This foreign exchange pair has been in consolidation mode for fairly a while, however can a breakout from the triangle occur quickly?

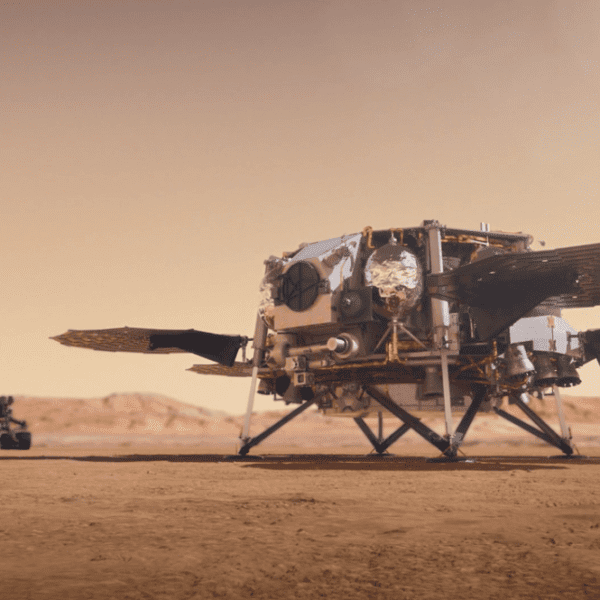

As you’ll be able to see from the 4-hour chart under, NZD/JPY shaped greater lows and located resistance on the 91.00 main psychological mark.

Listed below are the degrees I’m awaiting a bounce or a break.

NZD/JPY 4-hour Foreign exchange Chart by TradingView

Renewed dovish expectations for the BOJ have weighed on the Japanese yen previously few days, as merchants are warming as much as the concept that the central financial institution will hold charges in unfavorable territory for a lot a lot longer.

In spite of everything, inflation stays subdued whereas spending exercise continues to be on weak footing. To prime it off, the most recent common earnings report revealed that wage progress was almost nowhere to be seen, dampening hopes of seeing greater client worth pressures down the road.

Nevertheless, risk-off flows have allowed the lower-yielding yen to pare its losses early this week, as market gamers are additionally holding out for different top-tier catalysts.

With that, NZD/JPY retreated from its triangle resistance and is now dipping to the help zone at S1 (89.75) close to the dynamic help on the transferring averages.

Sustained bearish strain might nonetheless pave the way in which for a take a look at of the triangle help close to S2 (89.07) and a significant psychological mark. A break under this might set off a drop that’s the identical peak because the chart sample, taking NZD/JPY right down to the following bearish targets at S3 (88.45) then S4 (87.83).

Technical indicators are suggesting that consumers may not again down so simply, although.

The 100 SMA crossed above the 200 SMA to point that help ranges usually tend to maintain than to interrupt. On the identical time, Stochastic is beginning to pull up from the oversold area to indicate that consumers are taking on whereas sellers are exhausted.

A bounce off the present space of curiosity might spur one other take a look at of the highest close to R1 (91.05) and even an upside break and transfer in direction of R2 (91.67).

In any case, be sure you follow correct danger administration and hold a detailed watch on altering market sentiment when buying and selling this one!

The put up Chart Art: NZD/JPY Ascending Triangle Formation first appeared on Investorempires.com.