At The REIT Forum, we spend a significant amount of time covering the mortgage REIT sector. It remains one of the most misunderstood and mispriced areas of the income market. Mortgage REITs are heavily influenced by interest rates, spreads, and portfolio structure, which creates frequent difficulties for the market to get an accurate balance between price and intrinsic value. Those disconnects create opportunities for investors, but only if you’re paying close attention and have a strong understanding of the sector. We monitor common shares and preferred shares in the mortgage REIT sector so everyone can see where there could be an opportunity in real time.

While common shares tend to attract the most attention because of the high yields, preferred shares have consistently been one of our favorite areas to generate strong returns. The preferred shares offer a high yield with materially lower risk and volatility. That combination allows us to capture attractive yields while avoiding much of the risk that comes with the common stock. When prices diverge from fundamentals, preferred shares can offer opportunities to lock in high yields and have the added benefit of capital gains.

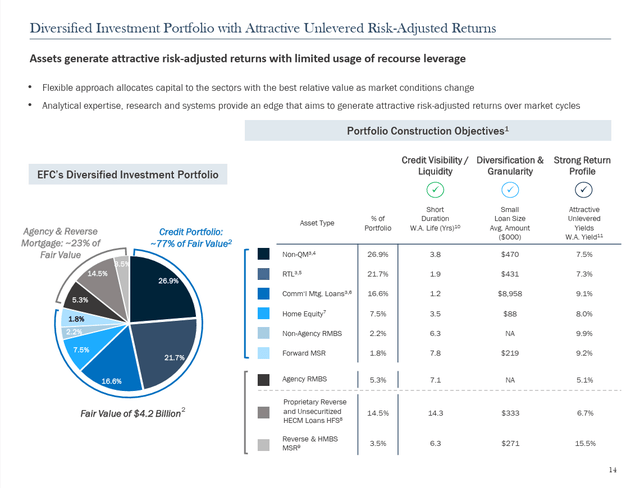

One of the mortgage REITs we actively cover is Ellington Financial (EFC). The company has a diverse portfolio, including agency and non-agency mortgage assets.

EFC

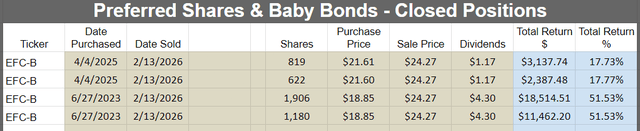

We have routinely invested in the preferred shares from EFC which have repeatedly provided excellent trading opportunities. Our approach to investing isn’t just theoretical – we actively trade and share all of our positions. We capture gains when valuations become less attractive and redeploy capital into more attractive opportunities.

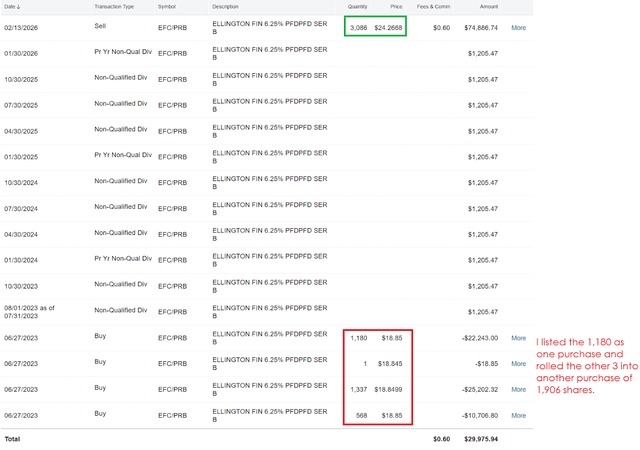

We recently closed out our position in EFC-B (EFC.PR.B) to take advantage of strong returns over the last year. These shares delivered everything investors could hope for in preferred shares: High yield, meaningful price appreciation, and low volatility. As EFC-B moved closer to our projected targets, the risk/reward balance became less attractive relative to other opportunities in the mortgage REIT preferred share sector. Harvesting gains when prices appreciate is a core part of our strategy, and it allows us to redeploy capital into investments we have in our buy range.

Shares of EFC-B are due for a moderate increase in targets as the date for the dividend resetting draws closer on Jan. 30, 2027. As that date gets closer, the market begins placing more weight on the forward dividend rate instead of the initial fixed rate. EFC-B will go from a fixed-rate dividend to having a new rate for the next five years. The new rate will be based on the five-year Treasury rate on that date (called the “reset date”) plus a credit spread of 4.99%.

We often find prices can deviate a bit too far from fair value. This can often bring opportunities where shares dip into the buy range giving investors a great opportunity to buy. On the flip side, it can bring opportunities where the price appreciates too much and investors have a chance to sell their shares and harvest gains. EFC-B rallied enough in anticipation of the improved dividend rate, making it an appropriate time to harvest gains. Are shares a bad deal now? Not at all. They just aren’t the monster investment they were before.

