Marina113

Introduction

Royal Caribbean (NYSE:RCL) inventory has seen a stellar yr in 2023. The corporate efficiently capitalized from a robust journey demand as a document variety of customers had been seeking to cruise at a premium. As 2024 begins, many buyers are beginning to be cautious of the journey trade basically possible as a result of the trade is very cyclical. Journey is among the first discretionary spending customers are likely to forego in occasions of financial uncertainty. As such, I’m downgrading my ranking on the corporate from a purchase to a maintain. Nonetheless, regardless of a gradual build-up of macroeconomic challenges in current quarters, I don’t assume it’s time to promote Royal Caribbean. Regardless of macroeconomic challenges, the journey demand continues to be robust, and Royal Caribbean’s distinctive operations enable the corporate to handle prices higher than different leisure or discretionary industries comparable to resorts and airways. Due to this fact, whereas I am downgrading Royal Caribbean’s ranking from a purchase to a maintain, I’m nonetheless not satisfied that the cruising demand is over for Royal Caribbean warranting a maintain thesis.

Macroeconomic Headwind

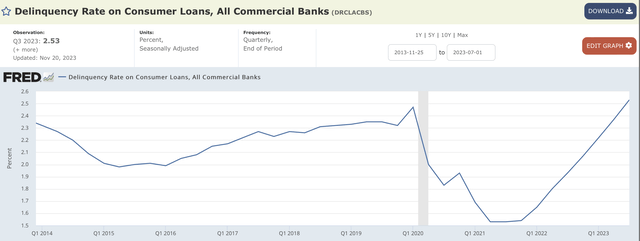

Customers’ monetary well being has been declining over the previous few quarters, mirrored by the mortgage delinquency charges. Trying on the information from the St. Louis Federal Reserve, the buyer mortgage delinquency fee has continued to extend with no clear indicators of stopping and even slowing down, which displays the weakening of customers’ monetary well being. Additionally, I don’t assume describing the present mortgage delinquency scenario as normalization is appropriate. Not solely has the delinquency fee surpassed the pre-pandemic degree, however the fee at which the delinquency fee is rising quarter-over-quarter will not be slowing down.

The primary proof of those macroeconomic situations taking a toll on the journey trade got here from Delta Air Traces (DAL). When Delta Air Traces reported 2023Q4 earnings, buyers had been dissatisfied by the lower-than-expected earnings outlook for 2024. As an alternative of a steerage of over $7 in earnings per share, the corporate is anticipating $6 to $7, which might imply there won’t be any significant bottom-line enlargement in 2024 in comparison with 2023. Thus, I imagine Delta Air Traces’ earnings report is among the first proof of macroeconomic situations impacting the journey trade.

General, because of these macroeconomic causes doubtlessly creating headwinds for Royal Caribbean’s demand atmosphere in 2024, I’m downgrading the corporate’s ranking from a purchase to a maintain.

Demand and Value Surroundings

Whereas the macroeconomic situations and preliminary airline earnings recommend that there may very well be a requirement headwind impending for Royal Caribbean, I’m hesitant to imagine so for a number of causes. First, cruise bookings and demand have been robust up till the earlier earnings report. Second, Royal Caribbean and the cruise trade’s price will increase can’t be in comparison with that of the airline.

Throughout Royal Caribbean’s 2023Q3 earnings report, the corporate touted robust present and future bookings. Consequently, the administration group stated that “the company is also increasing its full-year 2023 Adjusted EPS guidance to $6.58 – $6.63, driven by strong demand and continued strength in onboard revenue.” Thus, up till October twenty sixth, the corporate’s prospect of the trade and Royal Caribbean’s enterprise was extraordinarily optimistic.

Additional, for Delta Air Traces, the main motive for the corporate trimming the earnings forecast was the fee and demand improve imbalance. Whereas the operation prices present continued will increase from new labor contracts and different miscellaneous working prices, the macroeconomic atmosphere has possible curbed the journey demand barring the corporate from having the ability to elevate the costs sufficient to guard the underside line.

This isn’t the case for Royal Caribbean. Throughout the 2023Q3 earnings report, the corporate stated that the web cruising price is predicted to be up 7% to 7.5% together with the influence from Israel whereas the web yields are anticipated to be up 12.9% to 13.4%. Royal Caribbean’s capacity to hold over the prices to customers is way larger. It must also be famous that the cruise trade and the airline trade are inherently totally different. Every aircraft carrying a number of hundred passengers requires not less than two pilots and one flight attendant per 50-passenger capability the aircraft has, which is pricey and weak to impactful price will increase coming from renewed labor contracts. For Royal Caribbean, the passenger-to-pilot ratio is way smaller whereas nearly all of the crew will not be getting paid the US worker customary at sea permitting Royal Caribbean to handle labor prices extra effectively.

Due to this fact, contemplating each the demand and value atmosphere for Royal Caribbean, I imagine it’s untimely to offer a promote ranking on the corporate. Whereas it’s true that the difficulty could also be brewing as a result of macroeconomic situations, Royal Caribbean could not really feel the influence if the storm doesn’t get stronger.

Valuation

Since publishing my previous article, the inventory worth has appreciated about 81.8%. As a result of huge improve within the firm’s valuation, some buyers could level out that Royal Caribbean is overbought. Nonetheless, whereas the corporate is actually not undervalued, I imagine it’s an overstatement to say Royal Caribbean is just too costly. The corporate has a 2024 ahead price-to-earnings ratio of about 13.5. Contemplating that the corporate’s price-to-earnings ratio fluctuated between the 12 to 15 vary all through 2015 up till the pandemic, I imagine the present valuation of Royal Caribbean is honest.

Abstract

Going into 2024, the macroeconomic atmosphere surrounding the journey and cruising trade as an entire will possible create a headwind. Extra particularly, customers’ monetary well being is getting weaker, suggesting that discretionary spending like cruising and touring may decline. One of many potential early indicators of this got here from Delta Air Traces lowering its earnings steerage for 2024. Thus, on potential macroeconomic dangers referring to journey, I’m downgrading my thesis on Royal Caribbean from a purchase to a maintain; nonetheless, I don’t imagine the macroeconomic atmosphere alone warrants a promote thesis because of Royal Caribbean’s robust price management measures, anticipated demand, and honest valuation.