The founder of Capriole Investments has pointed out how Google searches related to “Quantum Computing Bitcoin” peaked alongside the price top.

Bitcoin Saw Increased Interest In Quantum Threat During Bull Run

In a new post on X, Capriole Investments founder Charles Edwards has talked about the trend in the Google search interest around the Quantum Computing threat to Bitcoin.

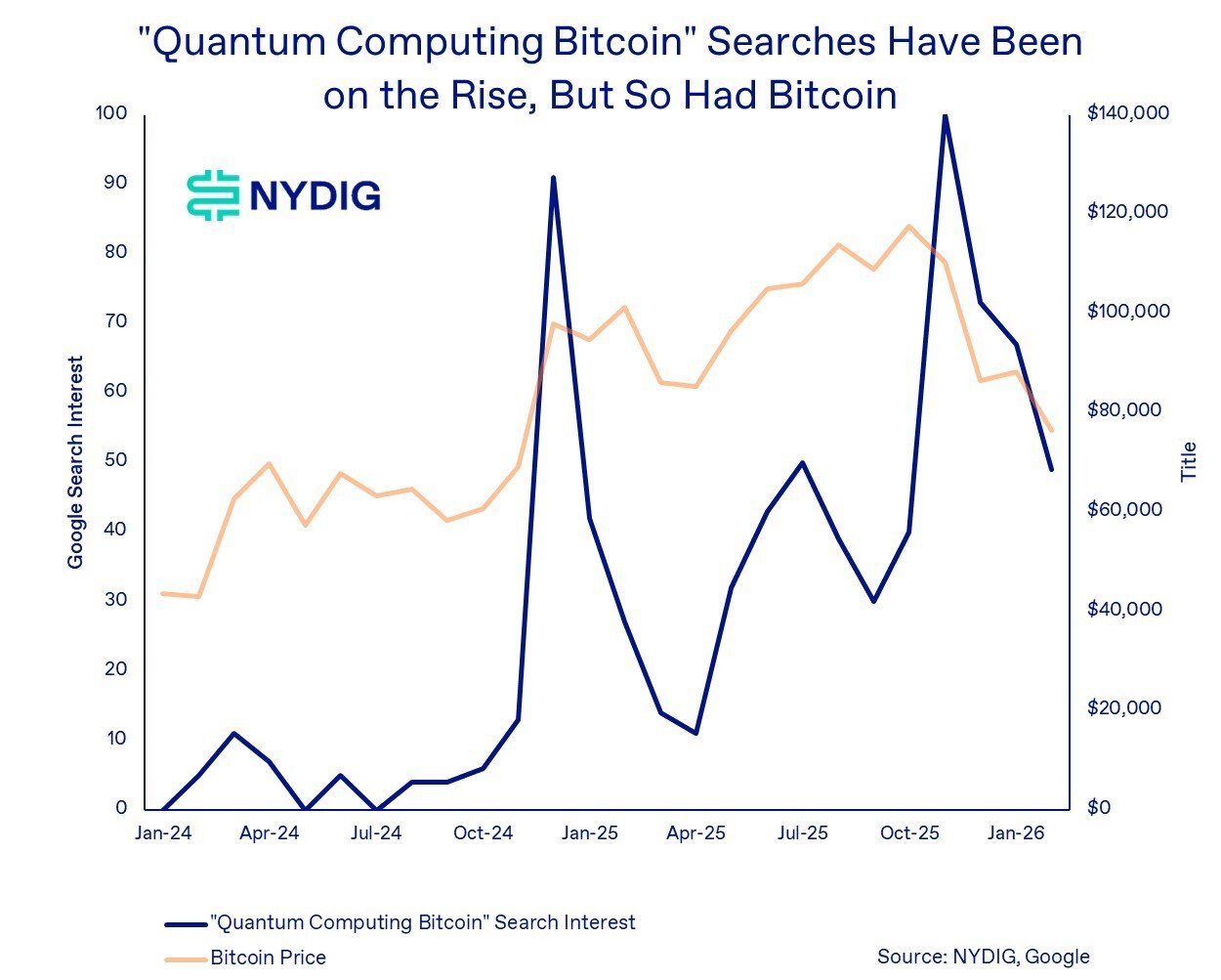

Below is the NYDIG chart cited by the analyst that lines up the Google search data for “Quantum Computing Bitcoin” against the cryptocurrency’s price trajectory.

Looks like interest in the search term hit a peak last year | Source: @caprioleio on X

As displayed in the graph, the Google search interest in the topic witnessed a sharp surge just as last year’s bull rally reached its peak. This would imply that the price appreciation brought with it risk evaluation around the Quantum Computing threat to the cryptocurrency.

Quantum Computing is an emerging technology that could, in theory, exploit the vulnerabilities present in old BTC wallets to access the tokens stored inside them and dump them on the market.

The timeline related to when Quantum Computing could become advanced enough to do this remains yet uncertain, but it has nonetheless raised concerns among many in the BTC community. Edwards has been one of the loudest voices when it comes to this issue, urging the community to work together on a solution as soon as possible.

Based on the Google search interest chart, the analyst has noted, “Evaluation of the risk was at a maxima when price was, resulting in derisking, a leading indicator to price falling.” Shortly after the peak in the metric, the asset observed a bearish shift that has today taken it below the $70,000 mark. “The Quantum threat drove Bitcoin down,” said Edwards.

From the graph, it’s also visible that a similar trajectory was visible during the price surge that occurred in late 2024. Back then, the topic saw slightly lower peak traction and faded quickly once the cryptocurrency slowed down.

Interest in the topic has gone down this time as well as Bitcoin has declined, but it still remains significantly above the low from early 2025, a potential sign that the floor interest in the risk has gone up. “The good news is, at least this means we are starting to get traction and attention in the right places to solve the problem (Strategy, Eth foundation etc),” noted the Capriole founder.

Analyst Willy Woo has also made an X post discussing the Quantum risk. As the chart shared by Woo illustrates, the Bitcoin vs Gold price has broken a twelve-year trend recently.

The trend in the XAUBTC ratio over the years | Source: @willywoo on X

The XAUBTC ratio was in a state of downtrend for twelve years, but its value saw a reversal last year and has since been rising. “The valuation trend broke down once QUANTUM came into awareness,” explained the analyst.

BTC Price

At the time of writing, Bitcoin is trading around $68,600, down 2.4% over the last week.

The price of the coin seems to have been moving sideways over the past few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.