Even after the rally, the annualized yield to call was around 10.1% when we sold, which indicates that shares could still provide a respectable return. EFC-B retains some investment merit for investors focused on income generation. However, valuation is always relative. When a position reaches a certain range, we are disciplined to lock in gains rather than continue holding because the yield appears appealing.

Important note: We were very price sensitive in closing the position. If share prices were lower by even a few percent, we definitely would not have harvested those gains yet.

Outlook on EFC-B

Just because we are exiting the position does not mean we have a negative outlook on the shares. If EFC-B were to dip in price, the valuation could become highly attractive. I would consider buying again. Preferred shares frequently move through cycles, going above and below our targets. A dip in the price can create excellent entry opportunities. It’s something we watch closely. We will continue to watch EFC-B. If the pricing provides the margin of safety and return potential that we require, we would be happy to open a position again.

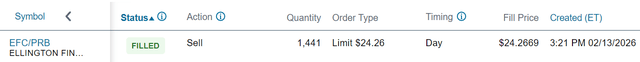

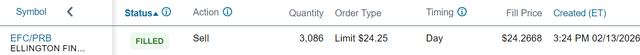

Our Trade

-

Sold 1,441 shares of EFC-B at $24.2669 per share.

-

Sold 3,086 shares of EFC-B at $24.2668 per share.

-

These trades close out our entire position, which was 6.09% of the portfolio.

Over our investment periods in EFC-B, they have been among the best performing preferred shares in our sector. The results were outstanding, especially when factoring in the very low volatility. I will look to reallocate the capital into other options.

Current Valuation

As of writing this article, EFC-B carries a 10.6% yield to call. There’s a chance that the shares get called. It’s not overwhelming, but it’s definitely possible. Would an annualized rate of 10.6% be bad? Not at all. That would be great. But the call is still far from certain. Given some of the other options in the sector, we decided to harvest our gains for now. If we see EFC-B dip, I could certainly be interested in getting back into it.

Investors should still expect a modest increase in targets when we next update our preferred share price target ranges. That’s common for shares that have a lower fixed-rate dividend for the initial period and are expected to see a material increase in the dividend rate.

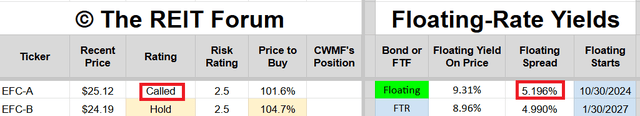

Ellington Financial called EFC-A already, but EFC-A had a higher spread and a higher base rate (which you can see in the red boxes below):

The REIT Forum

The dividend rate on EFC-B will most likely be lower than it was on EFC-A. For EFC-B to get a higher rate, it would require the five-year Treasury yield to increase materially between now and when shares become callable. Remember, the dividend rate resets based on the five-year Treasury rate on the day the shares first become callable and then every five years thereafter.

While we are not buying at the current price, we do have shares as a buy under $23.13. Shares would come into our “strong buy” range if shares dipped under $21.70. Either way, we would consider buying again if prices were to dip below our buy range (they do not need to dip into our strong buy range). Preferred shares do regularly come into our buy range, and it would not be unusual to see EFC-B drop back into said range.

Results

We believe in having full transparency with every one of our trades. Our investment results are included below:

The REIT Forum

All of these purchases generated strong returns. It’s particularly great when returns can come from investments with relatively low volatility compared to the common stock.

My Execution

Schwab

Schwab

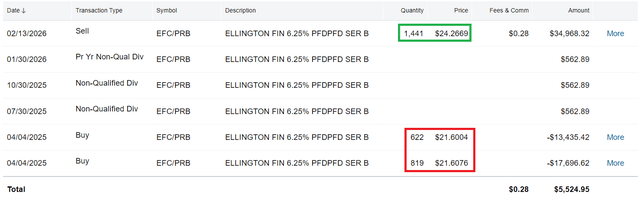

I usually include screenshots like that in our trade alerts for subscribers. But you can’t see the trade alert where we purchased shares. Clearly, you can’t calculate returns without evidence of the purchase price.

So, I pulled up the transaction history for the relevant accounts and searched EFC/PRB:

Schwab

Schwab

These results highlight why it’s so important for investors to be disciplined when it comes to the valuation of an investment. Preferred shares like EFC-B can deliver excellent returns when the purchase price is at an attractive valuation. This also goes to show that the exit pricing can be important when shares are reaching what we view as a fair value.

Even after we closed out of the position, EFC-B remains a preferred share we will continue to monitor closely. We believe mortgage REIT preferred shares remain one of the most attractive areas for investors looking at valuation and risk management. At The REIT Forum, we will keep our eyes on opportunities where pricing diverges from important fundamentals and act accordingly.