Economists bring forward BOJ hike expectations and see yen intervention risk near 160.

Summary:

-

All 76 economists expect the BOJ to hold rates steady in March

-

Majority now see policy rate at 1% by end-June, earlier than pre-election view

-

Growing concern about fiscal expansion and yen weakness

-

69% expect currency intervention if USD/JPY nears 160

-

Inflation risks and wage growth keep tightening bias intact

Expectations for the Bank of Japan have shifted meaningfully in the wake of Prime Minister Sanae Takaichi’s election victory, with economists bringing forward forecasts for the next rate hike and increasing bets on potential currency intervention.

According to a Reuters poll conducted February 10–18, all 76 economists expect the BOJ to leave its policy rate unchanged at its March meeting. However, beyond March, the outlook has turned more hawkish. A majority, 58%, now see the policy rate reaching 1% by the end of June, compared with just 36% in the January survey. Among those specifying timing, June was the most popular call, though a notable minority see April as a live possibility, while others expect July.

The shift reflects mounting concern over upside inflation risks, a still-weak yen and the implications of expansionary fiscal policy. The BOJ raised rates to 0.75% in December, the highest level in three decades, and signalled readiness to continue tightening, diverging from many global peers nearing the end of their rate-cutting cycles.

Currency dynamics remain central to the policy outlook. After briefly approaching the psychologically important 160 per dollar level in January, the yen rebounded sharply, but volatility has kept markets on alert. In the poll, 69% of economists said they expect Japanese authorities to intervene again in currency markets if the yen weakens materially. Among those, 40% identified the 160 per dollar level as the most likely trigger for action.

Fiscal policy is also influencing expectations. More than half of respondents expressed concern that a proposed two-year suspension of the consumption tax on food could strain public finances, potentially complicating the BOJ’s inflation outlook and bond market stability.

Wage growth remains a key variable. While economists expect solid increases in this year’s wage negotiations, expectations have moderated slightly compared with late last year, though still consistent with inflation running above target.

Overall, the consensus is clear: March is likely a pause, but tightening toward 1% by mid-year is now the base case, with intervention risks rising should yen weakness re-emerge.

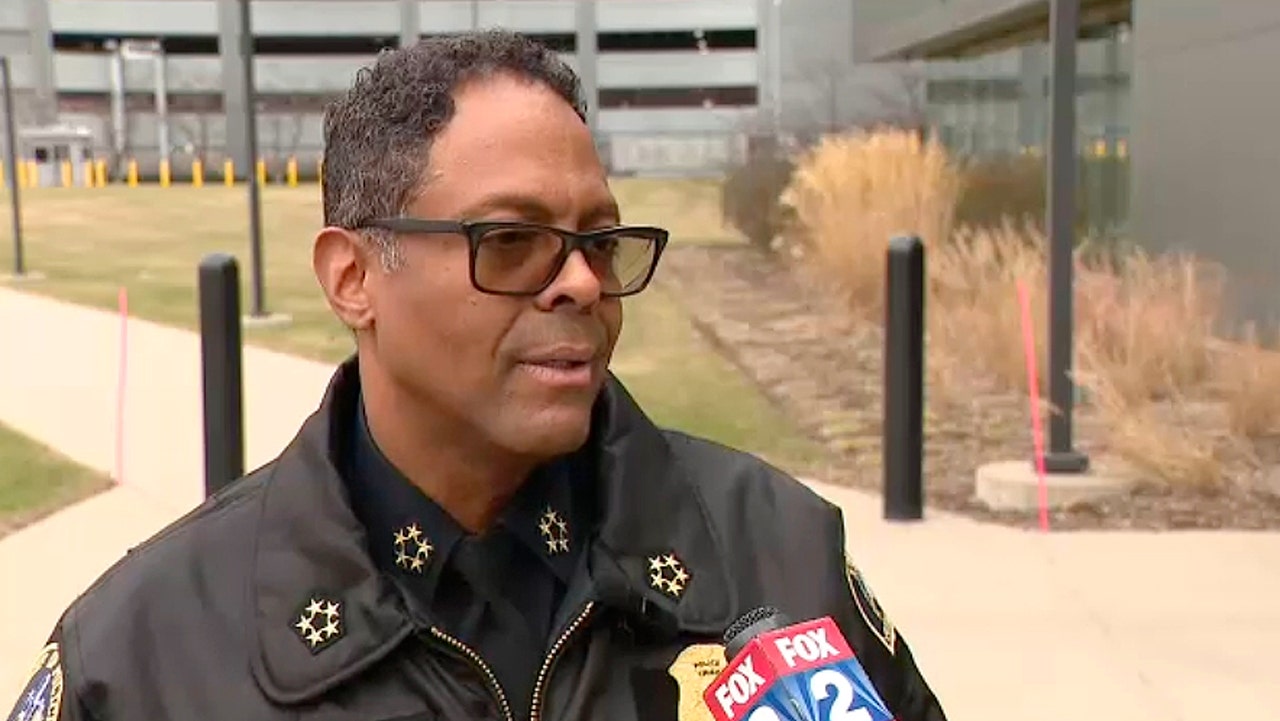

BoJ Ueda

“Bid 160? Go ahead, make my day!”

![Is ChatGPT Catching Google on Search Activity? [Infographic]](https://whizbuddy.com/wp-content/uploads/2025/06/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9kYWlseV9zZWFyY2hlc19pbmZvZ3JhcGhpYzIucG5n.webp.webp)