Owner-occupier commitments increased 4.8% on the quarter and the value jumped 10.6%, while investor commitments rose 5.5% and the value grew 7.9%, a sharp step-down from the prior quarter’s very strong run. First-home-buyer activity also improved, with commitments up 6.8% and the value up 15.5%.

The headline is that housing credit momentum stayed firm despite higher rates and still-elevated cost-of-living pressure, reinforcing the view that interest-sensitive parts of the economy remain resilient. For the RBA, however, housing finance is only one piece of the puzzle alongside inflation, wages, consumption and labour-market tightness.

The central bank raised the cash rate to 3.85% on 3 February and has been explicit that inflation is expected to sit above the target band “for a while longer,” with recent strength in domestic activity adding to capacity pressures.

Markets have been leaning to a follow-up hike in May, a line of questioning even surfaced in the post-meeting press conference, while the next decision is not until 17 March. A case can be made for a March move if inflation or activity surprises hotter again, but it remains a lower-probability outcome given the RBA’s preference to assess additional data and the already-tight setting of policy.

In short: the housing numbers are consistent with an economy that is still running warm, but on their own are unlikely to shift the rate path decisively.